How digital assets work and ways investors can gain exposure to them

Authored by:

- Rene Reyna, CFP

- Head of Thematic and Specialty Product Strategy for ETF and Indexed Strategies, Invesco

- Steve Kurz

- Partner and Head of Asset Management, Galaxy Digital

- Robert Hughes

- Chief Commercial Officer, Alerian

- Brett Boor, CFA

- Senior ETF Analyst, Invesco

- David Davenport, CFA

- ETF Analyst, Invesco

Introduction to digital assets

Since Bitcoin’s launch in 2009 in the wake of the global financial crisis, investors, companies, and governments have grappled with what this new asset class means for investment portfolios, society, and the global economy. Were the detractors, like Johannes Trithemius, the 15th century monk who feared the printing press,[1] simply Luddites? Or were the advocates ahead of themselves on a transformative technology? From where we sit in 2021, however, regardless of your stance on the path of development and regulation, it appears digital assets are here to stay.

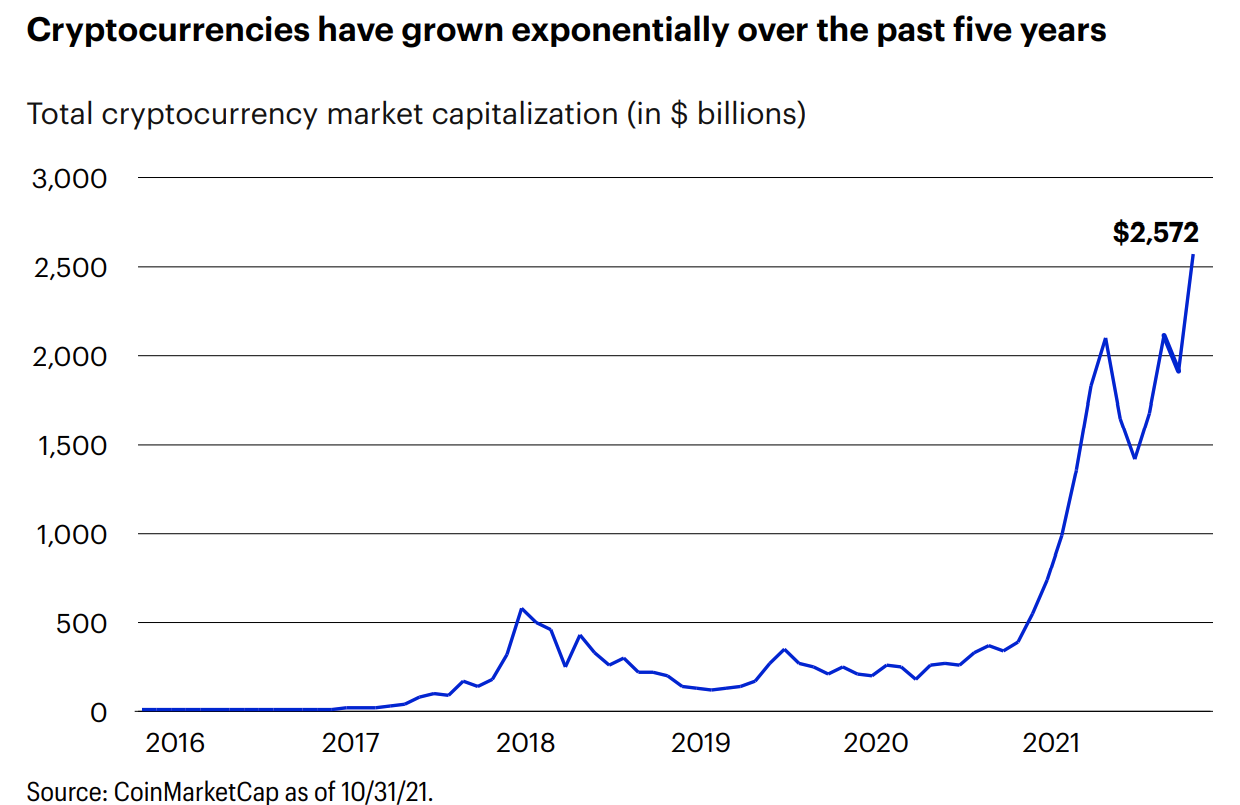

As of October 2021, the total market capitalization of digital assets crossed $2.5 trillion, covering over 11,000 digital assets on 395+ exchanges.[2] Given the growing presence of digital assets and the potential of blockchain technology, more investors are seeking ways to invest in — and asking important questions about the pros and risks of — digital assets. This is precisely why Invesco has joined Galaxy Fund Management, a leading financial services innovator in digital assets, and Alerian, a pioneering index provider, in forging a partnership to help our clients answer these questions. Collectively, we aim to help investors navigate the winds of change as technology and our economy transform.

In the pages to follow, we will explore three key topics in this new digital economy.

- First, we will discuss how digital assets work, aiming to go beyond the “101” and into the details of decentralized finance and “Web 3.0.”

- Next, we’ll discuss ways to implement them in a portfolio.

- Finally, we introduce two new Invesco ETFs that offer exposure to cryptocurrencies and blockchain users.

01: How digital assets work

To understand how blockchain — and the digital assets the technology supports — function, it’s helpful to think about how the internet itself works. As we’ve seen since the 1970s, a transformative development in digital technology seems to appear every 10 to 15 years: Personal computers, laptops, the internet, and cell phones. All of this drove rapid connectivity, allowing the information that had previously been on paper to be rapidly exchanged and disseminated. However, a key function of the current internet architecture we’re living with is centralization. This requires users to utilize specific gatekeepers to access and interact with certain types of information, which also leaves the current infrastructure susceptible to hacks and ‘permissioned misuse’ (as we’ve seen with corporations taking advantage of users’ data).[3]

