Bitcoin responded to the announcement of increasing crackdowns on cryptocurrency by China on Monday with a tailspin that slid into Tuesday before leveling off.

At its lowest point, the currency was negative for the year, falling more than 11% Tuesday morning to $28,911, versus the $29,026 that it ended 2020 on, according to CNBC. As of Wednesday morning, however, the crypto asset was once again on the rise, topping $34,000 as of press time.

Reasons for the Fall

China is currently the top miner of Bitcoin, producing up to three-quarters of the world’s supply. But Sunday saw Chinese authorities shutting down Bitcoin mines in Sichuan, the second largest Bitcoin mining province. It is an area known for its hydropower and one that miners move to during the rainy season, according to Reuters.

China’s central bank, The People’s Bank of China, held a meeting with state-owned commercial banks, Ant Group Co.’s Alipay, and others on Monday in which it reinforced the recent guidelines set forth by China’s government on curbing cryptocurrency and its related activities, accord to the Wall Street Journal.

Both moves caused Bitcoin to dip below the current $30,000 floor for a time before recovering to roughly $32,000 by mid-Tuesday.

Bitcoin hit record highs in February but has been on a volatile ride ever since, rising and falling with tweets from Elon Musk and concerns over its use in the recent hijacking of the Colonial Pipeline and subsequent Bitcoin ransom.

The volatility and lack of regulation of the cryptocurrency space is one that has been noted by the SEC and other government regulatory bodies, but as of now, there are no plans to address regulation of any sort in the digital asset markets.

See also: SEC Does Not Plan to Weigh in on Crypto Regulation in 2021

“The only guarantee with the cryptocurrency space is volatility, and obviously that’s what we have right now,” Fairlead Strategies founder Katie Stockton told CNBC. “It’s not new, we’ve had days like this before, it’s just a matter of navigating through this noise.”

BITQ and Tracking the Bitcoin Trends

Investors looking for crypto exposure without the volatility of actually holding Bitcoin can seek out one of several digital assets ETFs.

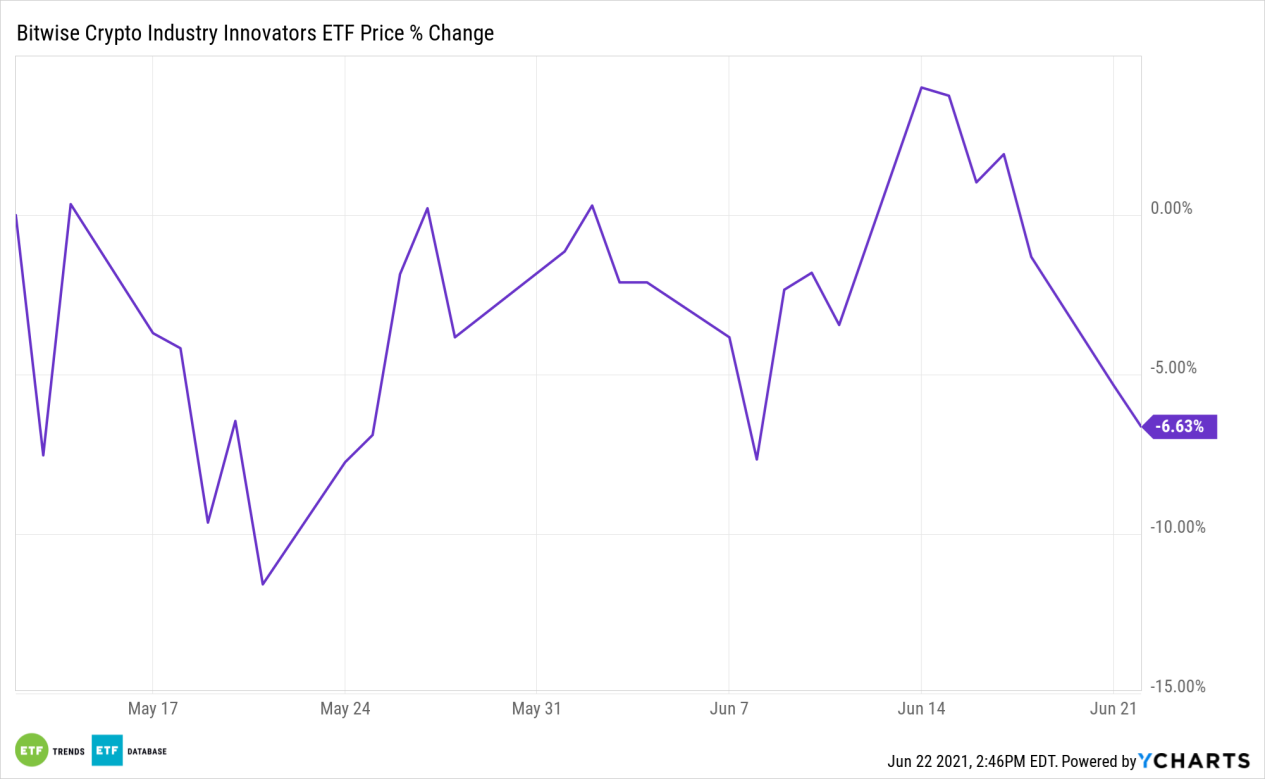

One example is the Bitwise Crypto Industry Innovators ETF (BITQ), which tracks the Bitwise Crypto Innovators 30 Index, an index that has at least 85% allocation into companies that are cryptocurrency exchanges carrying Bitcoin and other cryptocurrencies, crypto mining, and mining equipment companies, as well as service providers. The remaining 15% is allocated to support large cap support companies with at least one major part of their businesses dedicated to crypto.

Tracking BITQ year-to-date gives a rough snapshot of the volatility that the cryptocurrency markets experience and what makes crypto such a speculative investment.

The top 3 holdings of BITQ are MicroStrategy (MSTR), with a weight of 12.49%, Coinbase Global (COIN), with a weight of 10.09%, and Silvergate Capital (SI), with a weight of 8.96%.

The fund has an expense ratio of 0.85% and net assets of $48 million.

For more news, information, and strategy, visit the Crypto Channel.