We previously explored corporations’ bitcoin purchases and the investment management industry’s participation as two sources of growing institutional demand driving bitcoin’s past rally.

Here, we consider a third source of demand—the public’s increasing acceptance of bitcoin as payment.

Invented as peer-to-peer electronic cash, bitcoin aims to function as a global decentralized digital currency. Its creators envisioned an efficient and transparent financial system without centralized parties, directly empowering participants.

In the current stage of Bitcoin’s development, some doubt whether it’s a mature system able to facilitate transactions, given its high volatility and scalability issues, as well as regulatory uncertainties, tax complications and environmental concerns.

But potential developments could help move bitcoin forward.

Companies’ growing acceptance of bitcoin for payment could bring wider adoption, and the consequent increase in demand could dampen volatility. Technological advancement, such as the lightning network, could also improve the system.

Current Challenges

Money is a social construct to conveniently exchange goods. It has evolved from shells to fiat currency backed by governments.

These forms of currency have three aspects in common: store of value, medium of exchange and unit of account.

Examining bitcoin’s current stage of evolution from these three angles raises some doubts about whether it can be counted as money:

- Store of value: bitcoin’s price fluctuates widely

- Medium of exchange: bitcoin is not yet accepted in many places

- Unit of account: bitcoin is not a good vehicle to denominate goods given its volatility

The major challenge is volatility, which ensures that it is neither a good store of value nor a unit of account. Over the past five years, Bitcoin’s annualized volatility is approximately 80%. Its drawdowns during sell-offs could also be intimidating.

Regulatory uncertainties and crypto influencers’ changes of attitude can feed this volatility. Recently, we’ve seen bitcoin drop as much as 40% due to Elon Musk suddenly changing his decision to accept bitcoin as payment, citing environmental concerns.

The IRS’s current tax guidance also hinders Bitcoin’s adoption. Bitcoin is treated as a property rather than a currency, which implies that users need to pay capital gains taxes or recognize tax losses when transacting. This could lead to high tax payments when bitcoin’s price is soaring.

From a technical aspect, the system’s design poses a challenge to its scalability. Due to Bitcoin’s inherent block time and proof-of-work mechanism, it can only process up to seven transactions per second, compared to Visa’s 65,000.[1] These limitations prevent the network from handling large numbers of transactions, which can result in delays in processing times and increasing transaction fees, making it inefficient and expensive.

All these factors hold bitcoin back from being a “digital payment.”

Recently, investors appear to be focusing more on the “digital gold” narrative, treating bitcoin as an asset class that could provide inflation protection and portfolio diversification.

Yet, the narrative could shift again in the future as the network develops and its adoption accelerates.

Payment Platforms’ Participation

Payment platforms such as Square, PayPal, Visa and Mastercard are expanding their cryptocurrency businesses as bitcoin becomes mainstream. By participating in the crypto space, they hope to grow their revenues and leverage their existing infrastructures to form their own integrative crypto ecosystems.

With these companies’ participation making access easier, bitcoin could draw more usage from the public. Increased usage could potentially support bitcoin’s substantiation as a currency and lead to the stabilization of its price, although the challenges noted above may be difficult to overcome.

Payment platforms engage with cryptocurrencies in two major ways: providing cryptocurrency trading services and facilitating payment with cryptocurrencies. The latter is worth particular attention as it enables cryptocurrencies to function as money.[2]

Square

Square expanded Cash App—a payment service that allows users to transfer money to one another (like Venmo)—to include bitcoin in 2018.

