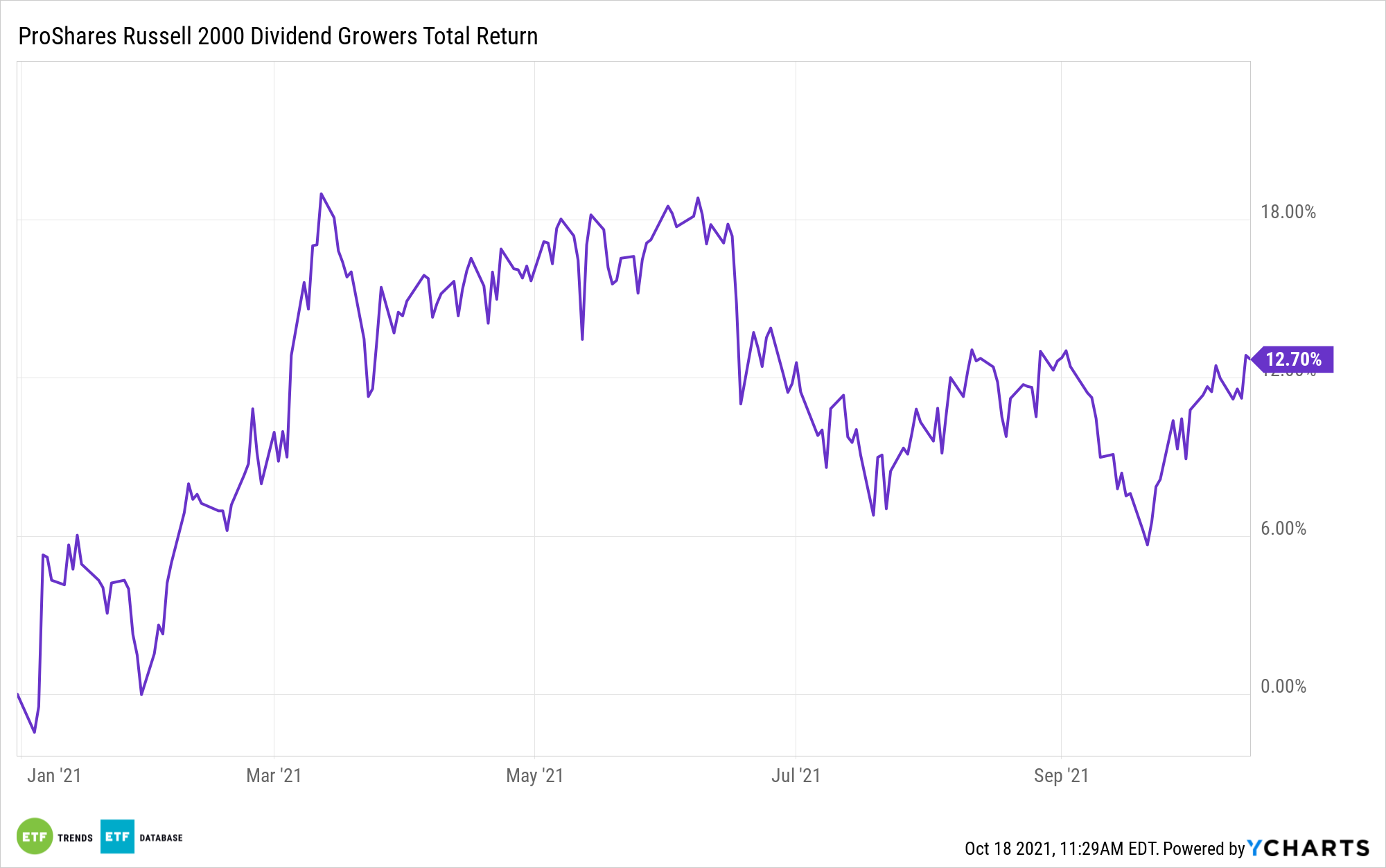

Small-cap value was hot earlier this year. It then cooled off, but there are signs that favored factor combination could heat up again into year-end.

Have a look at the ProShares Russell 2000 Dividend Growers ETF (SMDV), which is higher by almost 4.19% over the past month. SMDV, a dividend spin on the Russell 2000, the benchmark U.S. small-cap index, tracks the Russell 2000 Dividend Growth Index, which includes small-cap firms with dividend increase streaks of at least a decade.

Said another way, while some broader small-cap benchmarks are home to unprofitable companies and are short on dividend-paying stocks, SMDV offers investors a quality approach to smaller stocks. SMDV could also be worth considering over the near-term as an avenue for dealing with uncertainty surrounding Federal Reserve policy.

“Small-cap stocks outperformed the S&P 500 right after the Fed meeting through the end of the month,” notes ProShares Global Investment Strategist Simeon Hyman.

SMDV allocates 32.17% of its weight to financial services stocks, by far its largest sector weight. That’s a plus for investors because while bank stocks are historically positively correlated to rising interest rates, small-caps in this sector often display higher sensitivity to rising rates. Additionally, small-caps appear inexpensive today.

“A better bet might simply be valuations. Small caps are cheap after years of underperformance. But what’s the surprise? Another piece of conventional wisdom is that small-cap stocks are sensitive to rising interest rates. Why? They’ve got a lot more leverage than large caps, and thus are more exposed to increasing coupon payments on their debt. There’s some evidence that those two opposing small-cap forces—cheap but leveraged—were in play last month,” adds Hyman.

As the ProShares strategist points out, smaller companies usually carry more debt than their large-cap counterparts, which can make small-caps vulnerable to rising rates. However, that’s a broad statement. Zeroing in on SMDV, the Russell 2000 Dividend Growth Index’s components actually carry less leverage than members of the S&P 500.

“The Russell 2000 Dividend Growth index dramatically outperformed not just large-cap stocks but the Russell 2000, returning over 2% post the Fed meeting. And guess what—those Russell 2000 Dividend Growers—in addition to having consistently grown their dividends historically, have less leverage than the S&P 500,” according to Hyman.

Bottom line: SMDV is a quality idea in the small-cap arena and one with more rising rates protection than many of its counterparts.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.