In 2020, ETFs saw a record $504 billion in flows. According to CFRA Research’s Todd Rosenbluth, 2021 is set to blow that record out of the water. After the first 11 months of the year, flows have already eclipsed $800 billion.

“By all accounts, we will be over $1 trillion in total ETF flows in 2021,” Charles Schwab head of strategy David Botset told CNBC’s ETF Edge on Monday.

Dividend ETFs currently account for $38 billion, with seven funds eclipsing the $1 billion mark entirely on their own. “You’ve got a huge number of individuals that need income, that are transitioning to retirement,” Botset said, “and in a low interest rate environment it’s challenging to find that income.”

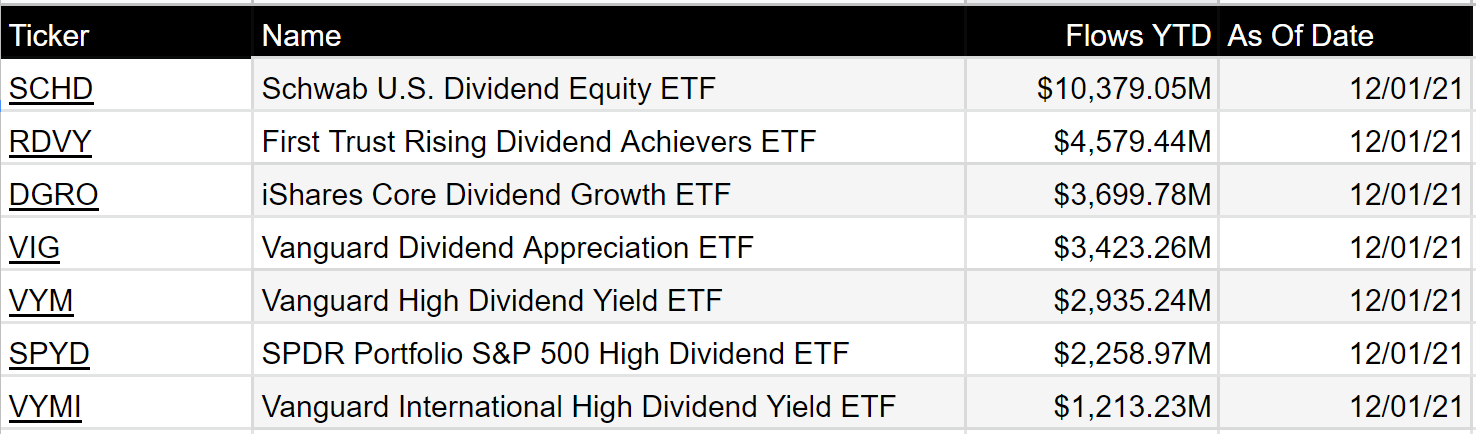

The Seven Dividend All-Stars of 2021

The Schwab US Dividend Equity ETF (SCHD) leads the pack with a commanding $10,379,050,000.00 in flows. SCHD offers exposure to divided-paying equities. The index utilizes a unique strategy that requires a long track record of distributions. This means you are unlikely to see small, speculative firms and more likely to see reliable income. SCHD has a yield of 2.83% and an expense ratio of 0.06%.

The First Trust Rising Dividend Achievers ETF (RDVY) generated over $4.5 billion in flows. To be eligible for RDVY’s index, companies must have paid a dividend in the trailing 12-month period that is greater than the dividend paid in the trailing 12-month period three and five years prior. It has a yield of 1.12% and an expense ratio of 0.50.

The iShares Core Dividend Growth ETF (DGRO) came in just shy of $3.7 billion in flows and boasts a low cost compared to other dividend ETFs, with an expense ratio of 0.12% and a screening method that looks for sustainable dividend growth across broadly diversified industries. This can be an excellent core component to an income-seeking portfolio. It has a yield of 1.94%.

Vanguard has three of the top seven, with the Vanguard Dividend Appreciation ETF (VIG), the Vanguard High Dividend Yield ETF (VYM), and the Vanguard International High Dividend Yield ETF (VYMI) all combining for over $7.5 billion in flows. VYM is linked to the FTSE High Dividend Yield Index, which offers exposure to safe, dividend-paying large-cap companies that exhibit value characteristics. Large-cap value stocks are key components to long term success. VYMI is the international version of that strategy. VIG, meanwhile, utilizes the NASDAQ US Dividend Achievers Select Index, focusing on consumer staples, healthcare, and industrials. The fund’s holdings must have increased payouts for at least 10 consecutive years to be included.

Finally, the SPDR Portfolio S&P 500 High Dividend ETF (SPYD) tracks an index that attempts to choose the top 80 dividend-yielding companies in the S&P 500. It has a dividend yield of 4.88% and an ultra-low expense ratio of 0.07.

For more news, information, and strategy, visit the Dividend Channel.