Soros Fund CEO and CIO Dawn Fitzpatrick said in an interview with Bloomberg that billionaire investor George Soros’ family office has invested in Bitcoin. This is another sign that cryptocurrencies have become more mainstream.

In addition, Forbes recently printed its newest listing of the 400 richest individuals. Cryptocurrency billionaires took six new spots, up from just one in the last listing. Since Coinbase was listed in April 2021, the march toward legitimacy for digital assets has felt inevitable. With rumors of a Bitcoin futures ETF on the cusp of SEC approval, the digital asset space is increasingly becoming normalized.

There’s more to cryptocurrency than direct exposure to the currencies themselves, however. The supporting digital infrastructures and the companies adjacent to the space are also poised for tremendous growth as digital assets become a regular part of everyday life. Miners like Marathon Digital Holding (MARA), banks like Silvergate Capital (SI), and players like Galaxy Digital Holdings (GLXY) all stand to reap the benefits of growing cryptocurrency legitimacy.

Renowned investors like Soros see the opportunities in the digital infrastructure space. Fitzpatrick said, “From our perspective again, we own some coins, not a lot, and the coins themselves are less interesting than the use cases of DeFi and things like that.”

DAPP Can Get You Into Digital Assets

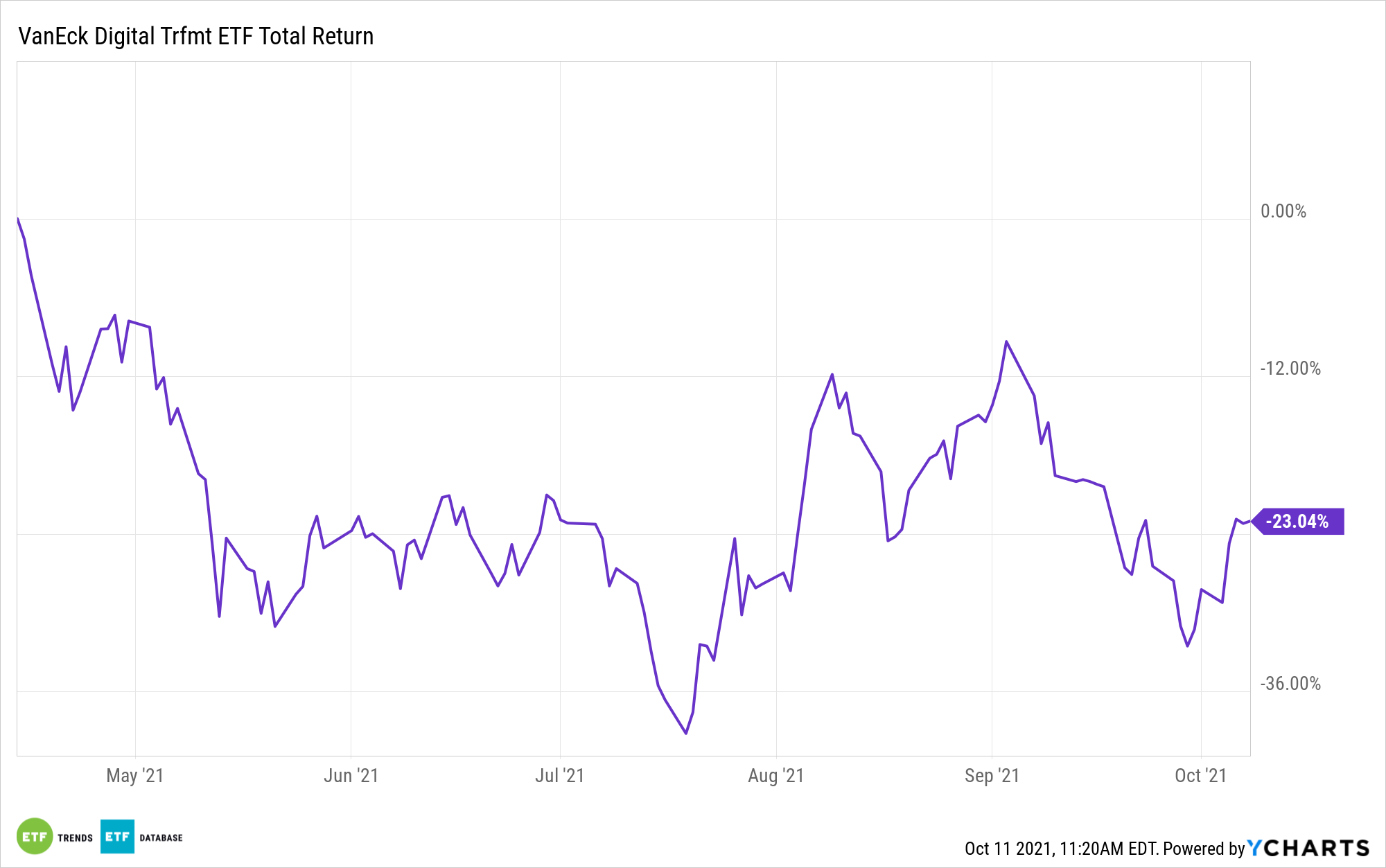

One thing all of the above companies have in common is that they are key holdings for the VanEck Digital Transformation ETF (DAPP). 7.7% of DAPP’s holdings are allocated to Marathon Digital Holdings Inc., along with 8% to Silvergate and 4.28% to Galaxy.

Marathon had a big week last week, jumping up 3.03%. It is also on the verge of breaking even and is a rare loss-making growth company that is operating with no debt on its balance sheet and purely off of its shareholder funding.

Silvergate is a cryptocurrency bank, which makes it a tremendous high-risk, high-reward holding. Income from the second quarter of this year increased 371% from a year earlier. The continued push for cryptocurrency legitimacy could help Silvergate continue to grow.

Galaxy Digital Holdings is poised to be a huge player in the cryptocurrency space, recently partnering with Invesco and Alerian to create digital asset investment products of their own.

DAPP has an expense ratio of 0.50%.

For more news, information, and strategy, visit the Crypto Channel.