An unruly student during a classroom lecture or an interruption in service from a cable provider–a recurring theme here is unwanted disruptions, but what about a technology that changes the landscape of an entire industry or industries for the better? Or a new technological advancement that results in increased efficiency or enhanced user experience? These are disruptions worth embracing and on Thursday, Oct. 18, 2018, ETF Trends will give financial advisors the opportunity to congregate in a cutting edge virtual setting to discuss these disruptions and how they positively impact the exchange-traded fund (ETF) space.

As the concept of disruptive technology increasingly becomes part of standard lexicon, a common denominator is that in order for technology to be deemed disruptive, it must challenge the status quo and buck the trend of the norm with respect to growth in the sector where it operates. In short, disruptive technology goes above and beyond traditional methods or processes within its respective industry.

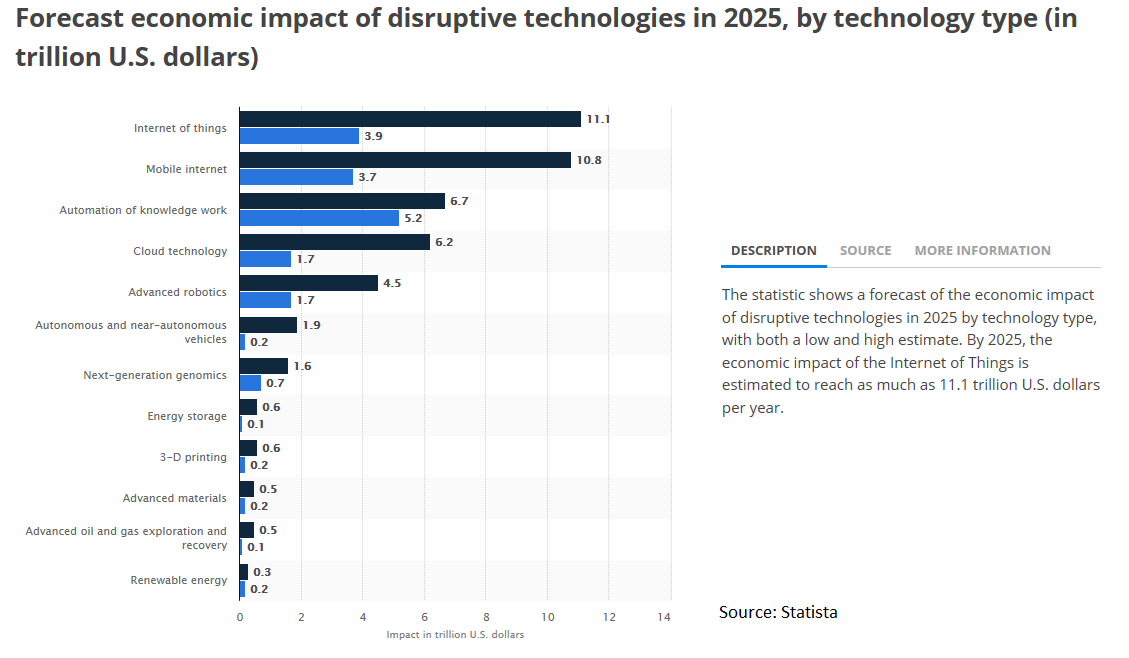

According to the online statistics and business intelligence portal Statista, disruptive technologies like the internet and robotics are expected to have an economic impact worth trillions of dollars by the year 2025. As such, an influx of investor capital is flowing into these disruptive technologies, spawning ETFs that are capitalizing on these areas of innovation.

![]()

At the 2018 Disruptive ETF Virtual Summit, registrants will have access to industry experts divulging a wealth of knowledge in the following areas:

- Robotics, AI & Automation: Disruptive technologies are changing the way new products and services are being brought to market, which is already being seen in the development of artificial intelligence and robotics. As the number of companies that focus on highly advanced computer integration grows, so does the number of targeted ETF strategies that have been designed to capture the best growth opportunities. With these emerging technologies set to take over multiple industries, financial advisors need to future proof their clients’ portfolios.

- ESG: Environmental, Social and Governance investing targets investors who are guided by various principles seeking out companies that strive to do social good. The capital markets are aptly called as such–the focus being on capital–but capital can manifest itself in other forms aside from money, including social responsibility. Rather than focusing on market value, social responsibility retrains investors minds to focus on just values–things that matter the most to investors rather than profitability and with this rise in social consciousness comes a rise in capital market innovation in the form of socially responsible ETFs. An advisor’s clients and their clients’ children are making ESG a greater priority in their portfolios.

- Online Retail: As the decline of brick-and-mortar stores continues to make headlines, online retail growth is booming around the world. Consumer spending is now happening online more than ever before as traditional retailers continue to close stores and declare bankruptcy at a rapid rate. With the change in spending habits comes plenty of opportunity for investors who are tapped into the best investment strategies to play this ongoing trend in the market.

- Crypto: Bitcoin, Ethereum, Ripple are among the growing list of cryptocurrencies that have received mainstream media attention during the past 12 months. As the SEC looks to regulate the cryptocurrency industry, extreme volatility has continued in the space, leaving most advisors uncertain on whether to invest or not. Hear from top industry experts on the case for crypto, the future of crypto related investment vehicles and how advisors can best educate their clients.

With these technological advances poised to lead future growth, register now in order to pinpoint where this growth will take place and what opportunities can be had with respect to investment opportunities in ETFs.

For more information on the Disruptive ETF Virtual Summit conference, visit our Virtual Summit page.