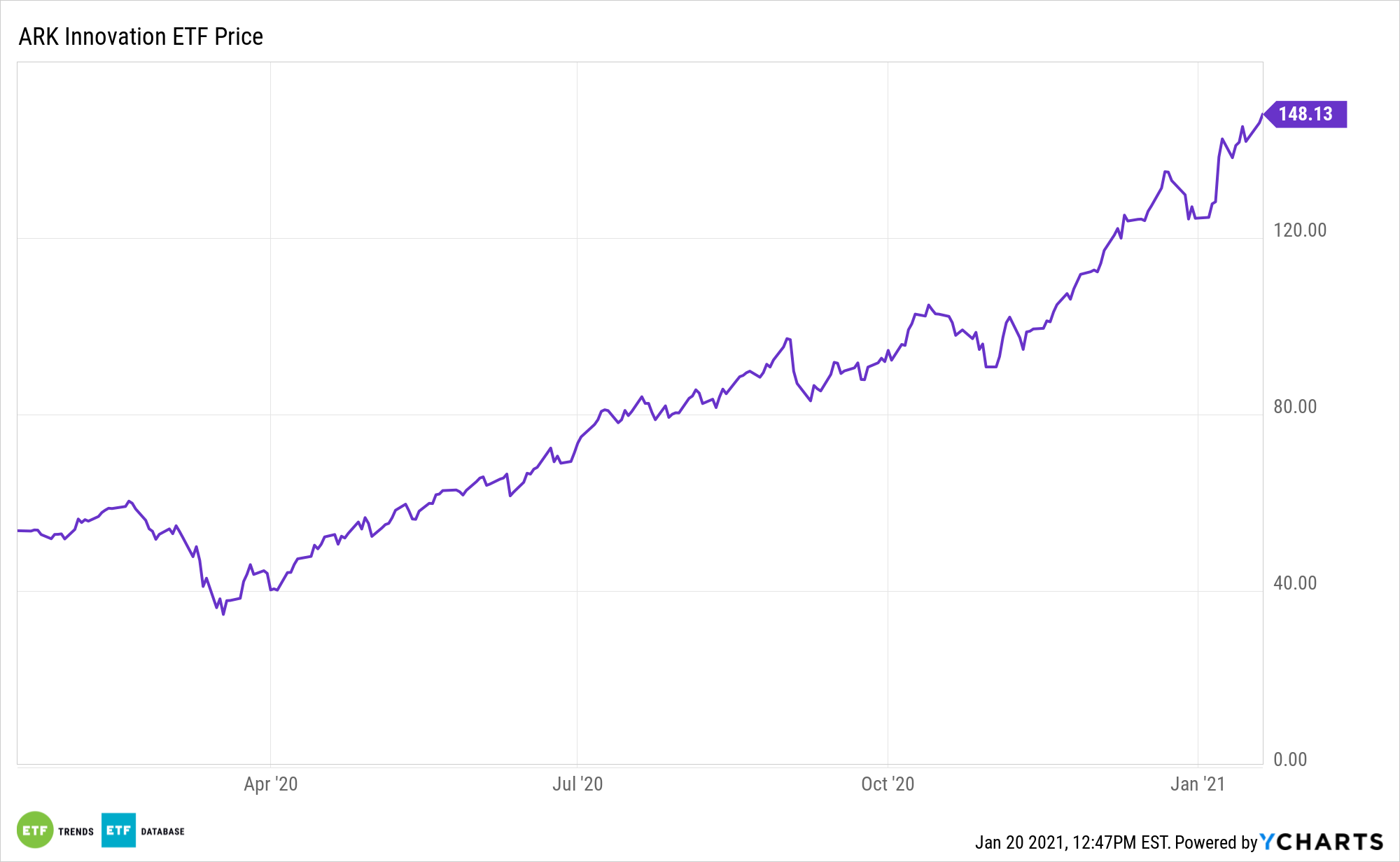

With a stellar track record, the ARK Innovation ETF (NYSEArca: ARKK) became something of a legend among exchange traded funds last year. ARKK’s large exposure to Tesla (NASDAQ: TSLA) is a big reason why.

While past performance is never a guarantee of future returns, Tesla doesn’t appear to be slowing down.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies (‘’Genomic Revolution’), industrial innovation in energy, automation, and manufacturing (‘Industrial Innovation’), the increased use of shared technology, infrastructure and services (‘’Next Generation Internet’), and technologies that make financial services more efficient (‘Fintech Innovation’),” according to ARK Invest.

ARKK is often highlighted for being an early ETF advocate for Tesla (NASDAQ: TSLA). The case for Tesla upside remains strong because of continuous advancements in EV.

Talking Tesla

Last Friday, “Wedbush analyst Dan Ives raised his Tesla (ticker: TSLA) target price by $235 a share to $950—a 33% increase to the target the analyst set only about a month ago. That adds roughly $220 billion to $250 billion to the company’s target market capitalization. (Where in the range the market value falls depends on whether investors focus on basic or fully diluted shares outstanding—the latter includes things such as CEO Elon Musk’s stock options,” reports Al Root for Barron’s.

Now the largest actively managed ETF by assets, is already up almost 14% to start 2021.

ARKK’s Tesla allocation is meaningful in that Elon Musk’s company consistently proves adaptable. It’s also winning the EV battle in terms of $/charging rate, or miles of range added per minute of charging.

“Tesla’s $211 rise over the past month is even more incredible because just a few months ago, it actually would’ve been the equivalent of more than $1,000 a share. That’s because Tesla split its stock five-for-one in 2020. So, on a pre-split basis, the new $950 target works out to about $4,750 a share. Tesla stock started out 2020 at about $330 on a pre-split basis—only 7% of what the analyst’s new target implies,” adds Barron’s.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.