Actively managed exchange traded funds are breaking asset-gathering records, and ARK Investment Management remains a big reason why.

Active ETFs “gathered net inflows of US$16.90 billion during February, bringing year-to-date net inflows to a record US$33.80 billion. Assets invested in actively managed ETFs and ETPs finished the month up to 4.9%, going from US$303 billion at the end of January to a record US$318 billion,” according to ETFGI.

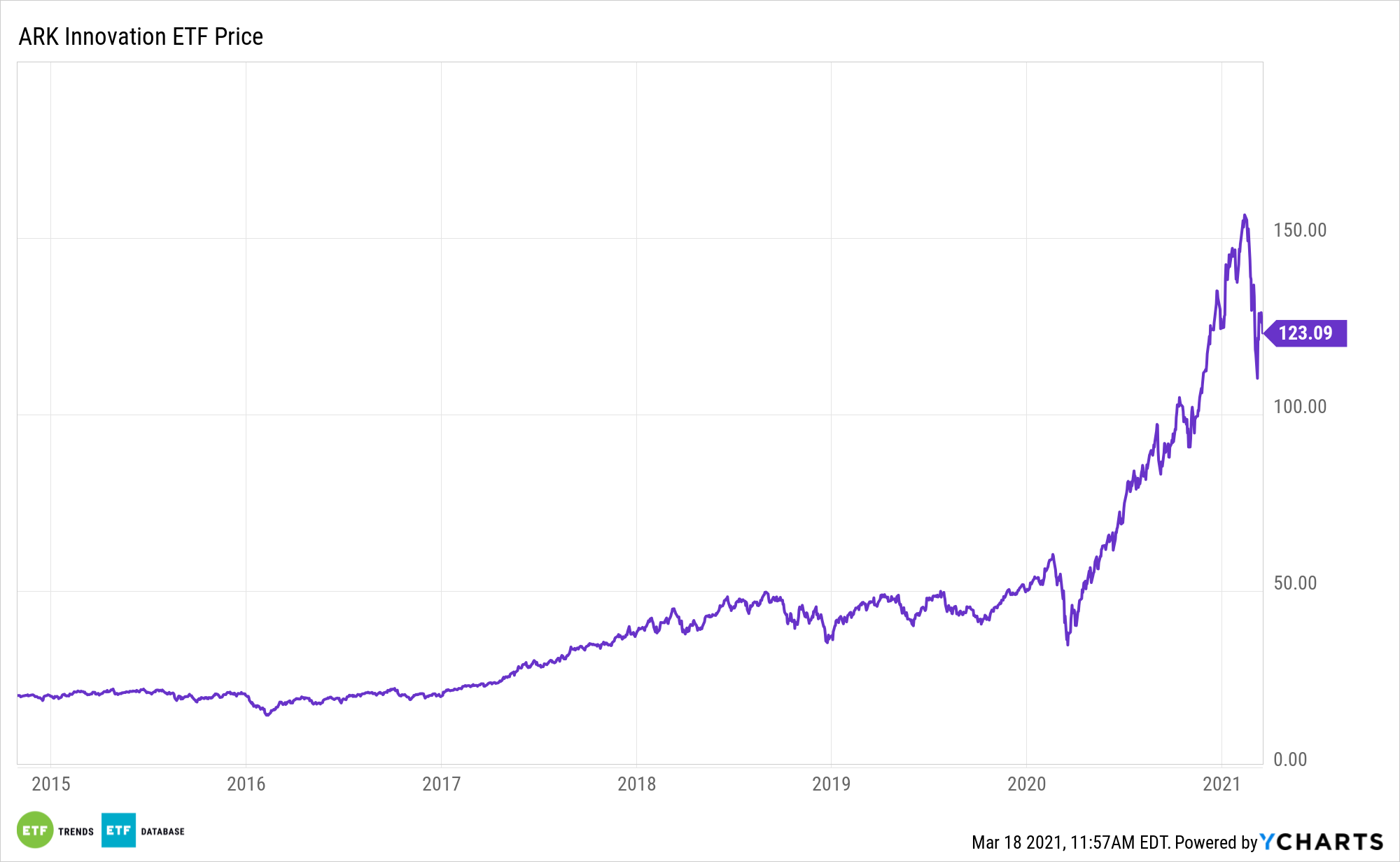

The famed ARK Innovation ETF (NYSEArca: ARKK) led the way among active ETFs for assets added in February.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

And for Second and Third Place…

Last month, the ARK Fintech Innovation ETF (NYSEARCA: ARKF) roared in terms of assets added, trailing only ARKK among active ETFs.

