Dividends are regaining their place at the forefront of the income conversation, the result of an improving outlook for payout growth.

While the 2021 forecast for dividend growth is undoubtedly attractive, it’s also worth remembering that dividends have driven 36% of the S&P 500’s total returns since 1936.

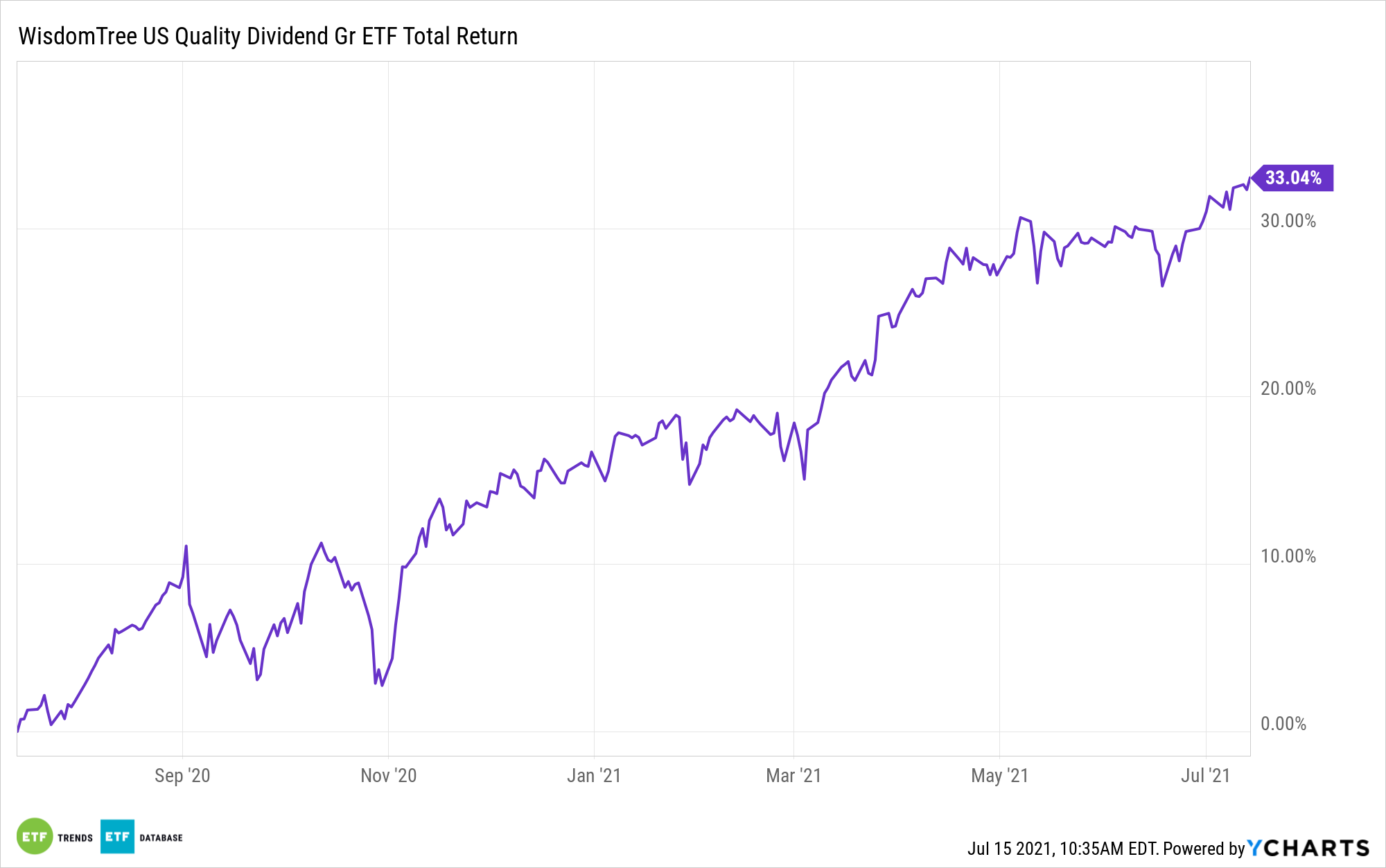

One prime dividend option is the WisdomTree U.S. Quality Dividend Growth Fund (NasdaqGM: DGRW).

Quality is a standalone investment factor, but unlike growth, value, or size, there’s debate over exactly what constitutes a “quality” stock. Despite this fluidity, there are also some obvious hallmarks.

“An additional academic factor that has gained significant following in the investment community is quality. Unlike market beta, size and value, it does not have a straightforward risk-based story,” notes WisdomTree analyst Matt Wagner. “High-quality companies—companies with high earnings, low debt, low variability in earnings—should be highly valued relative to low-quality companies, resulting in lower expected returns.”

Dividend Dependability with DGRW

The DGRW strategy is durable with all-weather credentials, but the exchange traded fund is particularly relevant at a time when last year’s rampant negative payout action (cuts and halts) is still fresh in the minds of many income investors.

Broadly speaking, last year’s worst dividends hailed from the consumer discretionary, energy, and real estate sectors, groups that combine for just 5.6% of DGRW’s roster. Confirming its quality leanings, the $6 billion DGRW devotes 45.61% of its weight to the technology and healthcare sectors – two reliable dividend growth groups.

Quality is relevant for other reasons, namely reduced volatility and the out-performance of lower-quality stocks.

“From a risk perspective, quality companies have had lower down capture than the market and lower downside deviation. These are characteristics that loss-averse investors should prefer, and thus efficient markets would compensate with below-market returns,” adds Wagner. “The anomaly of higher-quality stocks, measured here by operating profitability, outperforming lower-quality stocks by 400 bps annualized looks like a case of ‘a free lunch.’”

Some lower quality stocks reside in high-dividend territory, luring investors in with big yields. However, things don’t always turn out in investors’ favor when focusing on yield over quality. For example, DGRW is up more than 55% over the past three years while the high dividend Dow Jones U.S. Select Dividend Index is up just over 31% over that period. Plus, the WisdomTree ETF is less volatile on an annualized basis.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.