Broadly speaking, stocks with enviable track records of dividend growth usually aren’t inexpensive.

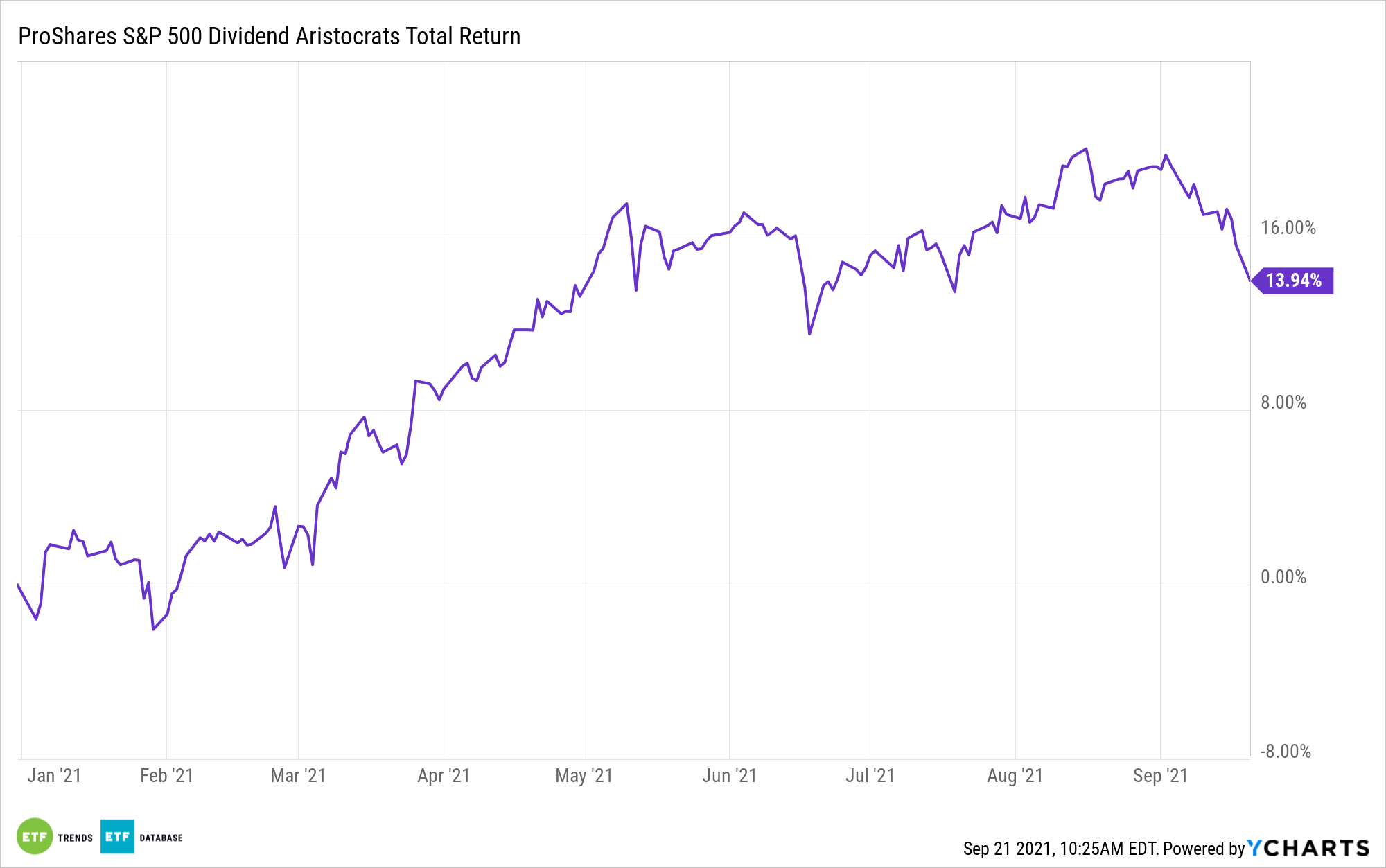

It’s not that these equities are often overpriced. Rather, there’s simply a price of admission for embracing stocks with steady payout growth, quality, and low volatility traits, and that price is usually multiples that are slightly in excess of the broader market. Good news: The ProShares S&P 500 Aristocrats ETF (NYSEArca: NOBL) isn’t too pricey these days, and that’s notable at a time when the broader market is.

NOBL tracks the the S&P 500 Dividend Aristocrats Index, which mandates that member firms have minimum dividend increase streaks of at least 25 years. This index could prove to be a solution to the risks inherent with embracing richly valued stocks.

“A potential solution can be found with the S&P 500 Dividend Aristocrats, high-quality companies that have grown their dividends continuously for at least 25 consecutive years,” according to ProShares research. “The Dividend Aristocrats have historically demonstrated hallmarks of quality like stable earnings, solid fundamentals, and strong histories of profit and growth. Stocks like the Dividend Aristocrats are arguably well positioned to continue consistently delivering the earnings growth ‘fuel’ that could drive future market returns.”

NOBL allocates about 35.5% of its weight to industrial and financial services stocks, giving it something of a value tilt. However, it also features substantial defensive exposure by way of allocating more than a third of its weight to consumer staples, healthcare, and utilities stocks. Likely owing to their long histories of dividend growth and reduced volatility, staples often sport premiums relative to the broader market.

However, the sector is lagging this year, and that might be taking valuations down a bit. Likewise, healthcare is performing admirably, but recent talk that Congress is eyeing drug price reforms could be suppressing multiples in that quality sector.

Add those factors up, and there’s a recipe for NOBL to be trading at unusually low valuations, as is seen today.

“The S&P 500 Dividend Aristocrats are also trading at the cheapest valuation levels relative to the S&P 500 in over a decade,” adds ProShares. “While investors often pay a premium for quality stocks like the Dividend Aristocrats, causing them to trade at higher valuation levels compared with the S&P 500, today’s situation is much different. Relative to the S&P 500, the Dividend Aristocrats traded at roughly 80% of the market’s P/E valuation as of 6/30/21. This is the cheapest level the Aristocrats have traded since March 31, 2010.”

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.