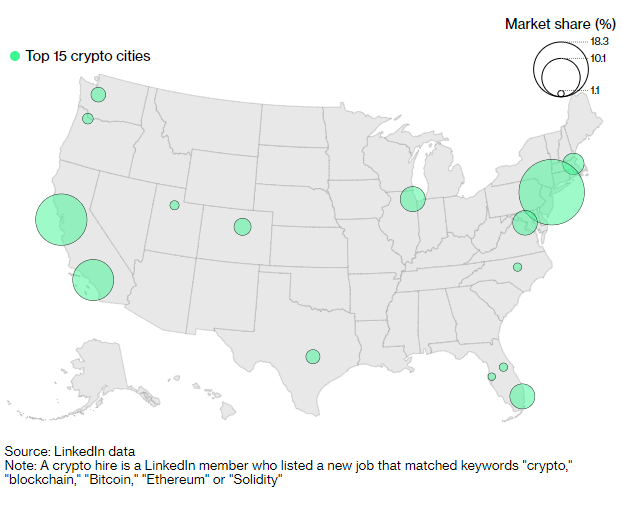

As life imitates art, the pattern of crypto hires across the United States reflects the decentralized structure of the cryptosphere itself. Bloomberg recently compiled data from LinkedIn of crypto hires that reflects the lack of any singular hub for crypto, but instead shows clusters all across the country.

The largest cities, New York, San Francisco, and Los Angeles, followed by Miami and Chicago, accounted for 47% of crypto hires, but the remaining 53% were spread out in small clusters in various parts of the country. This is a reflection of the nature of crypto itself as a decentralized base, in combination with a pandemic-adjusted society that has proven that white-collar work can be done just as effectively from home.

Image source: Bloomberg

“Crypto companies are an extreme version of tech, where the ethos of their work is about being decentralized,” said Seattle-based Diogo Monica, co-founder of crypto technology services company Anchorage Digital. “This means cities and states with lower taxes, great infrastructure, and quick access to an international airport will benefit from fully remote work.”

LinkedIn pulled data from the first nine months of the year on any new job titles that contained the words “blockchain,” “crypto,” “Bitcoin,” “Ethereum,” or “Solidity,” the last being a programming language used in smart contracts on blockchain technology. The survey is limited in that it only pulled what are considered specialists within crypto, and not broader jobs that work for crypto companies, such as administrative positions.

In large cities, the job market is already competitive and big cities often serve as hubs for many industries, but in mid-sized cities, crypto is having an increasingly larger allure. Per capita, there were at least two people hired for a crypto-oriented job per every 100,000 members of LinkedIn in cities such as Salt Lake City, Utah; Austin, Texas; and Raleigh, North Carolina.

With crypto miners increasingly settling in more rural areas, there is already a diversification happening within the crypto industry to different parts of the country. Cities will most likely serve as hubs for exchange activities while rural areas will be a draw for those running energy-intense operations, such as miners.

“The medium to long-term prospects are enormous,” Miami Mayor Francis Suarez said. “It’s as transformational as the Industrial Revolution was.”

A Burgeoning Jobs Market Reflects Crypto Industry Growth

The Invesco Alerian Galaxy Crypto Economy ETF (SATO) invests across the crypto industry in a variety of crypto-related categories that are hiring to accommodate the rapid growth they are experiencing. The fund invests across all market caps and within developed and emerging markets.

The fund seeks to track the Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts and ETPs Index, an index that is divided into two different security types: digital asset companies that are engaged in cryptocurrency or the mining, buying, and enabling technologies of cryptocurrency, and exchange traded products (ETPs) and private investment trusts traded over-the-counter that are associated with cryptocurrency.

To be considered for the index, a company must have a minimum full market cap of $50 million, a minimum float-adjusted market cap of $10 million, a minimum free-float factor of 20%, a minimum average daily trading value of $1 million over the last three months, and it must also be listed on a global exchange. This portion of the index is given an 85% weighting.

ETPs and private investment trusts must have a minimum market cap of $1 billion (or $500 million for current constituents), a minimum average daily trading value of $15 million over the last three months, and an open structure to be considered for the index. This portion of the index is given a 15% weighting.

SATO does not invest directly in bitcoin, cryptocurrencies or crypto assets, or in initial coin offerings or futures contracts for cryptocurrencies, and it is non-diversified. The fund may gain exposure to securities within the ETP and Trust component indirectly through a Cayman Islands subsidiary. The subsidiary is wholly owned and advised by Invesco and may constitute no more than 25% of the fund.

SATO carries an expense ratio of 0.60% and currently has 39 holdings, which include Voyager Digital Ltd (VOYG) at 4.29%, Marathon Digital Holdings Inc. (MARA) at 4.15%, and a 13.12% allocation into the Grayscale Bitcoin Trust (GBTC).

For more news, information, and strategy, visit the Crypto Channel.