Electric vehicles are among the greatest disruptive forces of our time. Fortunately for investors, that theme is still in its early innings, calling attention to long-term upside potential with exchange traded funds such as the ARK Autonomous Technology & Robotics ETF (CBOE: ARKQ).

The ETF has one of the largest weights to Tesla, and makes for an ideal way for investors to access the EV boom.

The actively managed ARKQ invests in companies that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence (AI), including those involved with industrial robotics and automation, non-industrial robots, and autonomous vehicles.

“Electric vehicles are approaching sticker price parity with gas-powered cars. Leaders in the EV market are developing innovative battery designs to enable longer range vehicles at lower costs,” according to ARK research. “Based on Wright’s Law, ARK forecasts that EV sales should increase roughly 20-fold from ~2.2 million in 2020 to 40 million units in 2025.”

Tesla Still Winning the Electric Battery Game

Another reason ARKQ’s Tesla allocation is meaningful is that Elon Musk’s company consistently proves adaptable. The company is also winning the EV battle in terms of $/charging rate, or miles of range added per minute of charging.

ARKQ enables investors to access high growth potential through companies critical to the development of autonomous and electric vehicles – a potentially transformative economic innovation. It also boasts a broad reach into the EV ecosystem. Declining EV costs are a vital part of the long-term ARKQ equation.

“According to Wright’s Law, for every cumulative doubling of units produced, battery cell costs will fall by 28%. The largest cost component of an EV is its battery so these cost declines are critical to reaching price parity with gas-powered vehicles,” notes ARK.

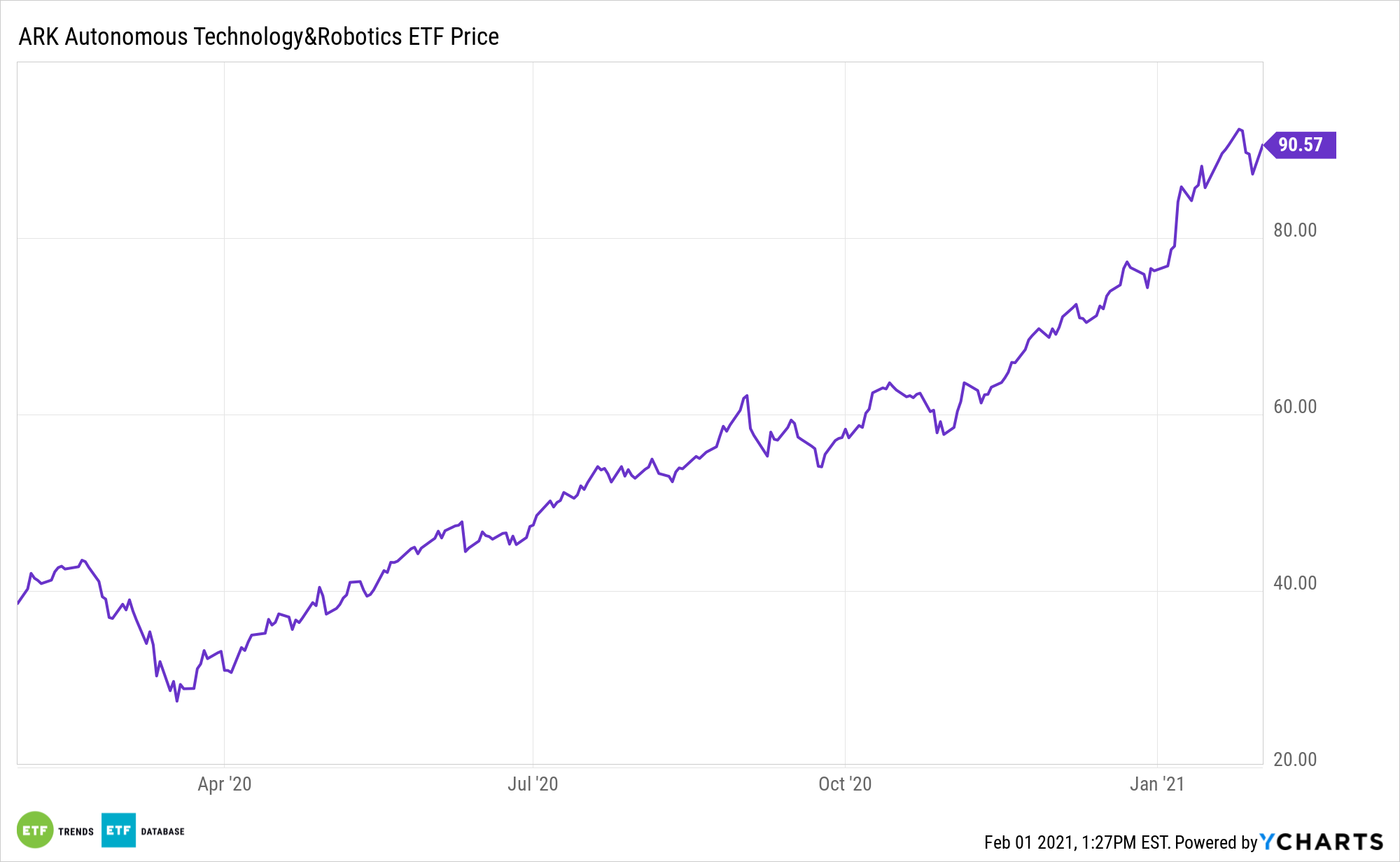

Electric vehicle (EV) manufacturers played a significant role in the standout performance of alternative energy equities last year. With a strong 2020 in the rearview mirror, can these companies continue their upward momentum in 2021?

The long-term outlook for EVs shows significant growth for the sector over the next two decades, driven by supportive government policy and acceleration of investment in the space, among other factors.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.