ARKF invests in equity securities of companies that ARK believes are shifting financial services and economic transactions to technology infrastructure platforms, ultimately revolutionizing financial services by creating simplicity and accessibility while driving down costs.

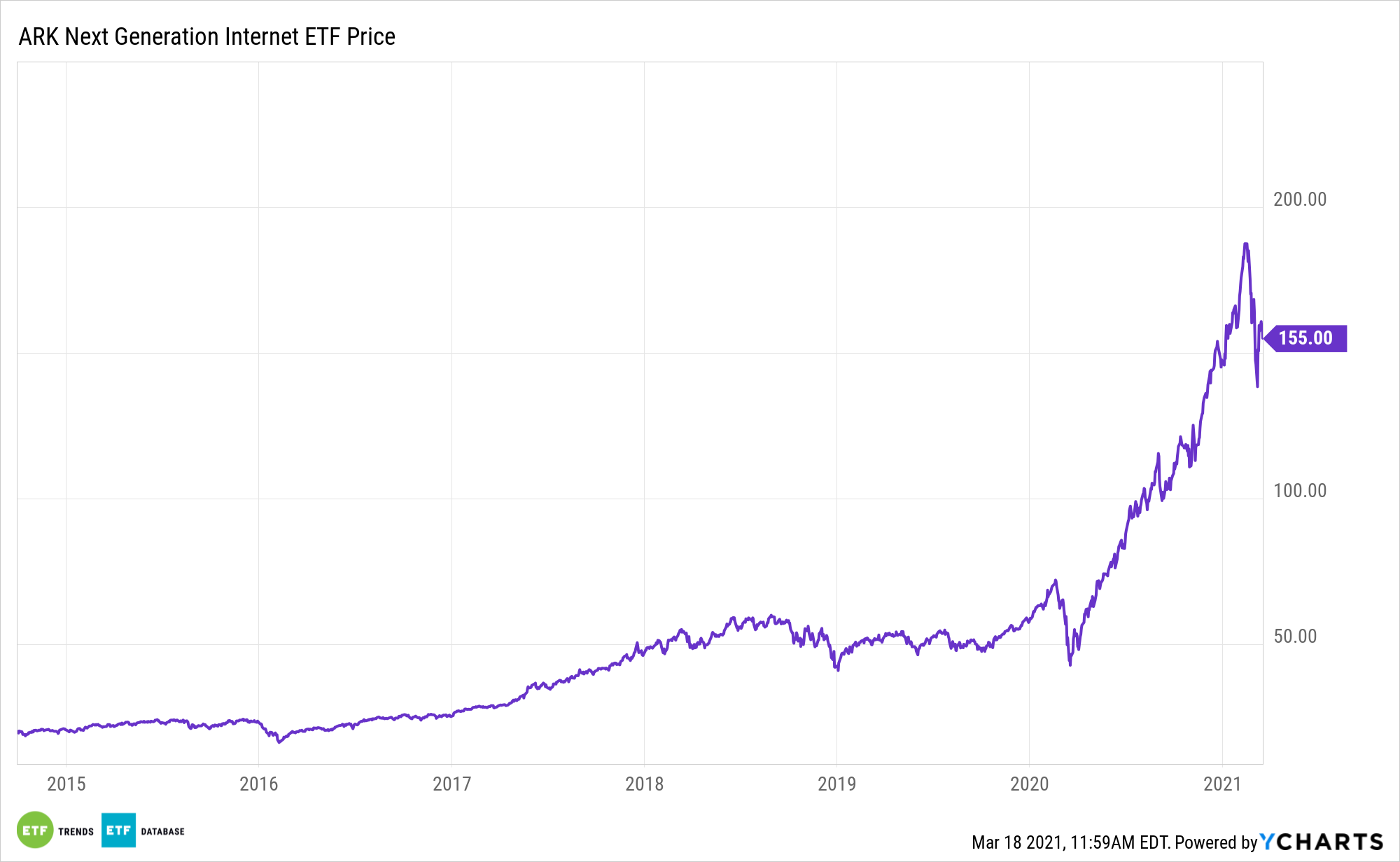

In February, the ARK Web x.0 ETF (NYSEArca: ARKW) ranked third among active ETFs for new assets added.

ARKW aims to capture long-term growth with a low correlation of relative returns to traditional growth strategies and a negative correlation to value strategies. It serves as a tool for diversification due to little overlap with traditional indices. The actively managed strategy combines top-down and bottom-up research in its portfolio management to identify innovative companies and convergence across markets.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.