Here is a really cool inside look at Betterment from Bloomberg:

Betterment Investing

To start investing with Betterment, you simply choose your investing goal, risk tolerance, and timeline. Betterment makes all of this easy. You can choose pre-selected goals like saving for a house, college, or retirement, or you can just invest without picking a specific goal.

Based on what you select, Betterment offers you a pre-selected asset allocation. This saves you time because most investors have no idea what their asset allocation should be. By having the experts at Betterment pick your asset allocation based on your goal, you can sleep well at night knowing your money is being put to work.

Once you have your goal and asset allocation set up, your next step is to set up an automatic transfer from your bank account to Betterment. Betterment will invest this money and periodically rebalance your portfolio for you.

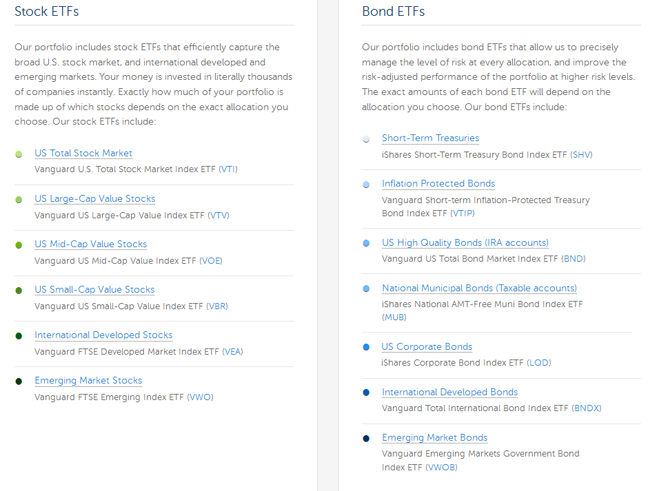

![]() Getting back to your asset allocation, Betterment invests your money in one of their index portfolios consisting of ETFs. Depending on the goal you selected, your portfolio will be created with a mix of ETFs in the stock basket and the bond basket.

Getting back to your asset allocation, Betterment invests your money in one of their index portfolios consisting of ETFs. Depending on the goal you selected, your portfolio will be created with a mix of ETFs in the stock basket and the bond basket.

Advantages And Disadvantages To Betterment

As with anything in life, there are both advantages and disadvantages to Betterment. Below I’ll go through what I feel is great about Betterment and some areas where I think they could improve.

Advantages

- No Researching Investments: All I have to do is pick a goal and set up a monthly transfer and I am done. This saves me time from researching what to invest in. It also keeps me from worrying if I picked the right investments or not.

- Solid Principles: Betterment is built on the idea of index investing. It’s been proven time and time again that you can’t consistently beat the market. Betterment knows this and doesn’t engage in it. They also understand fees and taxes are what really determine performance. By managing the entire investment process for you, Betterment returns more money than other investment options.

- Fees: They have to charge a fee for what they offer you, but the Betterment fee is more than reasonable. In fact, it is a fraction of what you would pay a financial planner for the same level of service.

- Automatic Rebalancing: Over time, depending on how the stock market performs, your asset allocation can get out of whack. Your 60% stock/40% bond portfolio can turn into a 70% stock/30% bond portfolio. This is a bad thing. If you become too heavily weighted in stocks, you will be taking on more risk than you would like and could lose a lot if the market were to drop. On the other hand, if your bond holdings become too great, you risk not earning the return you need, thus never reaching your goals. With Betterment, they will keep your portfolio allocation where it needs to be.

- Tax Benefits: Tied to the automatic rebalancing above, Betterment makes sure they rebalance in the most tax efficient way possible. This means come tax time, the chance of you owing a large amount of taxes is small. This is done through first selling share lots that show a loss instead of those with a gain. From there, Betterment will sell holdings with a long-term gain before a short-term gain, since the tax impact of long-term gains is much lower. This is great because the only advisors that do this for their clients are those that deal with investors who have millions of dollars. You get the same benefit while having less money! Below is a great video explaining this concept.

- Tax Coordinated Portfolio: This feature allows you to use a tax efficient asset allocation across all of your portfolios, both taxable and non-taxable. By allocating your investments in this manner, you save on taxes and can boost your Betterment returns. In fact, Betterment states this strategy can boost after-tax returns by an average of 0.48% each year. When you take this out 30 years, it comes to approximately an extra 15% return. You can read more about this feature here.