This brings us to digital assets and the blockchain that supports them. As you may be aware, blockchain is simply a digital ledger, an immutable database that stores data chronologically, storing records block by block. However, the key aspect that differentiates this technology is its decentralization. This ledger is maintained by a wide array of computers, and it is their computing power collectively — or hash power — that keeps the network secure and ensures that those records are immutable. In the case of Bitcoin, for example, transactions on the ledger are permanent, auditable, encrypted, and distributed. Importantly, the Bitcoin blockchain has never been hacked.[4] To explore how this network of computers functions, let’s explore cryptocurrency and how it is mined.

Mining

Like physical gold, someone must do the work to bring a valuable asset into the world. With cryptocurrencies, miners do the work of keeping the network secure in exchange for winning newly minted coins. Miners validate transactions before they can be added to the blockchain — which helps keep the database immutable. They compete to solve cryptographic equations, with the quickest being awarded coins and permitted to amend the ledger. The beauty of solving these equations is that it requires complex computing power — which increases security because one would arguably need to have more power than the entire blockchain to override it. The security of blockchain continues to be studied, and it’s important for investors to stay abreast of current trends.

Digital payments and technology

The ability to utilize this decentralized technology to support transactions is a key component of what makes the blockchain transformative. That’s well before getting into the awesome potential of automated business logic or smart contracts. But before that, how exactly do transactions on a blockchain network take place? The important thing to remember from earlier is that blockchains operate as networks. They are virtual databases laid atop a large group of physical computers that participate in supporting the blockchain. This means that every computer interacts based on pre‑determined rules in the software and shares a copy of the immutable digital ledger. This is thought of as a trustless process, meaning you don’t have to know your counterparties or make sure you like the bank you’re working with as you do in the real world. The pre-established rules and the immutability of the blockchain drive the process for you. So, when a transaction is completed, it is submitted to the blockchain, verified by the miners, and then added to the database in a new block. This record is transmitted to the entire network.

DeFi (Decentralized Finance)

Now that we’ve established what drives this network, the next logical question is what to do with all that computing power. DeFi aims to answer that question, iterating on many of the familiar functions and services of the financial system but emphasizing the permissionless, decentralized power of the blockchain. This goes beyond just payments to include functions like borrowing, lending, and investing, all of it happening digitally and without the traditional gatekeepers of the existing financial system. Like anything, of course, this is more evolution than revolution, with new efficiencies and capabilities being introduced on top of existing financial interactions. That also means scale and debugging will need to take place to make the ecosystem work efficiently.

