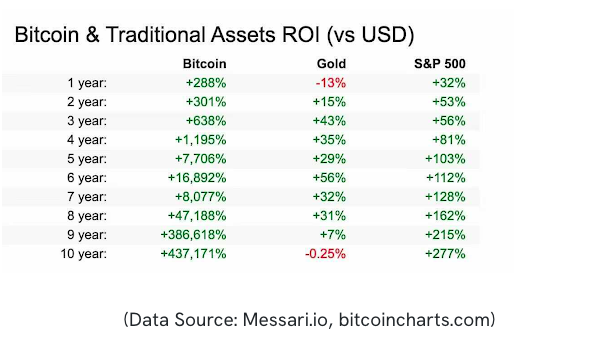

Even as cryptocurrencies are tumbling, it’s important to see the forest for the trees — over the last decade, Bitcoin has vastly outperformed gold and the S&P 500.

Despite being around for over a decade, digital currencies like bitcoin are still the new kid on the block. As such, the asset class has a lot to prove in traditional finance circles, but despite that, the past decade has been nothing short of remarkable.

“A decade ago crypto was unknown and even lesser understood. Fast forward today, and the tables have turned,” The Block notes. “Over the last 10 years, gold’s return on investment (ROI) in USD is seeing -0.25% and the S&P 500 is showing +277% today (November 15). Both these benchmarks pale in comparison to Bitcoin — 437,171% since 2011.”

As such, a number of cryptocurrency-related products are making their way into traditional markets within the U.S., including the first bitcoin futures ETF that debuted on the New York Stock Exchange last month. A number of other crypto-related funds are sure to be in tow and vying for Securities and Exchange Commission (SEC) approval.

Nonetheless, the big win is still increased adoption for an asset class that much of Wall Street essentially looked at with great skepticism. While the asset class still has a lot to prove, it’s certainly come a long way since the financial crisis in 2008.

“Bitcoin’s unprecedented performance has driven exponential adoption of cryptocurrencies as a new asset class that merits an allocation in any forward-looking investor’s portfolio,” The Block adds. “As the next 1 billion crypto curious onboard with a long-term investing horizon, the need to manage and earn passive income from one’s digital assets, similar to dividends from equity, coupons from bonds and rental from real estate, will become self-evident.”

10x Your Crypto Returns in One Fund

Investors looking to get into cryptocurrency can give the Bitwise 10 Crypto Index Fund (BITW) a look. The fund seeks to track an index comprised of the 10 most highly valued cryptocurrencies, screened and monitored for certain risks, weighted by market capitalization, and rebalanced monthly.

For investors looking to get exposure beyond bitcoin, there’s the Bitwise 10 ex Bitcoin Crypto Index Fund (BITX), which provides diversified exposure to the largest investable cryptoassets in the world, excluding bitcoin, with the familiarity and convenience of a traditional investment vehicle. The fund offers investors a means of allocating to other exciting parts of the crypto industry that bitcoin does not cover, such as decentralized finance apps, NFT infrastructure, and Layer 1 protocols.

For more news, information, and strategy, visit the Crypto Channel.