Bitcoin mania is sweeping across financial markets, but there still isn’t a US-listed exchange traded fund dedicated to the cryptocurrency. Some ETFs are finding other ways to offer some Bitcoin exposure.

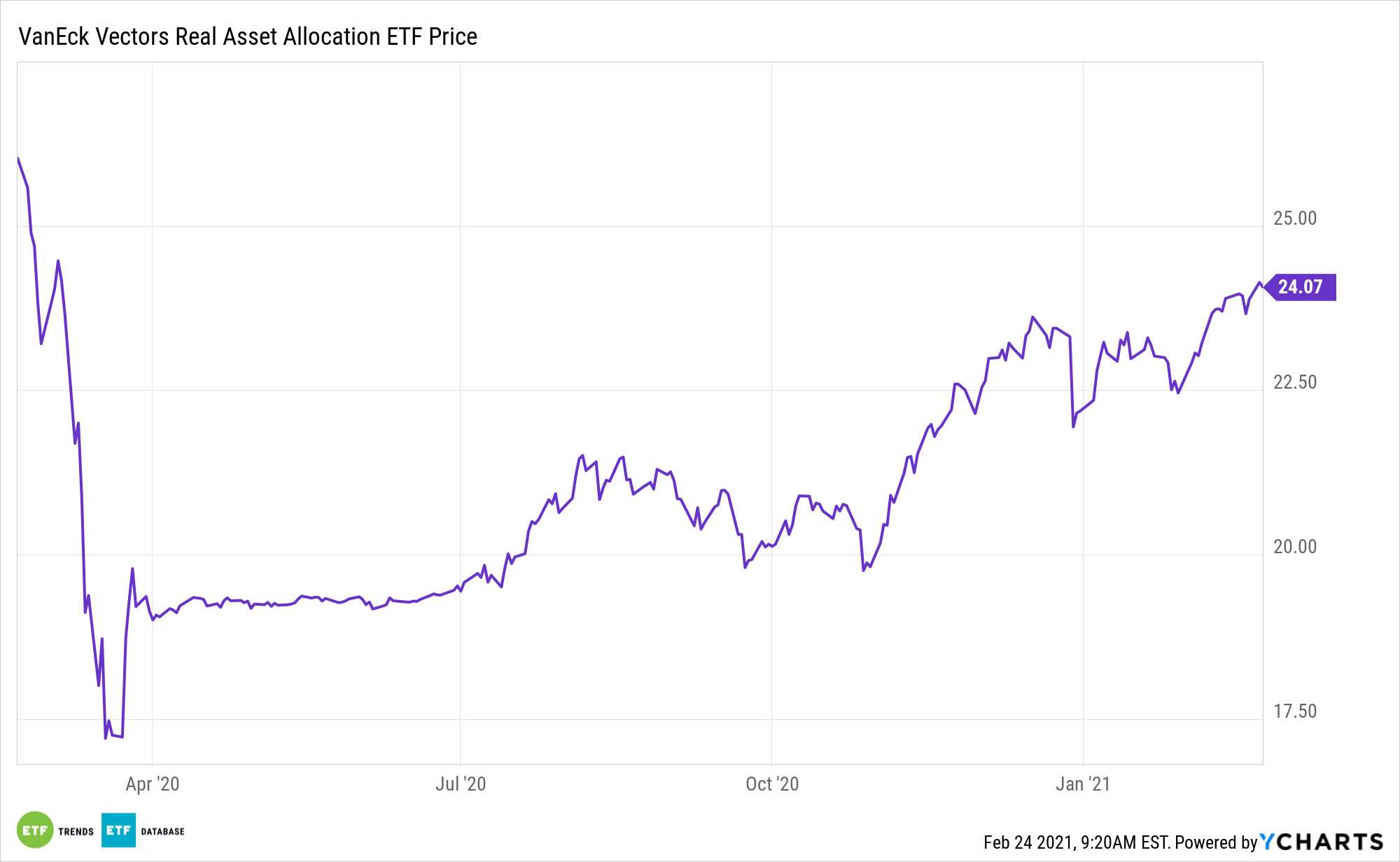

The VanEck Vectors Real Asset Allocation ETF (RAAX) recently added a small position in the Grayscale Bitcoin Trust.

The fund’s primary goal is to seek long-term total return. In pursuing long-term total return, RAAX seeks to maximize real returns while seeking to reduce downside risk during sustained market declines by allocating primarily to exchange-traded products that provide exposure to real assets, which include commodities, real estate, natural resources, and infrastructure.

“RAAX invests in three types of real assets: financial assets, income assets and resource assets. RAAX evolved and diversified its financial assets in February by gaining exposure to the price of bitcoin,” said VanEck portfolio manager David Schassler. “This was accomplished with an initial investment of 2% into the Grayscale Bitcoin Trust. We believe that digital assets may offer RAAX many of the same benefits as gold. Most notably, protection against inflation and currency debasement in addition to overall portfolio diversification.”

Bitcoin an Ideal Fit for RAAX

RAAX holdings span assets that provide hedges against rising inflation and a weak U.S. dollar, meaning Bitcoin fits seamlessly into the portfolio.

Bitcoin has sometimes been referred to as ‘digital gold’, with supporters suggesting it could be a good safe-haven investment. However, the cryptocurrency has tended to trade closer to equity markets in recent times and has been plagued by massive volatility, which has either made investors fortunes or crushed them. Like gold and other commodities, Bitcoin is a real asset, meaning its place in the RAAX portfolio is credible.

“Real assets continue to benefit from fears of inflation and hopes of higher global growth in the second half of 2021. The recent positive trends in commodity prices offer much relief to an asset class that has struggled to perform since the financial crisis. Now that the tides are turning, commodities and other real assets have the potential to lead the market higher for many years to come,” according to Schassler.

For more news, information, and strategy, visit the Crypto Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.