With the launch of the first cryptocurrency-related ETF, which invests in bitcoin futures and has boosted interest in cryptocurrencies and the potential of crypto investments, the Amplify Transformational Data Sharing ETF (BLOK) continues to harness the growth that the industry is experiencing.

Bitcoin has hit new highs as of today, flirting close to $66,900 and blowing past the previous high of $64,899 from April of this year. The record prices have been a culmination of a lot of factors for investors; the SEC giving the go-ahead for the ProShares Bitcoin Strategy ETF (BITO) certainly saw prices climb, but comments from billionaire investor Paul Tudor Jones regarding inflation fears and using crypto as a hedge instead of gold also helped the world’s largest cryptocurrency reach its new peak today, reported CNBC.

Ethereum is also on the rise, finally gaining to hit above the $4,000 level and nearing its May highs of $4,380.

Image source: CoinMarketCap Top Cryptocurrency Spot Exchanges

Crypto exchanges are experiencing massive volumes; Coinbase has recorded an almost 27% increase in trading volume over the last 24 hours, with Binance, the largest cryptocurrency exchange, logging a 22.57% volume increase and Kraken hitting a 35.21% increase in volume in the last day.

BLOK Offers Diversified Blockchain Industry Exposure

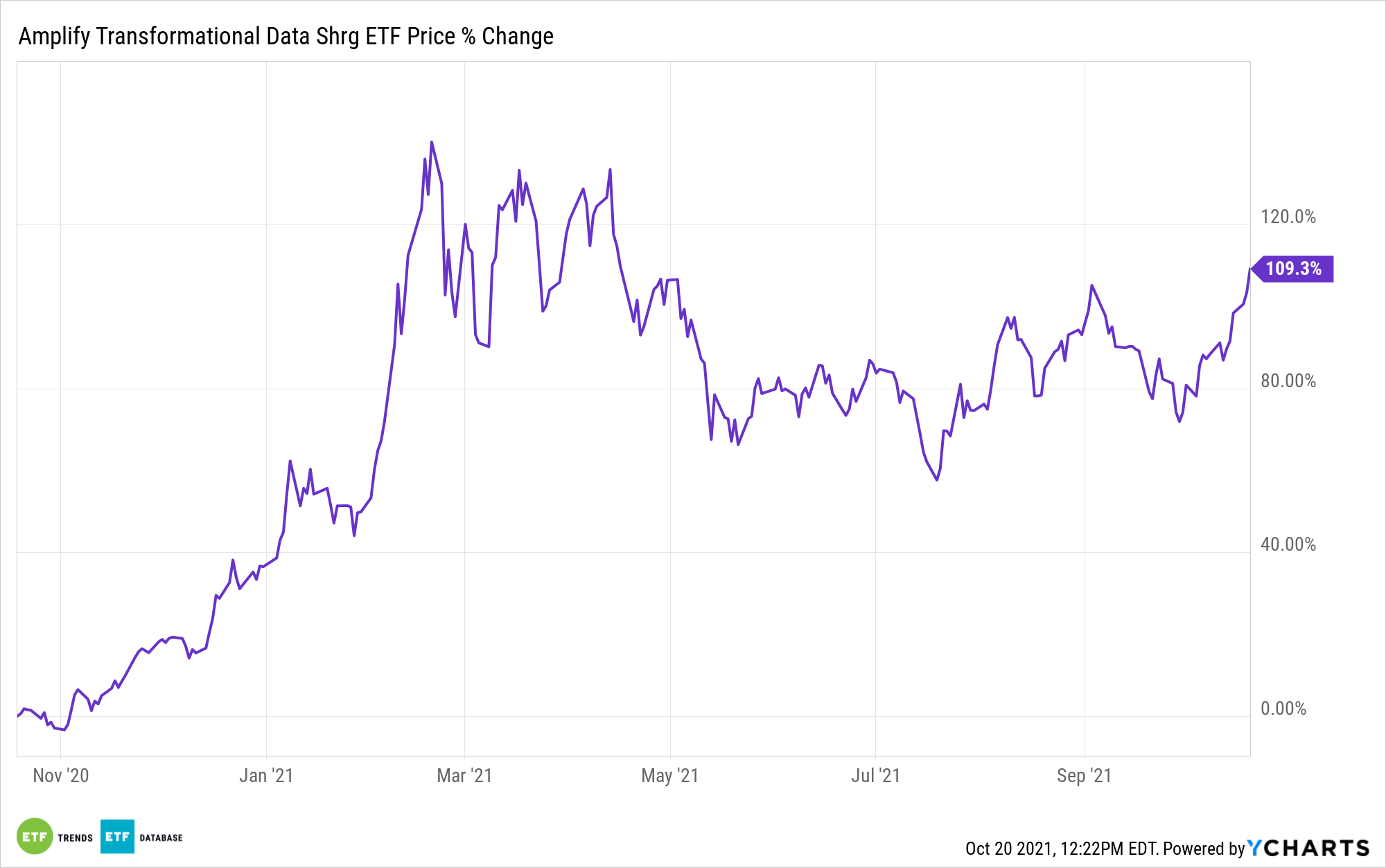

The Amplify Transformational Data Sharing ETF (BLOK), which now tops $1.37 billion in AUM and is the largest of the blockchain ETFs, is actively managed and invests in companies directly involved in developing and using blockchain technology. BLOK was also the first blockchain ETF approved by the SEC and launched in 2018.

The fund invests in companies partnered with or directly investing in companies utilizing and developing blockchain technologies. However, the fund does not invest directly in blockchain technology or cryptocurrencies.

The BLOK ETF spreads its holdings across the size spectrum, investing in all market caps. Within the blockchain industry, top allocations include transactional at 30.0%, crypto miners at 28.0%, and venture at 10% as of the end of September. BLOK invests across the blockchain landscape, in miners, exchanges, and developers.

Top holdings include Marathon Digital Holdings (MARA) at 6.25%; Hut 8 Mining Corp, a cryptocurrency mining company focused on bitcoin mining, at 6.13; and Microstrategy Inc (MSTR), a business intelligence and data analytics platform, at 5.79%

BLOK has an expense ratio of 0.71% and currently has 46 holdings.

For more news, information, and strategy, visit the Crypto Channel.