Investors can always use more income, and there exist several ETFs that are paying out over 7% in annual dividend yields.

Dividend yield is a measure of how much of security’s value is returned to shareholders in the form of dividends. Any ETF may hold one or many stocks that pay out dividends; those dividends are aggregated into a single payment to the shareholder at the ETF level.

To calculate an ETF’s dividend yield, simply divide that most recent dividend by the current share price of the ETF.

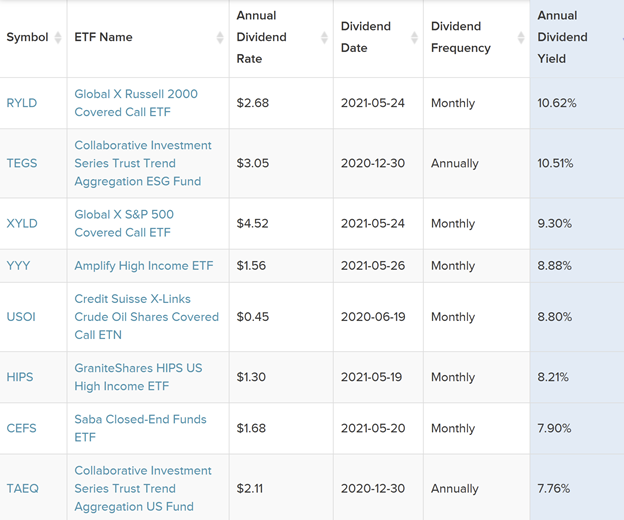

Below is a list of eight ETFs putting out dividend yields of over 7%:

Source: Top 100 Highest Dividend Yield ETFs | ETF Database (etfdb.com). Data as of June 9, 2021

The Global X Russell 2000 Covered Call ETF (RYLD) is a U.S. small and micro-cap ETF that uses an options-based covered call strategy to generate return. Its returns over the past year are up 46%, placing it the best in its peer group. It has a dividend yield of 10.8%.

The Trend Aggregation ESG Fund (TEGS), which is up 6.7% over the last four weeks, is a multi-asset ETF that factors ESG and momentum into its methodology. Its dividend yield is 10.51%.

Another covered call strategy, the Global X S&P 500 Covered Call ETF (XYLD) sells at-the-money call options on the S&P 500 index. XYLD’s dividend yield is 9.3%

Don’t be discouraged by the 2.28% expense ratio on the Amplify High Income ETF (YYY), which has a dividend yield of 8.88%. YYY holds U.S.-listed closed-end funds (CEFs), weighted by yield, volume and discount to NAV.

Meanwhile, the Credit Suisse X-Links Crude Oil Shares Covered Call ETN (USOI) also tracks a covered call strategy, this time on shares of the U.S. Oil Fund (USO). Currently it has an annual dividend yield of 8.80%.

One set of HIPS that won’t lie is GraniteShares HIPS US High Income ETF (HIPS). This multi-asset fund holds a range of high-income and pass-through assets, including REITs, BDCs, MLPs, and closed-end-funds. It has a dividend yield of 8.21%.

The Saba Close-Ended Funds ETF (CEFS) utilizes a strategy similar to YYY, whereby it purchases CEFs at a discount to NAV and hedges the portfolio’s exposure to rising interest rates. Currently, its dividend yield is 7.90%

Finally, Collaborative Investment Series Trust Trend Aggregation US Fund (TAEQ) invests in income producing securities and ETFs via active trend aggregation strategies. TAEQ’s dividend yield is 7.76%.

For more news, information, and strategy, visit the Dividend Channel.