Web 3.0

Even more than finance, blockchains — and cryptocurrencies — have more value to add. Coins like Ethereum offer open-software programmability that can drive more use cases beyond simple value transfer. However, another potential development is what can take place across the internet using this innovative technology. Web 3.0, broadly speaking, is a cultural shift, driven by the innovation of digital assets, to improve upon the current internet we all interact with every day. Web 2.0, the current world we live in, was ushered in by the broad availability of smartphones, which dramatically increased demand to do everything on the web and make every application mobile. This, however, came with significant costs — most notably, the centralization of vast amounts of user data that can be either abused or outright stolen in hacks. The blockchain, however, would allow users to interact with a wide variety of applications in a number of ways, using the verification technology of cryptography to attest to customer information rather than giving it away to whatever internet startup a consumer is trying to interact with. By verifying your identity, funds, etc., using the blockchain, users maintain ownership of their valuable data, which also opens the door to new innovations like digitally native assets, the most common example currently being non-fungible tokens or NFTs.

Non-fungible tokens (NFTs)

NFTs are frequently featured in the news, especially given their often obscure or tongue-in-cheek art and quickly rising price tags. However, what they represent for digitally native assets is revolutionary — assets that were created on the internet, live on the internet, and are ultimately owned and controlled on the internet. The key part of the name NFT is the ‘non-fungible’ part, where ownership of something as unique as a jpeg of abstract art can be verified as original and properly owned on the blockchain. However, this reveals the potential of a new creator economy where ideas born on the internet can be controlled and monetized there. While this is outside the scope of this piece, some of the potential ideas like user-owned real estate inside virtual worlds — essentially a user-owned video game — continue to revolutionize the digital assets space.

02: Potential ways to implement digital assets in a portfolio

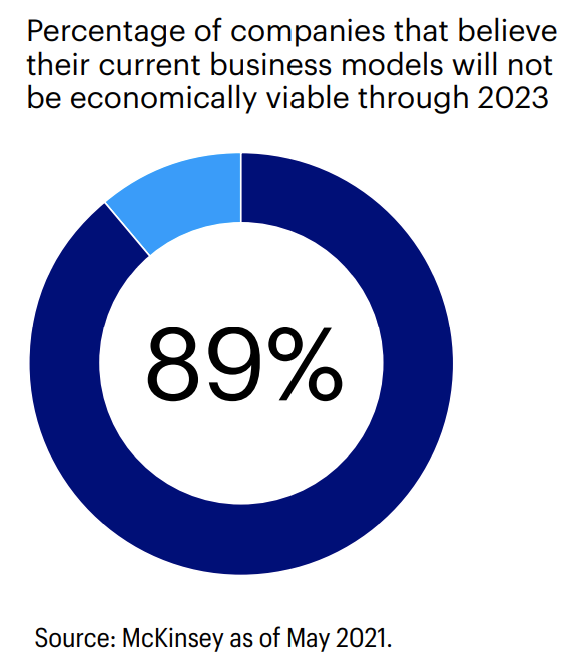

Digital assets are growing quickly as blockchain technology capabilities become more widely recognized by the broader investing community. Investors looking to add more exposure to disruptive technologies in their portfolios may find an abundance of opportunities in the digital asset space. An ever-expanding list of companies is dedicating significant resources to digital assets as the rise of digitization unfolds. According to a recent McKinsey survey,[5] organizations are embracing the need for disruption across industries as 89% of companies believe their current business models will not be economically viable through 2023. Traditional companies like MasterCard[6] are on board with plans to enable digital asset purchases across all merchants.

