By Gary Stringer, Kim Escue and Chad Keller, Stringer Asset Management

Global economic growth for 2017 will likely be the strongest since 2011 according to annual GDP projections by the Organization for Economic Co-Operation and Development (OECD). Both the U.S. and the euro zone are growing more quickly than expected. In fact, the latest estimate of U.S. Q3 2017 GDP came in at a robust 3.3%. Importantly, several forward-looking indicators of economic growth suggest that that global economy should carry this momentum into 2018.

For example, The Conference Board’s Index of U.S. Consumer Confidence rose to its highest level in 17 years during November. Within this index, the sub-index of Jobs Plentiful made a new high, while Jobs Hard to Get fell to a new low. This bodes well for the labor market going forward. Combined, these indicators suggest a virtuous feedback loop where increased consumer confidence leads to increased spending, which can increase business confidence and investing.

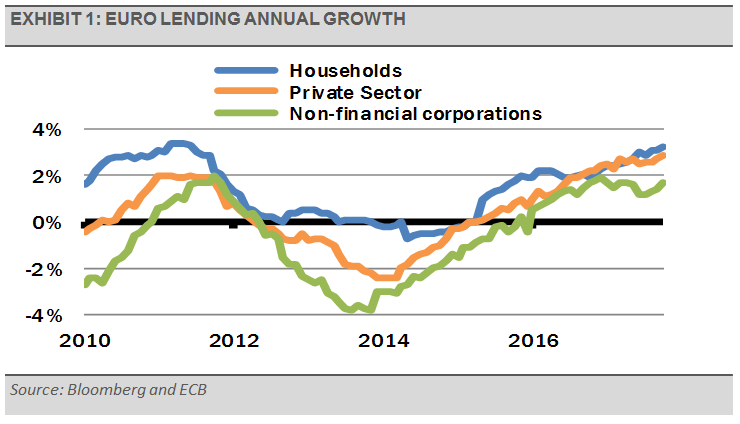

![]() We are also seeing positive signs coming out of Europe. Annual growth of bank lending to the private sector is at the highest level since May 2009 (exhibit 1).

We are also seeing positive signs coming out of Europe. Annual growth of bank lending to the private sector is at the highest level since May 2009 (exhibit 1).

Even at these elevated levels, our models suggest that equities have further to run. With the context of a constructive economic back drop, we then look for attractive relative values. As we discussed previously in our piece, What The Earnings Yield Can Tell Us About The Future, we think that earnings yield is one of the best indicators of future equity market returns. Meanwhile, we think that yield is often the best predictor of future bond returns. As you can see in the following graph, even at these elevated levels, equities look attractively priced relative to bonds. Certainly, high quality bonds are an important risk diversifier, but going forward, we continue to expect relatively attractive returns from equities.

Furthermore, tight credit spreads continue to suggest that any stock market selloff will likely be contained. We think that credit spreads lead significant equity market volatility by several months. The currently tight credit spreads suggest that any near-term equity market volatility will be contained and should not be feared.

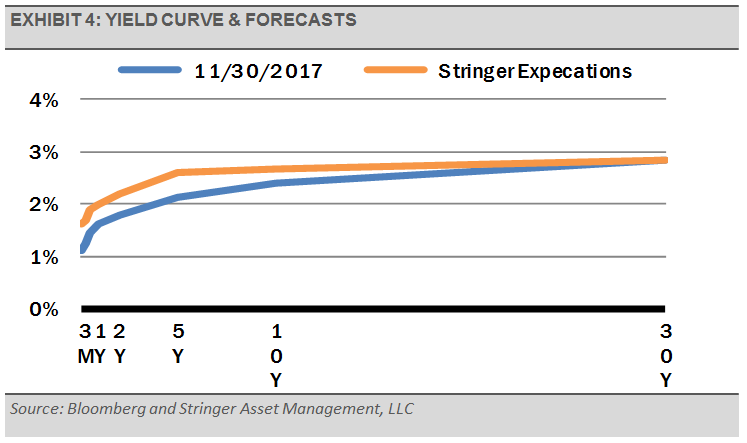

As a money manager focused on managing risk in real time, we continue to monitor our dashboard of economic and monetary conditions. As we forecast out into 2018 and beyond, things begin to look more challenging in late 2018 and early 2019. By that time, we expect the U.S. Federal Reserve (Fed) to have raised interest rates in December 2017 and at least once more in 2018 (exhibit 4). Unless global economic growth and inflation work together to push long-term interest rates higher, we fear that additional policy tightening from the Fed could choke off liquidity. Tightening monetary policy too much could bring an end to this business cycle.