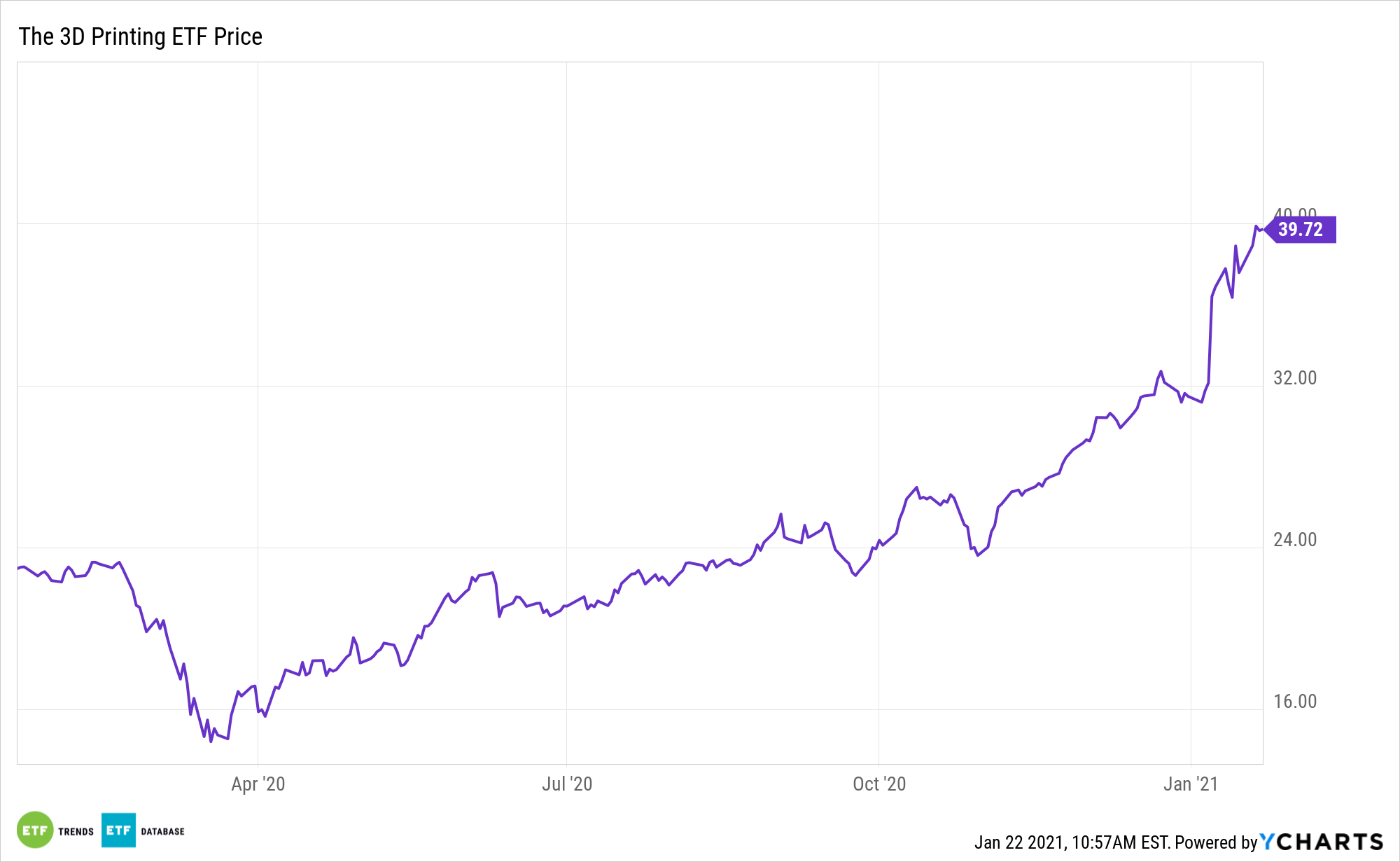

Following a banner 2020, the ARK 3D Printing ETF (CBOE: PRNT) is already up 26% to start 2021. More upside could be on the way with the help of growing 3D printing demand in healthcare.

PRNT is the first US-listed ETF dedicated to the 3D printing theme. The fund is one of two passively managed products from New York-based Ark Investment Management. ARK believes 3D printing will revolutionize manufacturing by collapsing the time between design and production, reducing costs, and enabling greater design complexity, accuracy, and customization than traditional manufacturing.

The healthcare market is just one reason for investors to consider PRNT this year.

“Global healthcare 3D printing market is registering a healthy CAGR of 19.22% in the forecast period of 2019-2026. This rise in the market can be attributed to the increased demand for specific 3D printing, increasing applications for medical treatment and government investments in 3D printing project,” according to Data Bridge Market Research.

PRNT: 3D Printing in Healthcare

3D printing, one of the original disruptive technologies, intersects with a variety of industries. Its healthcare applications could bode well for PRNT’s long-term trajectory. Plus, 3D printing will play an integral role in the fourth industrial revolution.

As it pertains to healthcare applications, 3D printing is rapidly evolving and that could have wide-ranging positive implications for PRNT. The phenomenon isn’t confined to the U.S.

“Europe healthcare 3D printing market is expected to gain market growth in the forecast period of 2020 to 2027. Data Bridge Market Research analyses the market to account to USD 1.89 billion by 2027 growing at a healthy CAGR of 21.00% in the above-mentioned forecast period. The growth of this market is owing to multiple factors such as increased demand for direct 3D printers, growing clinical use, and government 3D printing funding,” according to the research firm.

Passively managed PRNT offers leverage to its namesake as its benchmark “is composed of equity securities and depositary receipts of exchange-listed companies from the U.S., non-U.S. developed markets and Taiwan that are engaged in 3D printing-related businesses within the following business lines: (i) 3D printing hardware, (ii) computer-aided design (“CAD”) and 3D printing simulation software, (iii) 3D printing centers, (iv) scanning and measurement, and (v) 3D printing materials,” writes Ark Investment Management.

For more on disruptive technologies, visit our Disruptive Technology Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.