In what amounts to some good news, investors are hearing plenty about the resumption of dividend growth in 2021. Adding to that ebullience is the fact that the theme isn’t confined to the U.S.

That makes sense because dividends were cut or suspended in plenty of international markets at the height of the coronavirus pandemic. It’s also worth remembering that prior to the global health crisis, plenty of ex-U.S. markets were admirable dividend destinations in their own right, including the U.K.

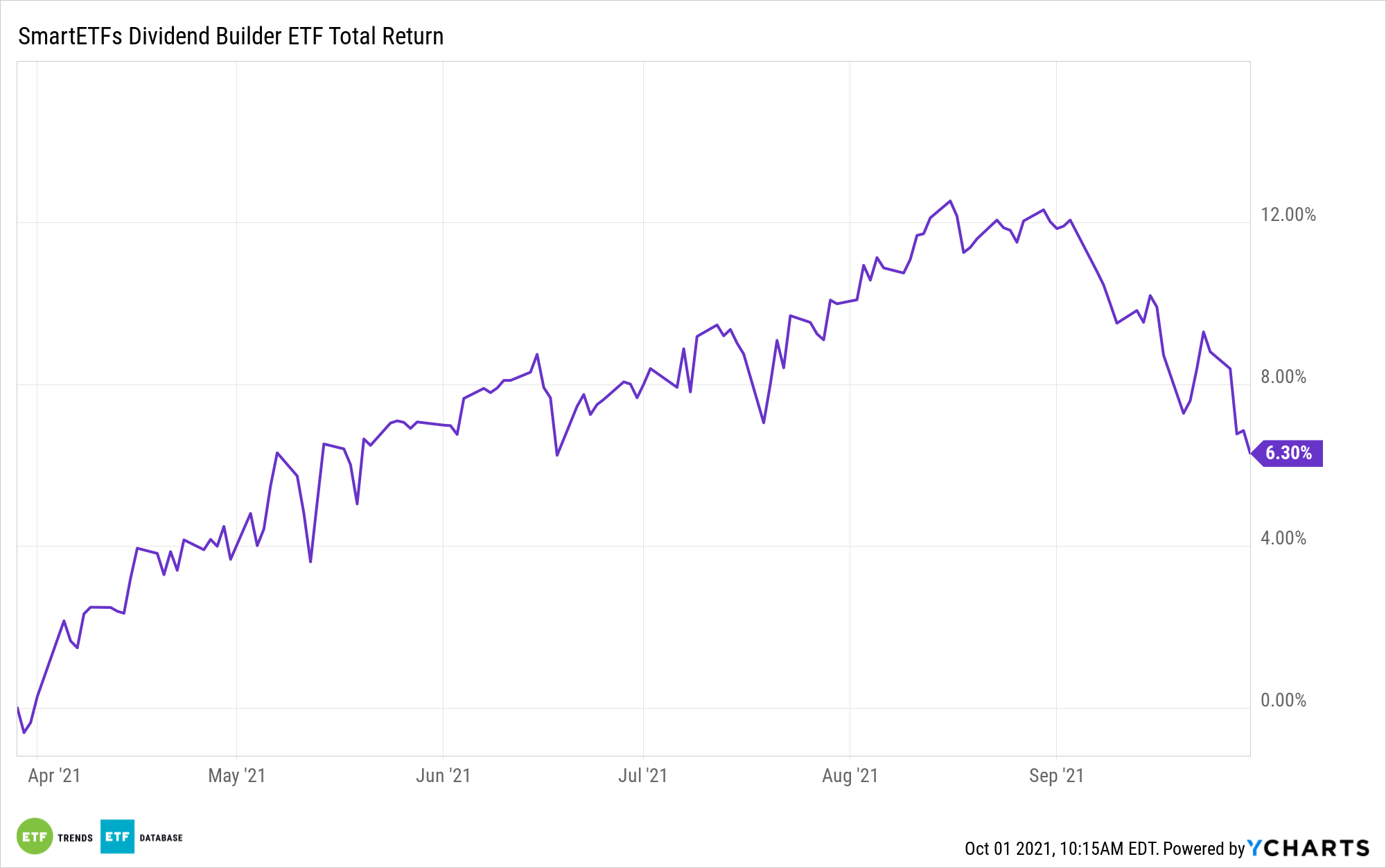

After some rough spots last year, U.K. dividend payers appear to be getting their payout grooves back, and investors can access that growth without a full commitment with the SmartETFs Dividend Builder ETF (DIVS). Fortunately, there’s still room for ample growth among U.K. dividends.

“The aggregate dividend fell 43% in 2020, from GBP111 billion in 2019 to GBP63 billion. The 45% rebound in 2021 remains below its precrisis level, undermined by weaker sectors such as Oil & Gas, Banks, and Travel & Leisure,” according to IHS Markit.

The actively managed DIVS currently has no exposure to the energy sector, but the U.K. is the fund’s second-largest geographic exposure at 15%, trailing only the U.S. at 51%. British American Tobacco (BATS), a DIVS holding, is highlighted by IHS Markit as one of the steadier U.K. dividend growth stocks.

“In 2019, the aggregate dividend paid by UK companies stood at GBP111 billion, but the resulting hardships brought on by the pandemic sunk that amount to GBP63 billion in 2020. Despite vaccine progress and the reopening of the UK economy, the total dividend is still not expected to reach its 2019 level this year, remaining 18% lower,” adds the research firm.

While it may sound ominous that U.K. dividends are not returning to pre-pandemic highs this year, there’s some silver lining for investors considering DIVS. First, S&P 500 dividends likely will return to pre-crisis highs this year, which is relevant because the U.S. is the fund’s largest country weight. Second, investors considering the fund today, if they exercise patience, may derive some benefit from U.K. payout growth in 2022.

“Looking forward, IHS Markit anticipates Oil & Gas as well as Telecommunications companies to be part of the growth drivers for next year,” notes the research firm.

As an actively managed firm, DIVS can allocate to those groups if the fund’s managers identify quality opportunities in those sectors.

For more news, information, and strategy, visit the Dividend Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.