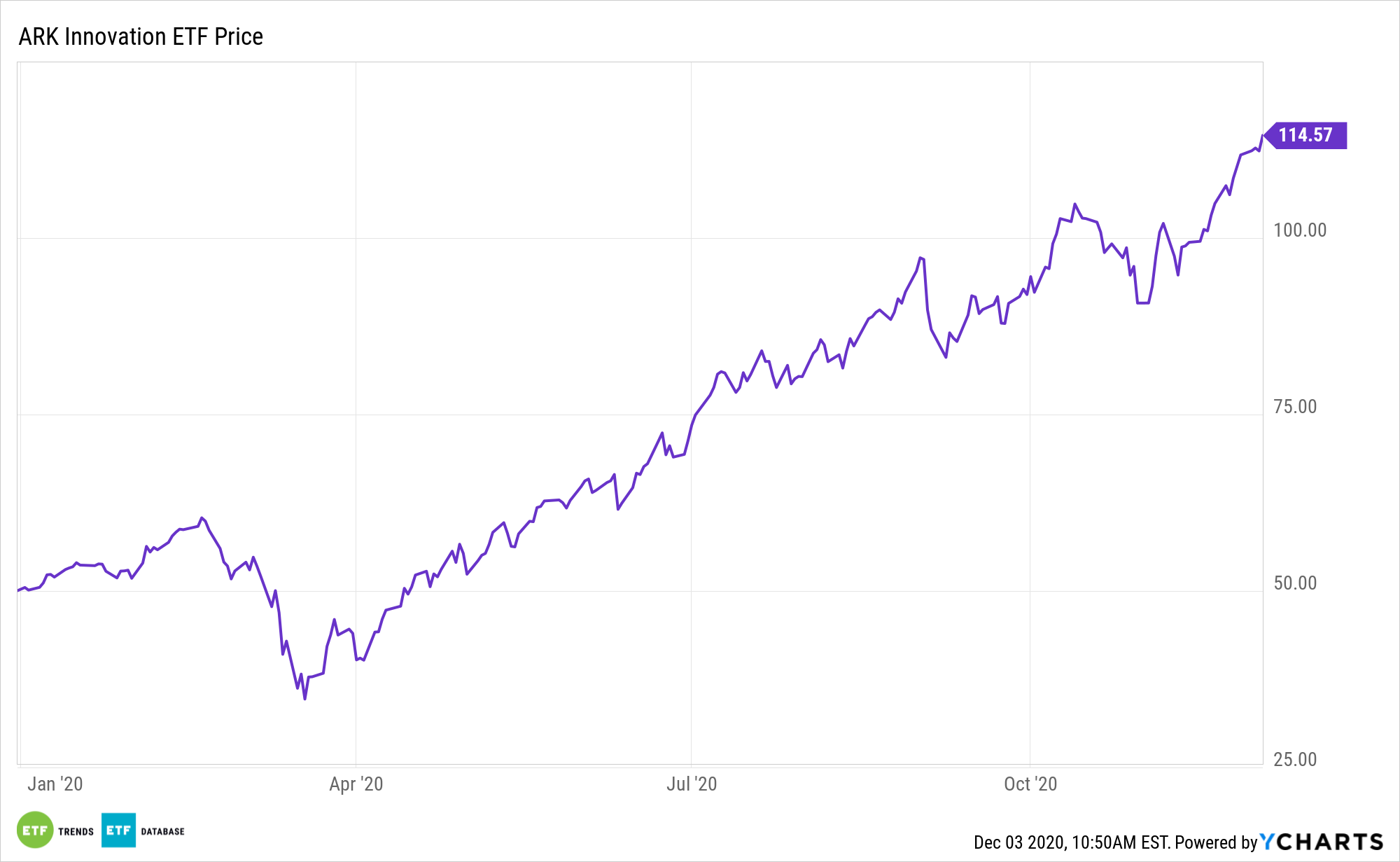

The ARK Innovation ETF (NYSEArca: ARKK) is already ascending to legendary status amongst actively managed exchange traded funds. The same is true of Tesla (NASDAQ: TSLA), ARKK’s top holding.

Elon Musk’s company is clearly disrupting the automotive industry, and it has continues to do so, with ride-hailing one of its next autonomous vehicle ambitions.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘’Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘’Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

Investors who are looking for up-and-coming opportunities should consider the developing smart transportation industry and an exchange traded fund strategy to tap into this quickly evolving segment. ARKK checks those boxes.

ARKK Set for a Ride-Hailing Opportunity

“ARK believes that a ride-hail network will enhance Tesla’s profitability prior to the launch of a robotaxi service,” writes ARK analyst Tasha Keeney. “Moreover, it seems that the launch of a robotaxi service would not tie up significant engineering resources except for routing, payment integration, and other functions that will be critical to the launch of robotaxis.”

On a cost basis alone, new transportation alternatives will likely prove attractive to consumers. Automobiles are expensive. U.S. car owners spend, on average, $1,000 per month to own, operate, park, and insure a vehicle. Meanwhile, the world’s appetite for car ownership has not waned.

“Pursuing a vertically integrated ride-hail service, Tesla could unlock the benefits of a robotaxi-like financial model and at the same time lower considerably the technical risk of launching a robotaxi network,” according to Keeney. “For the first 3 million cars sold into the ride-hail channel, ARK believes that Tesla would generate net profits per mile close to that of an autonomous robotaxi service. As shown below, a vertically integrated ride-hail service priced in line with existing services like Uber and Lyft should generate 28 cents of profit per mile.”

Currently, electric vehicles represent a small percentage of new automobiles sold around the world and cars on the road, but that percentage is expected to increase in a big way over the next several years. Increasing battery life and power is essential to converting more drivers to electric vehicles

Finally, electric vehicles are viewed as the next frontier in ride-hailing because companies want to reduce emissions and drivers want to lower fuel costs.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.