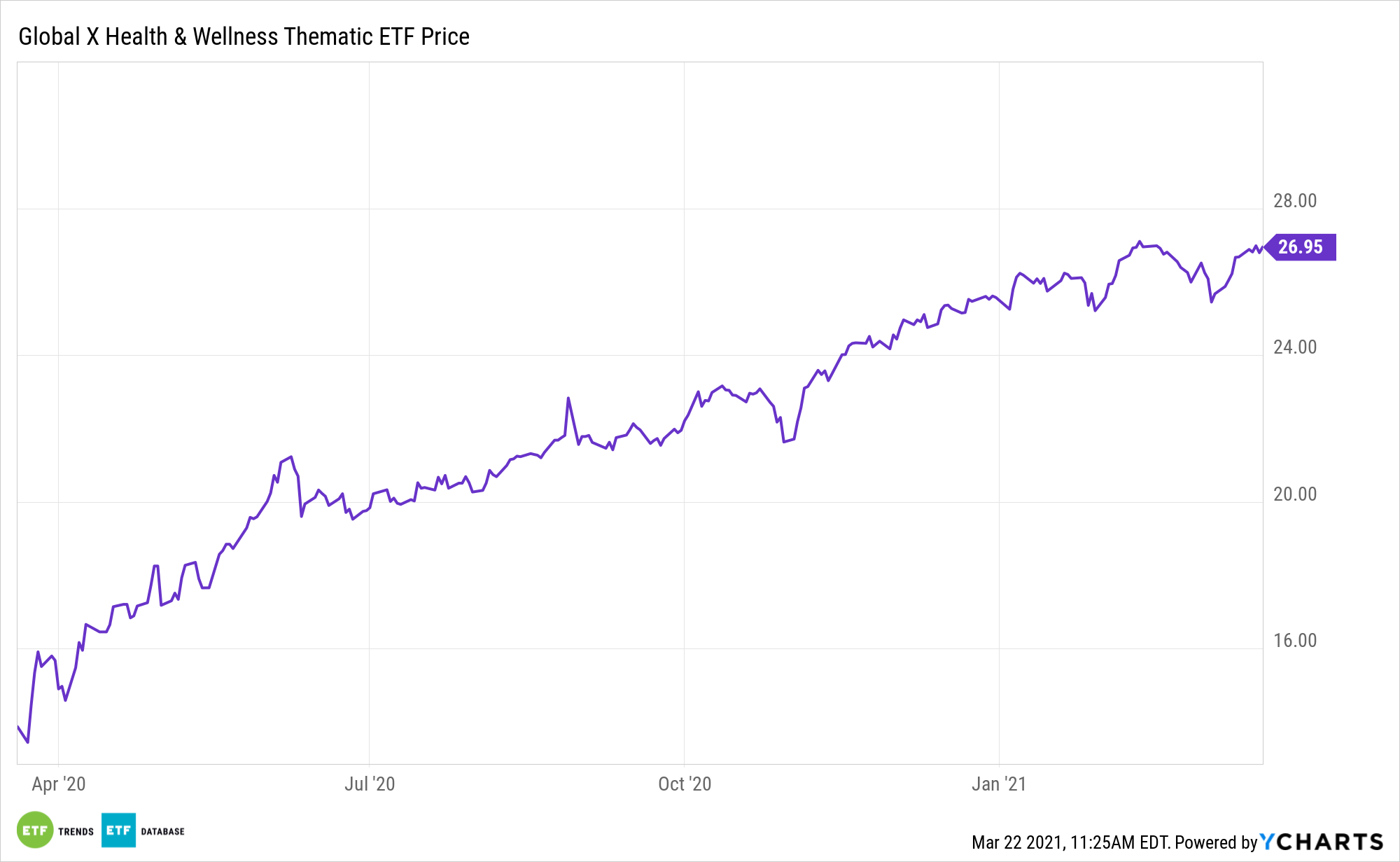

The coronavirus pandemic has forced many Americans to shelter in place and reassess their own health and wellness, two trends supporting the thesis for the Global X Health & Wellness Thematic ETF (BFIT).

BFIT seeks investment results that correspond generally to the price and yield performance, before fees and expenses, of the Indxx Global Health & Wellness Thematic Index. The fund invests more than 80% of its total assets in the securities of the underlying index and in ADRs and GDRs based on the securities in the underlying index. The underlying index is designed to provide exposure to exchange-listed companies in developed markets that provide products and services that facilitate physical wellness through active and healthy lifestyles.

Despite gyms closing, health and wellness is still a prime concern, particularly as a preventative measure against the COVID-19 pandemic.

“Gyms shuttered, fitness classes ceased operations, and health-focused stores closed their doors. Forced to look elsewhere for physical activity and wellness goods, consumers embraced at-home fitness and turned to digital mediums for health and wellness-related products and services,” writes Global X analyst Andrew Little. “Beyond this, infection fears and a growing body of evidence correlating overall health and disease-severity are underscoring what most already knew – that lifestyle choices meaningfully impact one’s long-term health.”

Bank on BFIT Upside

What makes BFIT a compelling idea is that taps into younger demographics’ spending trends. Health and wellness are big business with millennials and Gen Z.

“2020 U.S. health and fitness app installs grew 23% year-over-year (YoY) to reach 409 million, exceeding the 3% YoY rate seen in 2019 and grossing $837M,” according to Global X. “Top 10 installed apps included Under Armour’s MyFitnessPal and Map My Run, Weight Watchers International’s WW app, and eponymous apps from Peloton International and Planet Fitness.”

Bolstering the case for BFIT are long-term changes in how consumers emphasize health and wellness, which leads to important spending shifts.

“With the post-pandemic ‘New Normal Economy’ in sight, one might fairly ask if the at-home fitness trend will continue or if the fitness industry will revert to its pre-pandemic state,” adds Global X. “We think the answer is somewhere in between. In our view, the fitness industry will become a hybrid of traditional brick-and-mortar and at-home models. We expect that this will partially be consumer-driven as convenience, reduced health risks, and synergies with disruptive technologies and consumer trends like wearables reinforce the staying power of at-home fitness.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.