The regulatory crackdown on cryptocurrency mining and subsequent exodus of miners from China has led to the U.S. becoming the top country for bitcoin mining, reports the Wall Street Journal.

Before the crackdowns, China had been number one for bitcoin mining, generating over half the world’s supply of new tokens, with the U.S. only accounting for a fifth of all bitcoin being mined; the U.S. now accounts for more than a third of the dedicated computing power working on bitcoin mining globally.

The bitcoin network is structured so that new bitcoin tokens are only released on the network every ten minutes, and miners have elaborate computing rigs that are set up to run 24 hours a day in order to try and capture as many bitcoin releases as possible, running complex math equations to unlock the opportunity. With the price of a single token currently hovering around $60,000, it is a lucrative endeavor.

It is also an extremely energy-intensive process and has come under scrutiny for ESG concerns recently. New York is currently debating a bill that would ban crypto miners from using fossil fuels to run their rigs while also requiring carbon footprint accountability and reporting.

Crypto miners prefer the U.S. because regulations are transparent and are often slow to act; this is something that crypto companies are counting on, as it gives them time to adjust and be a part of the conversation. With the passage of the bitcoin futures ETFs recently by the SEC, companies are taking it as a sign that there is some security for them in the U.S.

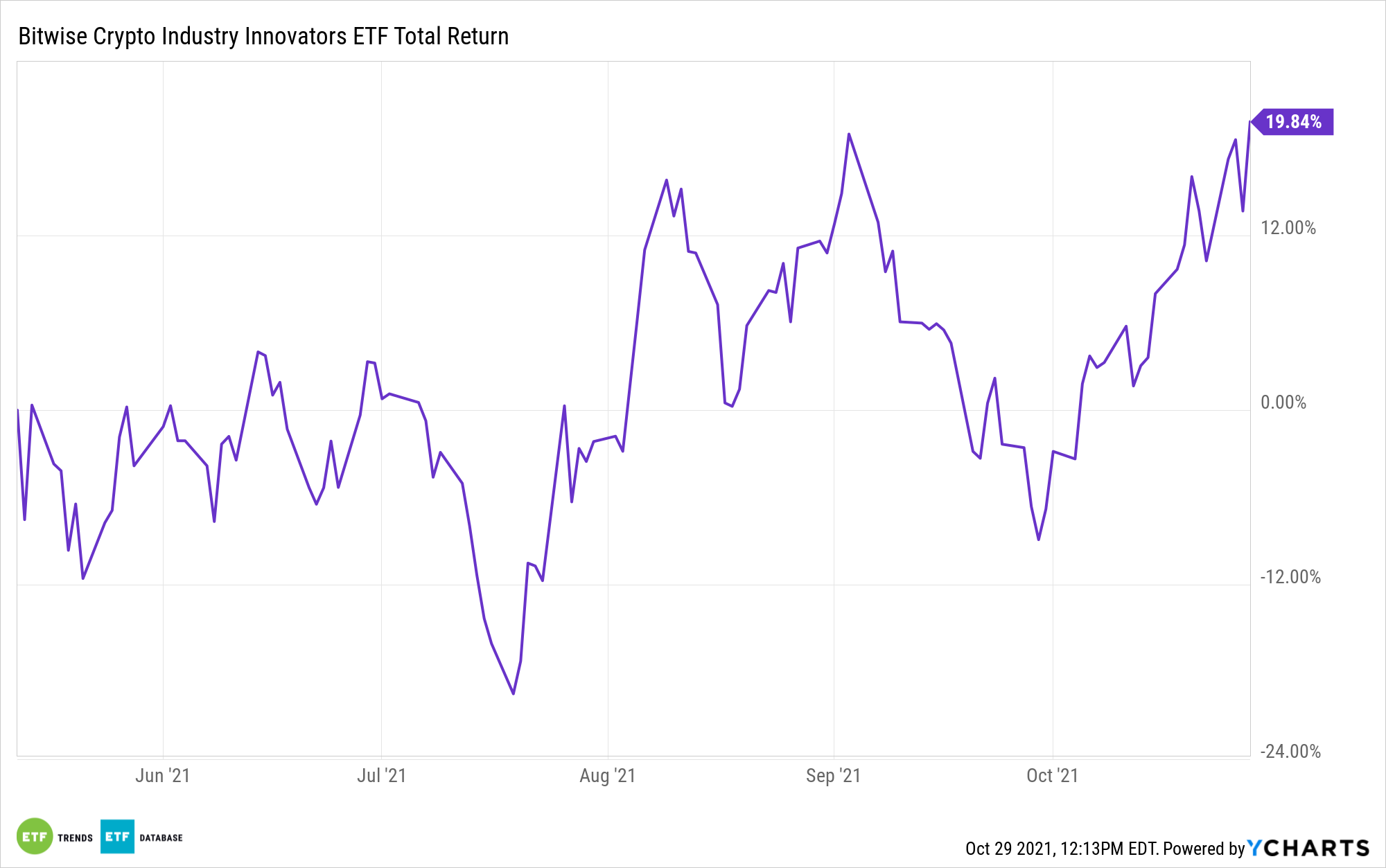

Investing in Crypto Mining With BITQ

The Bitwise Crypto Industry Innovators ETF (BITQ) offers investors exposure to the crypto revolution without investing directly in crypto assets.

BITQ tracks the Bitwise Crypto Innovators 30 Index, an index that has at least 85% allocation into companies that are cryptocurrency exchanges carrying bitcoin and other cryptocurrencies, crypto miners, mining equipment companies, and service providers. The remaining 15% is allocated to large-cap support companies with at least one major part of their businesses dedicated to crypto.

BITQ carries crypto mining companies such as Marathon Digital Holdings (MARA) at 5.34%, Hut 8 Mining (HUT CN) at 5.24%, and Hive Blockchain Tech (HIVE CN) at 4.42%.

The fund has an expense ratio of 0.85% and net assets of $91.9 million.

For more news, information, and strategy, visit the Crypto Channel.