Low interest rates and inflation are just two of the reasons investors may want to consider revisiting dividend exchange traded funds, but before embarking upon on that journey, it’s critical to realize that while plenty of ETFs have “dividend” in their titles, these funds often arrive at payouts in differing ways.

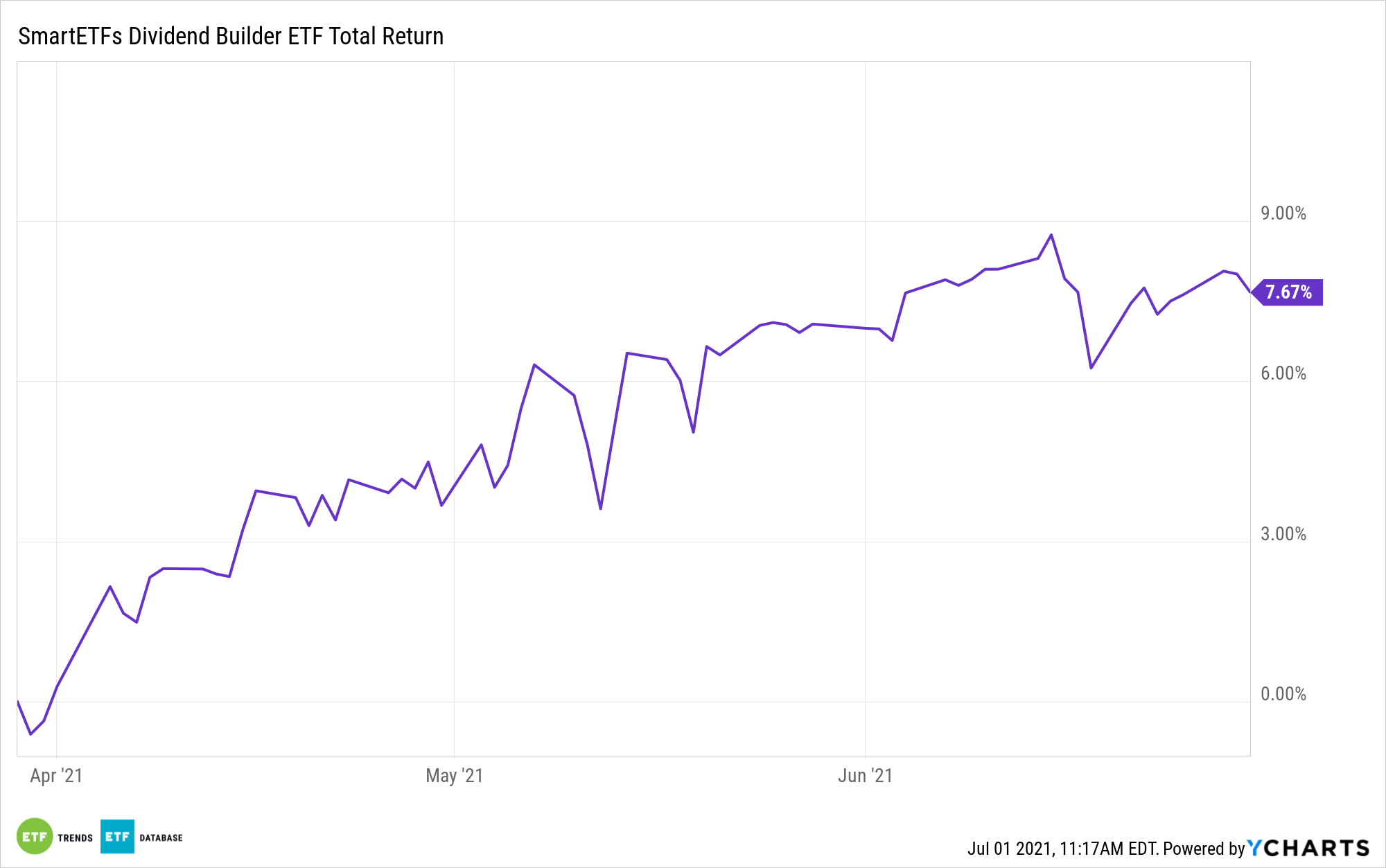

The SmartETFs Dividend Builder ETF (DIVS), which recently converted to ETF form from its prior existence as a traditional mutual fund, offers investors a pertinent income idea for today’s market environment. As SmartETFs points out, many old-guard dividend ETFs either focus on yield or a company’s history of dividend increases.

For its part, DIVS is more forward-looking in its approach. The fund’s managers consider factors such as cash flows and balance sheet fortitude (low debt levels) as avenues for forecasting not only payout sustainability, but growth as well. Consider it a refreshed spin on index dividend strategies that don’t always deliver what investors are looking for.

“Many investors looking for dividend income are more concerned with the income provided by these strategies and less so with their ability to beat a bogy,” writes Morningstar analyst Daniel Sotiroff. “Furthermore, a fund’s potential to beat its category benchmark may not necessarily align with its ability to provide consistent dividend payments.”

DIVS: Right for the Times?

In addition to focusing on companies with tidy balance sheets and robust cash flow, DIVS integrates value into the equation. Nevertheless, with the quality overlays of balance sheet and cash flow emphasis, the fund steers clear of many of the junky stocks that ignited the value rally.

For example, DIVS features no exposure to energy – a sector that a was major dividend offender in 2020. That’s just one example, but it highlights the benefits of DIVS not being a high dividend strategy. Another way of looking at DIVS is that it drives home the merit of avoiding the temptation of high yields.

“Stocks with rising dividends are often backed by financially stable companies with strong sales and profit growth that support those higher cash distributions,” adds Sotiroff. “These profitable companies often trade at higher prices relative to their fundamentals, including dividends, and rarely if ever land in the higher-yielding segment of the market.”

Another perk with DIVS is that it’s a global ETF. It devotes just 47% of its lineup to domestic stocks – a relevant point when considering that 2021 dividend growth is already proving to be an international theme.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.