With the capital markets exhibiting signs of a more risk-off sentiment, the search for income-generating assets is more apparent than ever and Cushing® Asset Management is meeting that need. The investment firm, which has a plethora of experience in energy, materials, and industrials, announced on Thursday the debut of a new suite of income focused Equity Sector & MLP ETFs: The Cushing® Sector Plus ETFs.

These new ETFs, which trade on the NYSE ARCA Exchange, are designed to offer investors exposure to the ever-evolving master limited partnership (MLP) and energy infrastructure markets by seeking to replicate the performance of custom indices in energy, utility, transportation, and the energy supply chain.

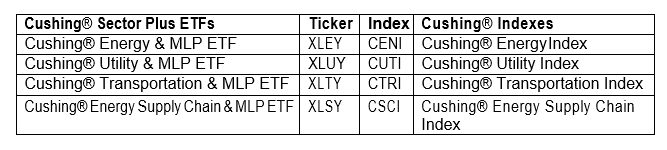

The funds, their tickers and respective indexes are as follows:

Through a custom yield-weighted approach, constituents of the Cushing® indices are selected from the S&P 500® Energy Index (SPN), S&P 500 Utility Index (S5UTIL), S&P 500 Materials Index (S5MATR), and the Dow Jones Transportation AverageTM (TRAN), and then combined with constituents from the Cushing 30 MLP Index (MLPX).

Each of the Cushing® indices, and consequently the funds, limit the exposure of MLPs to 24 percent at each rebalance, allowing investors to add the income-generating potential that MLPs can bring to a portfolio, but avoiding the receipt of schedule K-1s come tax time.