Institutional investing

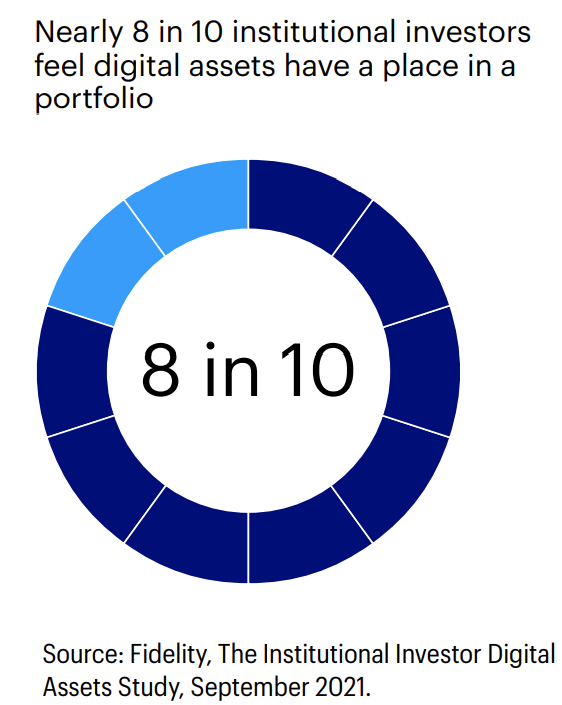

Major university endowments were among the first institutions to make significant investments in cryptocurrency back in 2018, and institutional investor interest has only grown since then. According to a September 2021 study by Fidelity,[7] nearly 8 in 10 institutional investors surveyed felt digital assets have a place in a portfolio. From a macro perspective, 81 countries representing 90% of global GDP are now developing a central bank digital currency.[8] We expect adoption to continue at an impressive rate as institutional infrastructure and regulatory frameworks continue to take shape. Leading companies like CME Group and Fidelity are already setting standards for the custody, trading, and settlement of digital assets. Galaxy Fund Management partnered with Alerian to launch indexes that offer access through a transparent and rules-based approach. Consideration, adoption, and regulation continue to grow and evolve, which investors should keep an eye on.

Key risks to consider

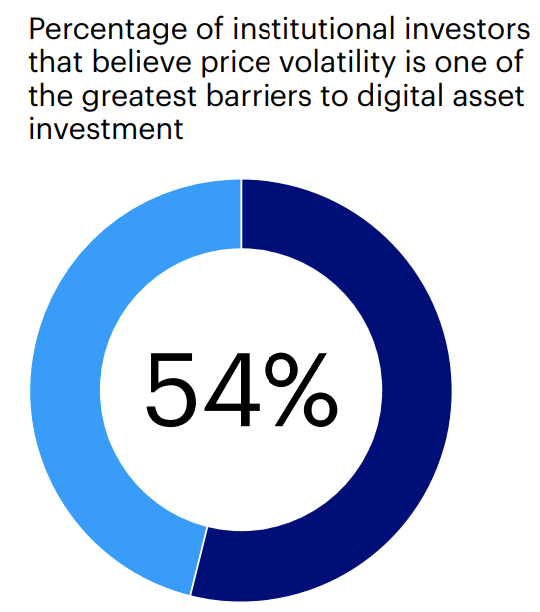

Digital assets come with inherent risks that need to be considered. Digital assets are volatile, and the exceptional returns of recent years may not repeat; notably, Fidelity’s survey found 54% of institutional investors believe price volatility is one of the greatest barriers to investment.[9] Bitcoin’s volatility is likely to decline, however, as the market matures and more experienced investors establish positions. For example, two of the largest US conventional commodities exchanges, the Chicago Board Options Exchange and the CME Group Exchange, now offer Bitcoin futures, and CME has also launched federally regulated Bitcoin options. Although this is new, they’re popular among professional traders, whose educated judgments may help moderate Bitcoin’s volatility. Also important to consider is that crypto companies have limited track records and analyst coverage, and their long-term success is largely linked to the outlook of the underlying cryptocurrencies. Additionally, as regulation continues to evolve in this space, the potential for market manipulation, insider dealing, and fraud are elevated risks for digital assets that need to be considered.