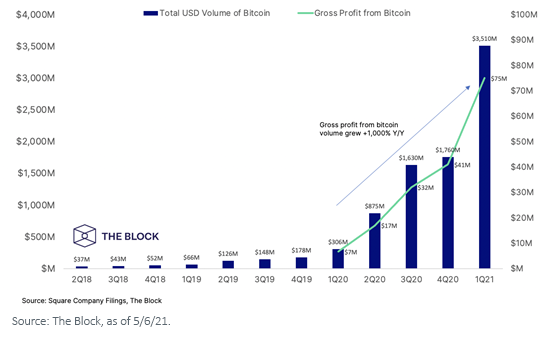

The success of Cash App indicates the service’s high demand. In the first quarter of 2021, Cash App generated a revenue of $3.5 billion related to its bitcoin services, or 11 times growth, year over year.[3]

Square’s Cash App—Bitcoin Sales Volume, Q1 21

More than three million users transacted bitcoin on Cash App in 2020.[4] While this number includes both purchasing and transacting in bitcoin, Square saw a larger base of customers interacting more frequently with the payment app.

Paypal

In November 2020, PayPal established its crypto selling and buying services. In March 2021, it started letting users pay seamlessly with selected cryptocurrencies through its “Checkout with Crypto” service, like using a credit or debit card.

Visa and Mastercard

Visa and Mastercard partnered with various digital platforms to roll out debit and prepaid cards that allow customers to pay with selected cryptocurrencies. These partners help convert cryptocurrencies to fiat currencies when processing the payment.

Going forward, Visa and Mastercard will focus on allowing direct settlement of stablecoins and central bank digital currencies (CBDC).[5]

The Lightning Network

Bitcoin developers are working on a solution to solve its scalability problem—adding a second layer protocol on top of Bitcoin called the lightning network. It carries transactions off-chain, allowing users to send instant payments and conduct micropayments (payments in small amounts).

The lightning network was introduced in 2017 and has been adopted by major crypto exchanges such as Kraken and OKEx. It now has 10,000 active nodes and holds around $69 million in value.[6] If widely supported, it could scale up the transaction process, making it faster and cheaper.

The Beginning of a New Trend

The idea of a decentralized currency is an exciting one, and bitcoin’s invention opens up the possibility of a more efficient and transparent financial system.

Right now, we are at an early stage and the system is being put to the test. More participants are riding this trend: Microsoft, Yum Brands (KFC in Venezuela accepts bitcoin), Landry’s restaurants (including Mastro’s)…

As PayPal’s CEO Dan Schulman said, we are at “a transitional point where cryptocurrencies move from being predominantly an asset class that you buy, hold and or sell to now becoming a legitimate funding source to make transactions in the real world at millions of merchants.”[7]

Originally published by WisdomTree, 6/15/21

1 Sources: Kyle Croman et al, “On Scaling Decentralized Blockchains (A Position Paper),” International Conference on Financial Cryptography and Data Security, 2/16; “Visa Fact Sheet,” usa.visa.com, 7/19.

2 However, most of the payment options offered now do not allow direct settlement. Instead, cryptocurrencies need to be converted to fiat currency to be used.

3 Source: Square, “Q1 2021 Shareholder Letter,” EDGAR, 5/6/21.

4 Source: Square, “Q4 2020 Shareholder Letter,”investors.squareup.com, 2/23/21.

5 Sources: “Digital Currency Comes to Visa’s Settlement Platform,”usa.visa.com, 3/29/21; Raj Dhamodharan, “Why Mastercard Is Bringing Crypto onto Our Network,” mastercard.com, 2/21/21.

6 Source: Colin Harper, “Bitcoin’s Lightning Network Now Has 10K Active Nodes and $69M in Locked Value,” coindesk.com, 5/5/21.

