Digital currency asset manager Grayscale Investments announced on Friday that three of its trusts have become SEC reporting companies.

The Grayscale Bitcoin Cash Trust (OTCQX:BCHG), the Grayscale Ethereum Classic Trust (OTCQX:ETCG), and the Grayscale Litecoin Trust (OTCQX:LTCN) will now be required to file 10-Qs and 10-Ks with the SEC.

For existing investors, the Trust’s new SEC reporting status will provide an early liquidity opportunity, reducing the holding period from 12 months to six.

Grayscale already has three investment products with the same reporting designation: the Grayscale Bitcoin Trust (GBTC), the Grayscale Ethereum Trust (ETCG), and the Grayscale Digital Large Cap Fund (GDLC).

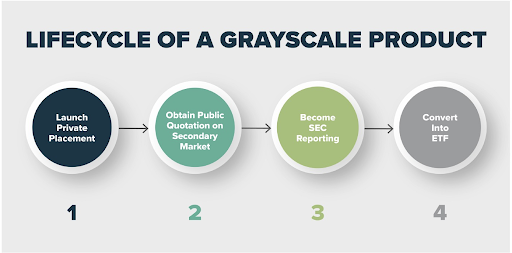

According to a Grayscale blog post, becoming an SEC reporting company is the third step in Grayscale’s product development pipeline. The fourth and last step will be conversion into an ETF.

Source: greyscale.com Accessed 9/11/2021

Currently, more than 20 digital asset ETF proposals sit on the SEC’s desk. However, Grayscale has not filed with the SEC to launch a digital asset ETF since they withdrew their application for a Bitcoin ETF in 2017.

The issuer has instead chosen to wait until a digital asset ETF has launched and then quickly convert their trusts into ETFs, relying on their large market size and reputation to gain traction without being first to market, according to Forbes.

Craig Salm, Vice President of Legal at Grayscale Investments said in the latest press release that the company is committed to “offering transparent investment vehicles that voluntarily exceed standard reporting requirements, meet a heightened level of disclosure, and are subject to additional regulatory oversight.”

Creating SEC reporting companies not only gains the trust of a wider audience for the time being (since, as Grayscale CEO Michael Sonnenshein told Forbes, many investors are used to looking at SEC reports when considering investments), but it builds credibility with regulators as well.

For more news, information, and strategy, visit the Crypto Channel.