In early June, Vanguard announced that the Vanguard Dividend Appreciation ETF (VIG), the largest dividend exchange traded fund by assets, is switching benchmarks, moving to the S&P U.S. Dividend Growers Index.

Index changes aren’t uncommon in the world of ETFs. In the case of VIG, investors shouldn’t expect material alterations to this beloved approach to steady dividend growth stocks. In fact, VIG’s new benchmark may offer some benefits.

VIG’s new index applies “a yield screen to try to steer clear of value traps. The top 25% of eligible stocks as ranked by indicated dividend yield is not eligible to be added to the index, while current constituents ranking in the top 15% will be removed,” according to Morningstar.

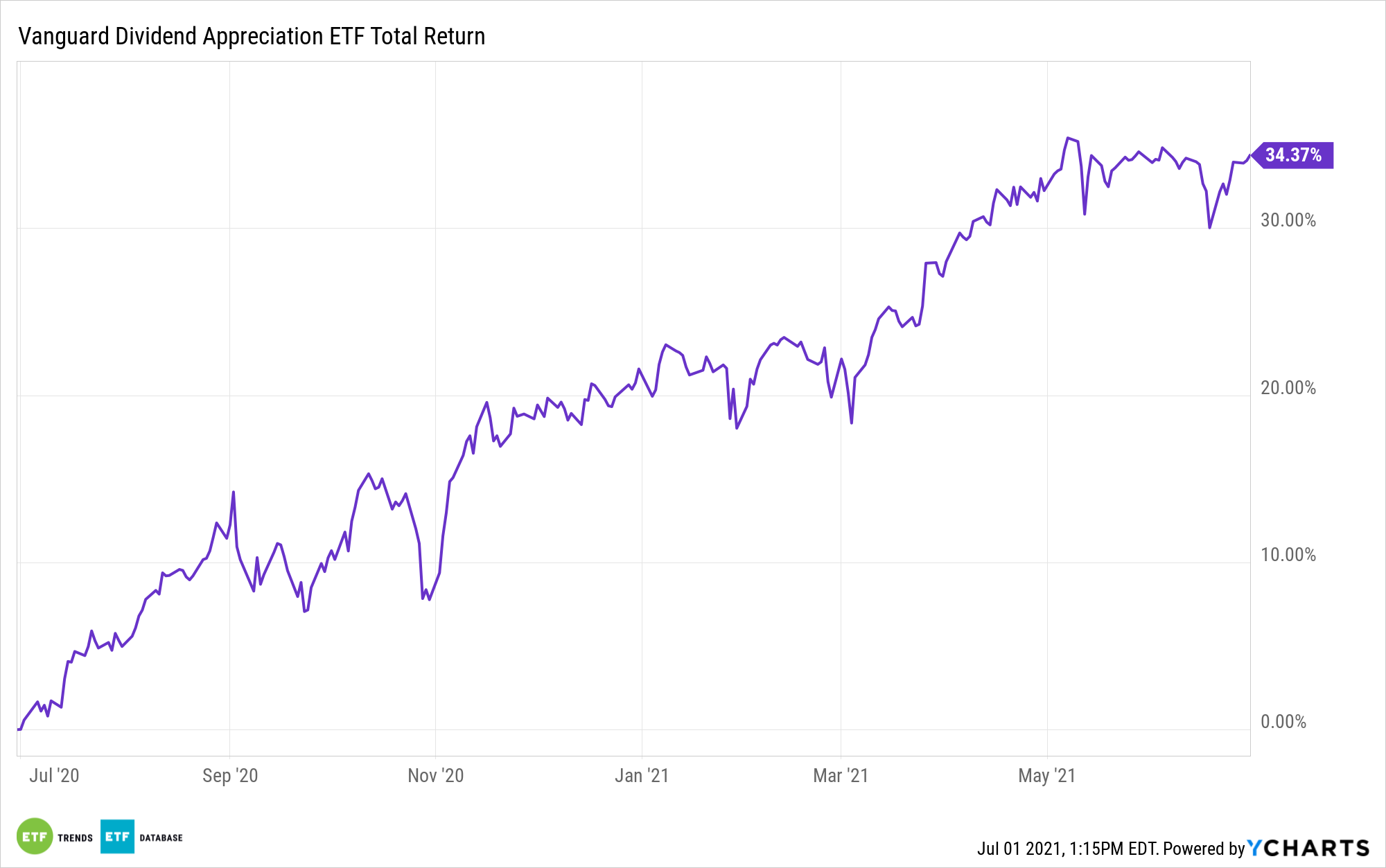

VIG isn’t an overt cyclical ETF. In fact, it has no exposure to energy and real estate stocks, yet it does have robust value exposure by way of a combined 36.60% weight to industrial and financial services stocks. While investors often think value and dividend stocks intersect – and they often do – VIG’s status as a blended fund is important. For example, it’s lagging the S&P 500 Value Index this year, but over the past three years, the Vanguard fund has trounced that index.

More Details on VIG’s New Index

Like the current benchmark, VIG’s new index weights components by market value and caps stocks at weights of 4%.

VIG’s upcoming index “will use stocks’ float-adjusted market caps in order to improve the funds’ liquidity, focusing on the portion of firms’ outstanding shares that is readily available to the market,” adds Morningstar.

As of the end of May, VIG’s top 10 holdings, nine of which are members of the Dow Jones Industrial Average, combined for 31.20% of the ETF’s weight, according to Vanguard data. Another interesting point about VIG’s upcoming index is that S&P moves quickly to remove dividend offenders from the gauge – something not all index providers do, which can allow cutters and suspenders to remain in an ETF longer than investors would like.

Add to that, VIG’s new index “will spread rebalancing over three days instead of trading everything in one day. This will help mitigate the market impact of rebalancing trades. It is also consistent with similar modifications that were made to the CRSP indexes in September 2017 that underpin many of Vanguard’s U.S. stock index funds,” according to Morningstar.

VIG charges just 0.06% per year, making it the least expensive fund in the dividend category.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.