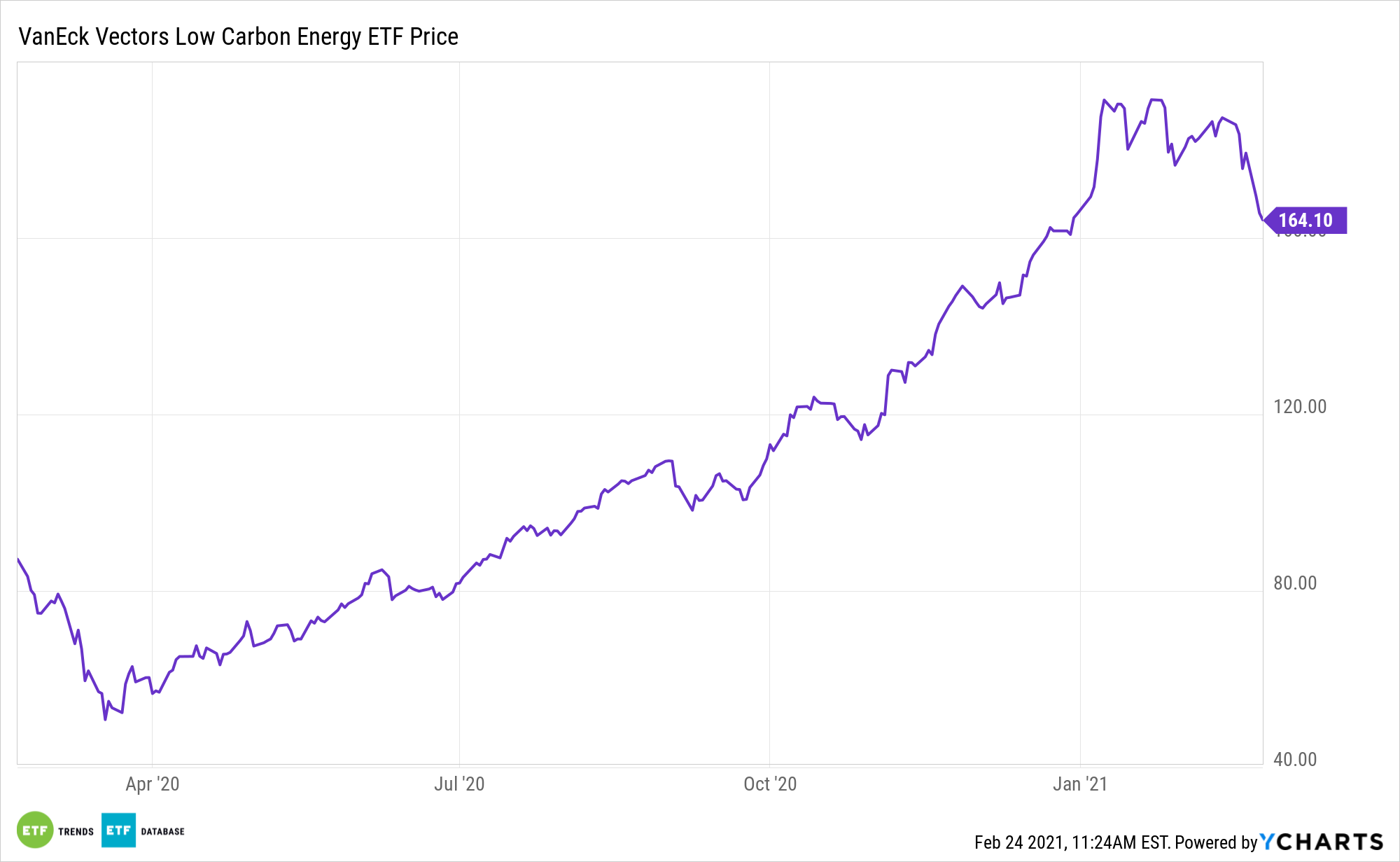

Shares of Tesla are retreating, dragging other electric vehicle stocks along for the ride, but near-term volatility doesn’t dent the long-term electric vehicle thesis. Nor does it diminish the allure of exchange traded funds like the VanEck Vectors Low Carbon Energy ETF (SMOG).

SMOG seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Ardour Global IndexSM (Extra Liquid). Tesla and Nio represent large percentages of the ETF’s holdings. With an emphasis on lowering emissions via their electrical vehicles, Tesla and Nio have been producing stellar gains the past year.

“The transition from conventional cars to electric vehicles (EVs) is accelerating, directly impacting auto makers and auto parts providers,” according to VanEck research. “This is creating investment opportunities in battery cell makers, charging infrastructure and charge stations, optimization software, as well as semiconductors, cameras, etc. We strongly believe this acceleration will continue, as stickier price parity between EV and fossil fuel autos is upon us and Wright’s Law continues to drive down EV costs – especially in the battery and battery software space.”

Sizing Up the SMOG ETF

Electric vehicle (EV) manufacturers played a significant role in the standout performance of alternative energy equities last year. With a strong 2020 in the rearview mirror, can these companies continue their upward momentum in 2021?

Electric vehicles are among the greatest disruptive forces of our time.

“From a consumer preference, competitive unit pricing and regulatory perspective, conventional automobiles are becoming increasingly unwelcome across the world,” notes VanEck. “This accelerating trend lifts demand, which helps add production scale, increasingly helping to drive down the cost of EV ownership to a level where the economic choice tilts in favor of EVs. In the past, the demand momentum was largely driven by the environmental concerns of the buyer, subsidies, as well as increasing performance and innovation.”

The long-term outlook for EVs shows significant growth for the sector over the next two decades, driven by supportive government policy and acceleration of investment in the space, among other factors.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.