Allocation management

Digital assets remain a nascent asset class, so elevated volatility relative to other traditional asset classes should be expected. As previously mentioned, however, volatility may decline over time as the market matures. Investors who have prudently considered the risk profile of digital assets often approach implementation as a smaller part of their overall portfolios. A Galaxy Digital Research analysis using modern portfolio theory found that the hypothetical risk-return (i.e., Sharpe) ratio is optimized with a 7% allocation to Bitcoin. However, the greatest marginal improvement occurs in the 0.5% to 2.5% range, demonstrating that even a small allocation to Bitcoin can have a major impact on a portfolio’s total returns. In May 2020, respected hedge fund manager Paul Tudor Jones disclosed a 1%–2% allocation to Bitcoin in his portfolio to protect against inflation. Hedge fund manager Bill Miller — who at one point had about half of his Miller Value Partners 1 fund’s assets in Bitcoin — recently said that having 1%–2% of assets in Bitcoin makes sense for investors concerned about inflation.[10] Besides serving as an inflation-sensitive asset within an alternatives sleeve, digital assets are also sometimes treated as speculative equities in portfolios. Under the speculative equities view, some investors prefer to allocate these assets within the more volatile small-cap and emerging market equity portion of their portfolios. Notably, elevated volatility may require frequent rebalances for digital asset allocations.

