By Marc Odo, Swan Global Investments

Strategy Comparison Series

One of the new strategies attracting attention and assets these days is “low volatility” investing. Also described as “managed volatility” or “minimum volatility,” these strategies are marketed as a better mousetrap in the world of investing. With this post, we will analyze whether or not these low volatility strategies really have anything new to offer. This fits into an ongoing series of posts where we answer the following questions:

- What are the drivers of returns in each strategy?

- What are the risks in each strategy?

- What role does a given strategy play within a portfolio?

- How does the given strategy compare to the Defined Risk Strategy?

Before discussing the above topics, however, it is necessary to define just what people mean when they use the term “low volatility” investing.

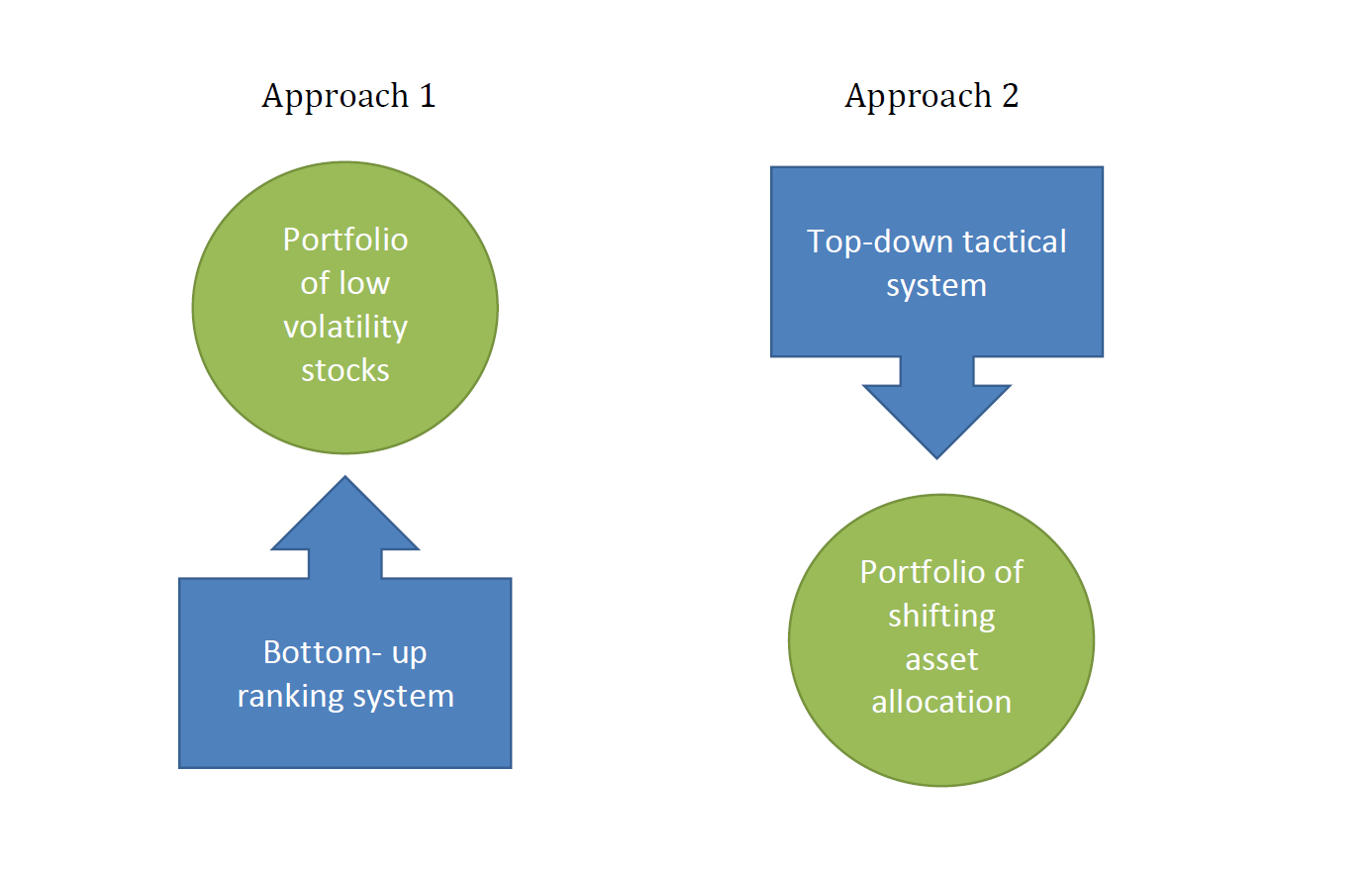

Low volatility better describes an outcome or a goal rather than an investment process; there are several different ways one can produce low volatility results. The products called low volatility or managed volatility typically follow one of two different investment strategies.

Two Types of Low Volatility Investing

The first and more common approach to low volatility investing is essentially a form of factor analysis. Using a quantitative scoring system, a large pool of stocks is scored then ranked on either their historic or anticipated volatilities. A portfolio is then assembled from the stocks that have favorable, low volatility rankings. For anyone familiar with the “smart beta” movement, this type of factor analysis should sound quite similar.

An alternative way to produce low volatility results is to sell out of the more volatile asset classes before things go south. A strategy like this might potentially invest in equities, bonds, cash and attempt to produce less volatile results by moving from equities to fixed income before a correction or bear market and then jump back in to equities during bull markets. Of course, some would call such a strategy tactical asset allocation or market-timing, and they wouldn’t be too far from the truth.

Different Approaches, Same End

These are two very different paths that attempt to get to the same endpoint, i.e. a pattern of returns less volatile than that of a buy-and-hold, fully invested, cap-weighted index like the S&P 500. The former approach of scoring individual stocks on their volatility characteristics is more of a bottom-up strategy, whereas the latter, tactical asset allocation approach can be described as top-down. When it comes to the returns, risks, and roles of low volatility or minimum volatility, the two approaches must be treated differently.

![]()

Drivers of Returns

If a low volatility strategy is built from the bottom up by ranking individual stocks on their “volatility scores,” then success or failure will largely depend on whether or not that factor happens to be in favor. Smart beta, factor analysis, strategic beta, whatever you want to call it, is all the same thing. A subset of stocks from a large pool is identified to be more sensitive to or display certain quantifiable traits. The list of potential traits is inexhaustible, but some of the more common ones are value, growth, dividends, momentum, size, and, yes, volatility. The problem, however, is that there is no one magic factor that always works. Every factor will have periods when it is working and periods when it does not.