- Tax Impact Preview: This feature lets you see the potential tax impact of selling shares or even changing your allocation. No more tax surprises! You’ll know before you make any trade what the tax impact will be.

- Free Advice: Betterment has a terrific blog and they offer basic investing advice to their investors free of charge.

- Fractional Investing: With some brokers you can only invest in ETFs in whole shares. This means that if you have $100 to invest and the share price is $75, you can only buy 1 share. Your remaining $25 will sit in cash, earning you virtually nothing. With Betterment, you can invest in fractional shares, meaning all of your money is working for you, all of the time.

- User Friendly Website: I haven’t really talked about the website, but it is great. You know when you go to some websites and you have to look around for 5-10 minutes trying to figure out where things are or how to do things? Betterment isn’t like that at all. The layout is clean and easy to navigate. In fact, I would argue it’s probably one of the easiest sites to navigate.

- Always Adapting: Even though Betterment doesn’t believe in active investing, they are always making enhancements and improvements to their site, service, and portfolios. These enhancements result in better efficiency for Betterment and the user. It even means better portfolios too. How do I know this? I’ve updated this post at least 3 times since I originally wrote it because of the new amazing features. While I can’t say they will be offering new features this frequently going forward, I am certain they will continue to introduce new features in the future.

- Great For New Investors: I know that for many newcomers to investing, it can be overwhelming. With most advisors wanting nothing to do with beginners because they don’t have the assets, they are left on their own. With Betterment’s simple approach, a beginner will feel at ease from the start and that will translate into long term investing success. In fact, many of the things I’ve just listed in this section might be too complicated for you to really grasp. That is OK. Just know that all of the features Betterment offers are of great benefit and tremendous value to you.

- Tools: The site has a lot of tools you can play around with to help you see where you will be in the future and what you can do to help make your goals more of a reality. This includes playing with the amount you save each month, adding a one-time deposit like a tax refund, and changing your time horizon or your investment allocation.

Disadvantages

- Investment Options: There are only a few ETFs which your portfolio is built upon. For some, the lack of investment options is a turn-off, which is why I list it as a negative. But in reality, this is secretly an advantage of the service. See, you don’t need 20,000 investments to build a diversified portfolio. In fact, I would bet that if you looked at all of the holdings in your portfolio right now, you would see a lot of overlap. What I mean is that if you own 2 large-cap mutual funds or ETFs, chances are you are holding the same companies, just a different percentage of them in each investment. Don’t fall for this “more is better” trick with investing.

Cost of Service: Betterment costs money to use. You can easily learn the basics of investing (I preach them throughout my blog) and do it all yourself. I even put the basics together into my book. But the fee they charge is small in comparison to what most advisors charge and the benefits you stand to gain. And if this is what will finally get you to start investing, the small fee is more than worth it.

Why I Recommend Betterment

To me, it all comes down to what I get for my money. I’ve learned that you can’t just look at what something costs you. You have to look at the benefit it provides. For example, when I worked for a financial planning firm, we had a client tell us at the end of a meeting that he paid us over $10,000 in fees to manage his money for him. He then explained that this was the best money he ever spent.

It turns out, if he tried to invest on his own, he admitted the drops in the market would have caused him to sell his investments and never come back in. But because we helped him stay invested for the long term, he was able to retire sooner than he planned and experience a lot more of life.

The same idea holds true with Betterment. They charge a fee to invest. OK, that stinks. I’ll be the first to admit I would love to invest for free.

But, what do you get in the long run for paying this fee?

You get an increased chance of having money for a secure retirement or any other goal you choose. On top of that, look at what else you get:

- Free Trades

- Free Reinvesting of Dividends

- Free Rebalancing

- Free Tax Loss Harvesting

- Free RetireGuide

These typically cost money with other brokers. But those aren’t the only benefits of Betterment. It’s also the fact that everything is automated for you and you can begin investing within 10 minutes and never have to lift a finger again. You never have to think about making it a point to invest for your future. You set up the transfer once and then forget about it.

Automating like this works. If you automate saving money already, you know what I am talking about.

Even if you don’t, you still experience automation in other ways. Do you have any service that automatically renews? That is automation right there. I bet you never think about that. Is your credit card on file with iTunes? That is automation right there. All you have to do is tap the icon and boom, you have a song.

This is why even though Betterment charges a fee; that fee is more than worth it in the long-run. You will stay invested and be less likely to react based on emotions. Again, this is what defeats the overwhelming majority of investors out there. They allow their emotions to interfere.

This article was republished with permission from Money Smart Guides.