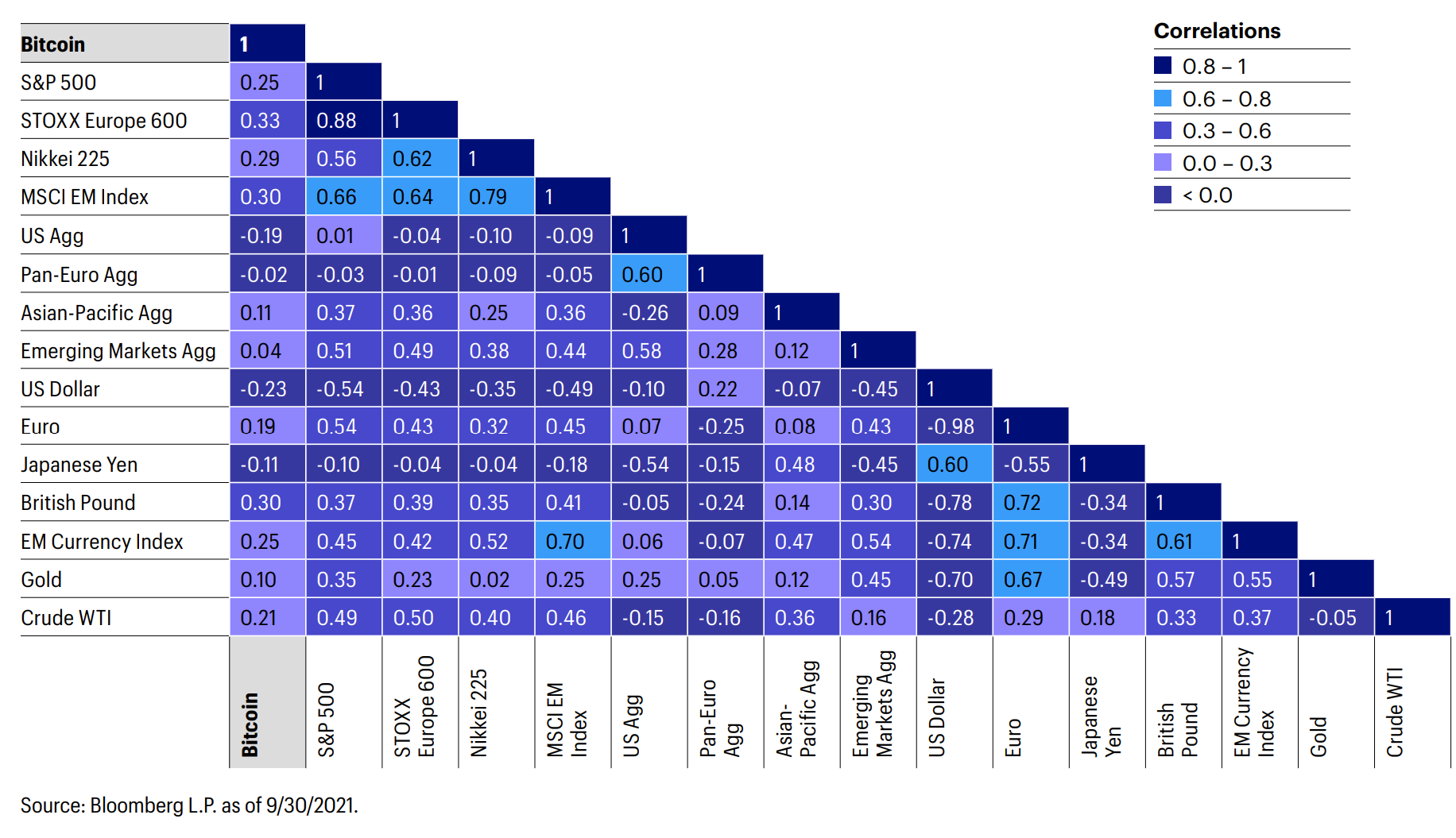

Asset correlations: Bitcoin may be a potential diversifier

03: Access digital assets with Invesco ETFs

Invesco Digital Asset ETFs

- SATO Invesco Alerian Galaxy Crypto Economy ETF

- BLKC Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF

Access digital assets with Invesco ETFs

Invesco teamed with Galaxy Fund Management and Alerian to launch two differentiated ETFs that provide investors access to digital assets: Invesco Alerian Galaxy Crypto Economy ETF (ticker: SATO) and Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (ticker:BLKC). Both seek to track Alerian Galaxy underlying indexes that hold 85% blockchain and crypto-related stocks and 15% cryptocurrency trusts and exchange-traded products (ETPs). Trusts and ETPs may provide more targeted exposure by directly tracking cryptocurrencies, while stocks provide the potential for future growth and exposure to the broader ecosystem.

SATO tracks the Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts & ETPs Index, which provides exposure to companies participating in both the cryptocurrency and blockchain space, including businesses such as cryptocurrency miners, cryptocurrency infrastructure enabling technologies, and cryptocurrency buyers. BLKC tracks the Alerian Galaxy Global Blockchain Equity, Trusts & ETPs Index, which offers access to the same companies as SATO as well as a segment of companies that are utilizing blockchain technology not tied to cryptocurrency. Both ETFs keep up with the quickly evolving landscape by following a monthly rebalance schedule; they diversify appropriately through an equal-weight approach.

Since SATO and BLKC provide exposure to an emerging asset class, they may be well-suited to complement a core portfolio as satellite holdings. The funds’ inclusion of trusts and ETPs helps to provide a stronger correlation to cryptocurrencies like Bitcoin and Ether, which may offer additional diversification benefits alongside traditional asset classes.

Current state of investment options

Given the dynamism of the digital assets space, there are an array of options for investors to choose from — with more being launched all the time. It’s important to know that these funds tend to fall along two axes — active vs. index-based and segmented versus bulk beta. First, we believe that taking an index-based approach is helpful for investors in this quickly growing space. The reason is that knowing what you’re likely to own with full transparency is helpful. The Invesco Digital Asset ETFs track Alerian Galaxy indexes that have rules designed in ways that make sense for the digital assets space. One of the greatest advantages of our predictable process is knowing the exact proportion of ETPs and equities the fund will own. While some of the active products in the marketplace make allocations to crypto ETPs, they may be without a dedicated allocation.

Second, as noted above, our transparent process fully segments the industry, helping investors know which vital trends in the digital asset industry they are targeting. By parsing the universe into miners, enabling technologies, buyers, users, and ETPs — and then allowing investors to equally weight between those opportunities — they can be more assured they’re getting access to a broad, more complete allocation to the industry. Many funds outside of our ETFs take a bulk-beta approach, simply owning any stock in the space in accordance with its current market capitalization, irrespective of a future opportunity or segment relevance.

Conclusion

We believe the rapidly growing digital assets space has transformative potential. While it is relatively new, it holds important potential for the future of the digital economy and may present opportunities to help investors achieve their objectives. Still, it is always vital to take a portfolio perspective on investments when it comes to this emergent technology, and it is critical to understand the inherent risks. ETFs are a useful tool for investing in the industry via a single ticker, and Invesco’s new funds, SATO and BLKC, could help investors pursue their goals with a well-defined passive structure providing access to a broad, segmented investment universe.

