The coronavirus pandemic is acting as a catalyst for an array of disruptive growth technologies, including the rapid adoption of cashless payment alternatives.

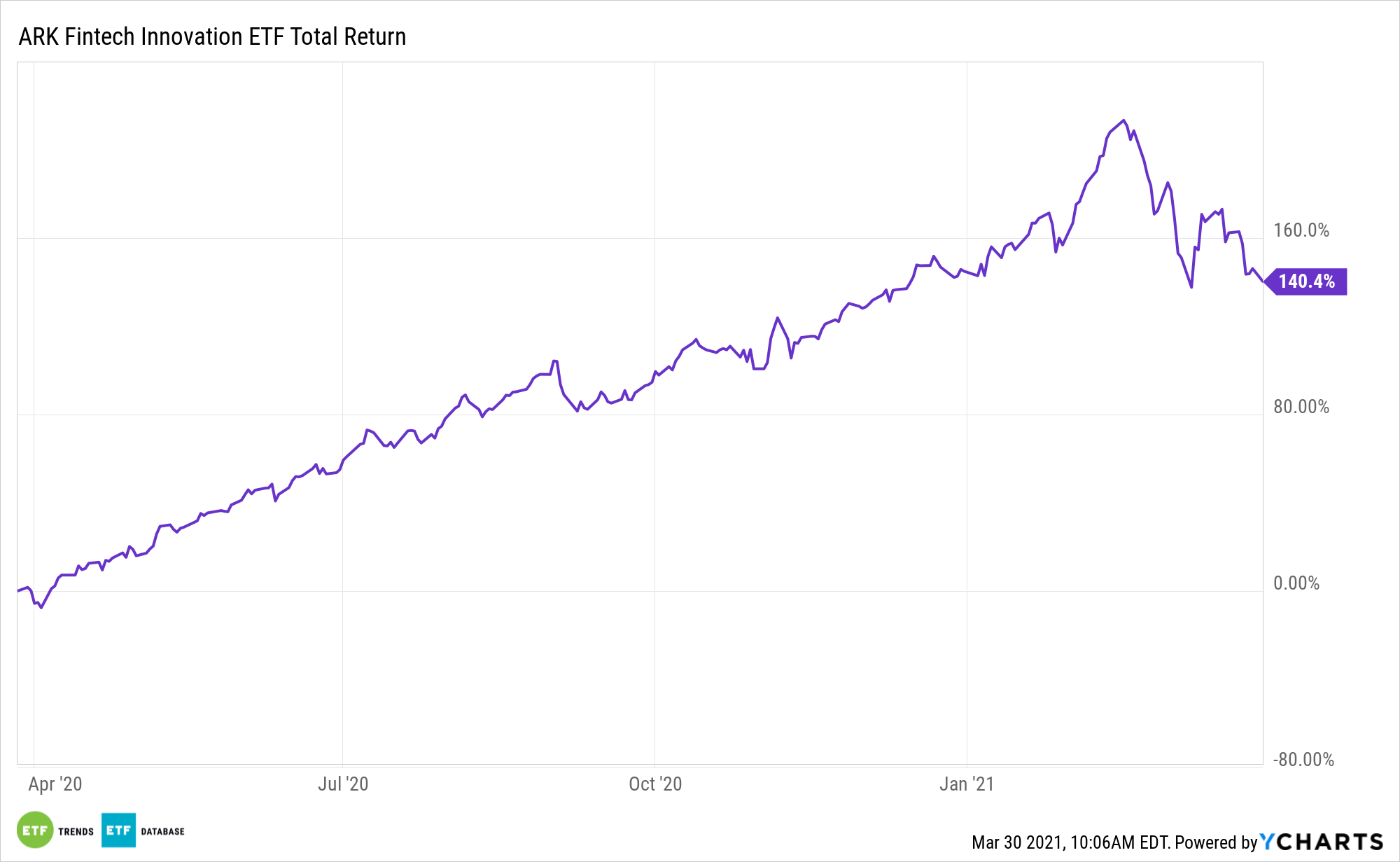

That scenario adds to the already compelling long-term thesis for the ARK Fintech Innovation ETF (NYSEARCA: ARKF). Data confirm the shift away from cash is gaining momentum.

“During the past year, the use of cash at Square’s merchants in the US dropped nearly 10 percentage points as a share of total transactions, from the high 30% range to the high 20% range, a drop three times the average annual decline during the past five years, according to a recent Square report. In other words, the coronavirus crisis seems to have accelerated the shift away from cash by three years,” according to ARK Invest research.

Cards and digital payments are slowly but surely usurping cash as a primary form of payment, providing a compelling, long-term runway for growth for ARKF investors. The time could be ripe for fintech names to push into more traditional banking services, potentially stealing market share from their slow-growth rivals.

‘ARKF’ at the Epicenter of Change

The actively managed ARKF invests in equity securities of companies that ARK believes are shifting financial services and economic transactions to technology infrastructure platforms, ultimately revolutionizing financial services by creating simplicity and accessibility while driving down costs.

“We believe several trends gained momentum during the coronavirus pandemic, explaining the accelerated shift from cash,” notes ARK. “Consumers changed their physical payment habits for small dollar transactions from cash to cards and digital wallets, and they started ordering more products online. As a result, the Fed’s Diary of Consumer Payment Choice is likely to show that the use of cash dropped below 20% of all transactions in 2020 for the first time.”

See also: Tidal, Square, and ARKF: An Attractive Fintech Trio?

At the industry level, contactless is viewed as a futuristic concept, but integral to the ARKF thesis, that future is now. Contactless payments could see their share of all payments rise 10% to 15% because of the coronavirus.

“We believe that if consumers continue to abandon cash, it should be easier for Square to merge its merchant and consumer ecosystems,” adds ARK. “In the past, Square has surveyed Cash App users about their willingness to pay for transactions by scanning a Cash App QR code displayed on merchant’s Point-of-Sale (POS) device. Abandoning cash and learning about the utility of QR codes during the coronavirus, more consumers are likely to answer Square’s survey question in the affirmative.”

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.