7 Source: Anna Irrera, “Exclusive: PayPal Launches Crypto Checkout Service,” reuters.com

Important Risks Related to this Article

There are risks associated with investing, including the possible loss of principal. Crypto assets, such as bitcoin and ether, are complex, generally exhibit extreme price volatility and unpredictability, and should be viewed as highly speculative assets. Crypto assets are frequently referred to as crypto “currencies,” but they typically operate without central authority or banks, are not backed by any government or issuing entity (i.e., no right of recourse), have no government or insurance protections, are not legal tender and have limited or no usability as compared to fiat currencies. Federal, state or foreign governments may restrict the use, transfer, exchange and value of crypto assets, and regulation in the U.S. and worldwide is still developing. Crypto asset exchanges and/or settlement facilities may stop operating, permanently shut down or experience issues due to security breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your customer/anti-money laundering) procedures, non-compliance with applicable rules and regulations, technical glitches, hackers, malware or other reasons, which could negatively impact the price of any cryptocurrency traded on such exchanges or reliant on a settlement facility or otherwise may prevent access or use of the crypto asset. Crypto assets can experience unique events, such as forks or airdrops, which can impact the value and functionality of the crypto asset. Crypto asset transactions are generally irreversible, which means that a crypto asset may be unrecoverable in instances where: (i) it is sent to an incorrect address, (ii) the incorrect amount is sent, or (iii) transactions are made fraudulently from an account. A crypto asset may decline in popularity, acceptance or use, thereby impairing its price, and the price of a crypto asset may also be impacted by the transactions of a small number of holders of such crypto asset. Crypto assets may be difficult to value and valuations, even for the same crypto asset, may differ significantly by pricing source or otherwise be suspect due to market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto assets generally rely on blockchain technology and blockchain technology is a relatively new and untested technology which operates as a distributed ledger. Blockchain systems could be subject to Internet connectivity disruptions, consensus failures or cybersecurity attacks, and the date or time that you initiate a transaction may be different then when it is recorded on the blockchain. Access to a given blockchain requires an individualized key, which, if compromised, could result in loss due to theft, destruction or inaccessibility. In addition, different crypto assets exhibit different characteristics, use cases and risk profiles. Information provided by WisdomTree regarding digital assets, crypto assets or blockchain networks should not be considered or relied upon as investment or other advice, as a recommendation from WisdomTree, including regarding the use or suitability of any particular digital asset, crypto asset, blockchain network or any particular strategy. WisdomTree is not acting and has not agreed to act in an investment advisory, fiduciary or quasi-fiduciary capacity to any advisor, end client or investor, and has no responsibility in connection therewith, with respect to any digital assets, crypto assets or blockchain networks.

U.S. investors only: Click here to obtain a WisdomTree ETF prospectus which contains investment objectives, risks, charges, expenses, and other information; read and consider carefully before investing.

There are risks involved with investing, including possible loss of principal. Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, currency, fixed income and alternative investments include additional risks. Please see prospectus for discussion of risks.

Past performance is not indicative of future results. This material contains the opinions of the author, which are subject to change, and should not to be considered or interpreted as a recommendation to participate in any particular trading strategy, or deemed to be an offer or sale of any investment product and it should not be relied on as such. There is no guarantee that any strategies discussed will work under all market conditions. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results. This material should not be relied upon as research or investment advice regarding any security in particular. The user of this information assumes the entire risk of any use made of the information provided herein. Neither WisdomTree nor its affiliates, nor Foreside Fund Services, LLC, or its affiliates provide tax or legal advice. Investors seeking tax or legal advice should consult their tax or legal advisor. Unless expressly stated otherwise the opinions, interpretations or findings expressed herein do not necessarily represent the views of WisdomTree or any of its affiliates.

The MSCI information may only be used for your internal use, may not be reproduced or re-disseminated in any form and may not be used as a basis for or component of any financial instruments or products or indexes. None of the MSCI information is intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may not be relied on as such. Historical data and analysis should not be taken as an indication or guarantee of any future performance analysis, forecast or prediction. The MSCI information is provided on an “as is” basis and the user of this information assumes the entire risk of any use made of this information. MSCI, each of its affiliates and each entity involved in compiling, computing or creating any MSCI information (collectively, the “MSCI Parties”) expressly disclaims all warranties. With respect to this information, in no event shall any MSCI Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including loss profits) or any other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Services, LLC.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

You cannot invest directly in an index.