Footnotes:

1. Johannes Trithemius, In Praise of Scribes, Cambridge University Press, 2011.

2. CoinMarketCap & Galaxy Digital as of October 2021.

3. Evolution, not Revolution: Investing in Digitization and Blockchain, Galaxy Digital, May 2020.

4. Cryptocurrencies 101, Galaxy Fund Management, January 2021.

5. McKinsey as of May 2021.

6. As of 10/11/21, the weight to Mastercard in BLKC and SATO was 1.54% and 0%, respectively. Source: Invesco.

7. Fidelity, The Institutional Investor Digital Assets Study, September 2021.

8. Atlantic Council, CBDC Tracker, August 2021.

9. Fidelity, The Institutional Investor Digital Assets Study, September 2021.

10. Cryptocurrencies 101, Galaxy Fund Management, January 2021.

For more news, information, and strategy, visit the Crypto Channel.

Before investing, investors should carefully read the prospectus and/or summary prospectus and carefully consider the investment objectives, risks, charges and expenses. For this and more complete information about the fund(s), investors should ask their financial professional for a prospectus/summary prospectus or visit invesco.com/fundprospectus.

For Institutional Investor Use Only — Not For Use With The Public

Companies engaged in the development, enablement and acquisition of blockchain technologies are subject to a number of risks. Blockchain technology is new and many of its uses may be untested. There is no assurance that widespread adoption will occur. The extent to which companies held by the Fund utilize blockchain technology may vary.

As blockchain technology is new, there is a risk that companies developing applications of this technology may be subject to additional risks including, but not limited to, intellectual property claims and legal action. Furthermore, blockchain technology may be subject to future law and regulation that may adversely impact adoption.

Companies transacting on the blockchain are required to manage a user’s account (or “wallet”) which is accessed via cryptographic keys. Mismanagement, theft, or loss of the keys can adversely affect the companies operations on the blockchain.

Blockchain technology relies on the internet, the disruption of which may adversely affect companies involved with the technology or even the blockchain itself.

While the Fund will not invest directly in cryptocurrencies, the value of a Fund’s investments in cryptocurrency-linked assets (including private trusts and ETPs) is subject to fluctuations in the value of the cryptocurrency, which have been and may in the future be highly volatile. The price of a digital currency could drop precipitously (including to zero) for a variety of reasons, including, but not limited to, regulatory changes, a crisis of confidence, flaw or operational issue in a digital currency network or a change in user preference to competing cryptocurrencies.

Cryptocurrencies trade on exchanges, which are largely unregulated and, therefore, are more exposed to fraud and failure than established, regulated exchanges for securities, derivatives and other currencies.

Currently, there is relatively limited use of cryptocurrency in the retail and commercial marketplace, which contributes to price volatility.

Alerian is a service mark of Alerian and has been licensed for use by Invesco Capital Management LLC (“Invesco”). Galaxy is a trademark of Galaxy Digital LP (“Galaxy”) and has been licensed to Alerian for use in connection with the Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts & ETPs Index and the Alerian Galaxy Global Blockchain Equity, Trusts & ETPs Index (collectively, the “Alerian Galaxy Indexes”) and sublicensed to Invesco. The Invesco Alerian Galaxy Crypto Economy ETF and the Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (collectively, the “Invesco ETFs”) are not issued, sponsored, endorsed, sold or promoted by Alerian, Galaxy or any of their affiliates. Neither Alerian nor Galaxy makes any representation or warranty, express or implied, to the purchasers or owners of the Invesco ETFs or any member of the public regarding the advisability of investing in securities generally or in the Invesco ETFs particularly or the ability of the Alerian Galaxy Indexes to track general market performance. Alerian and Galaxy’s only relationship to the Invesco ETFs is the licensing of their trademarks and the Alerian Galaxy Indexes, which are determined, composed and calculated by Alerian without regard to Invesco or the Invesco ETFs. Neither Alerian nor Galaxy is responsible for or has participated in the determination of the timing of, prices at, or quantities of the Invesco ETFs issued by Invesco. Neither Alerian nor Galaxy has any obligation or liability in connection with the issuance, administration, marketing or trading of the Invesco ETFs.

invesco.com/us P-SATOBLKC-BRO-1 11/21 Invesco Distributors, Inc. NA924