With mergers and acquisitions activity yet to heat up, healthcare stocks are lagging the broader market to this point in 2021.

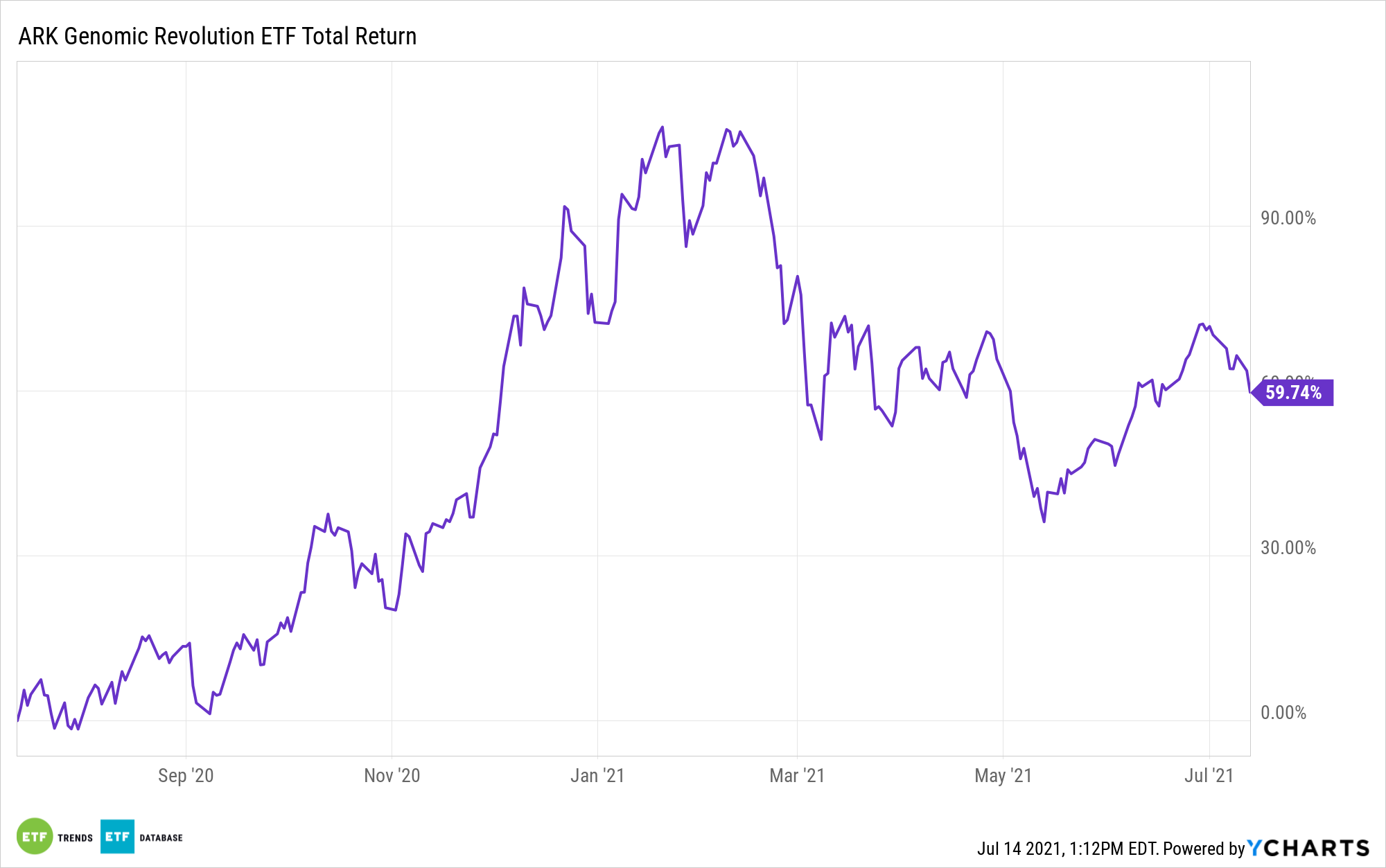

The ARK Genomic Revolution Multi-Sector Fund (CBOE: ARKG) hasn’t been immune to that trend, but the ARK fund also stands out as one of the exchange traded funds in this category that could rapidly go from laggard to leader when sentiment toward the previously beloved sector shifts.

One reason why ARKG can resume its perch atop the healthcare leaderboard is easy to explain: innovation. Put simply, the actively managed fund has an established track record of being at the forefront of healthcare innovation, meaning it’s ideally positioned to thrive when the growth factor and the healthcare sector rebound in earnest.

“Innovation is incredibly robust but unappreciated in the sector. It is creating new markets, particularly in biotech and pharmaceuticals,” according to BNP Paribas. “Science is advancing so rapidly that treatments are becoming available for conditions previously considered incurable.”

A Leg Up on Next-Generation Healthcare

While the broader healthcare sector is often viewed as defensive, there are some clear corners of growth that extend beyond basic biotechnology. For example, ARKG offers investors access to companies involved with CRISPR, next generation sequencing (NGS), and early cancer screening and detection, among other high-octane healthcare pursuits.

That ability to stay ahead of technological advancements in healthcare is one of the traits that separates ARKG from the pack. Fortunately, the outlook for the ARK fund and its peers is positive despite a slow start to 2021.

“We believe the outlook is relatively good, for example, given the substantial discount at which healthcare stocks are trading relative to the broader market,” adds BNP Paribas. “In our view, this discount is overdone. We expect the healthcare policy backdrop to become clearer in the coming months. Improved clarity should act as a catalyst for stronger performance across the segment.”

In addition to systemic innovation, other catalysts for ARKG include evolution of data use in healthcare, genomics advancements, enhanced novel drug development, and delivery and automation advancements, including precision healthcare.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.