Investment-grade corporate bonds have been strengthening as the prospects of an economic recovery and a slowdown in borrowing have helped support credit markets.

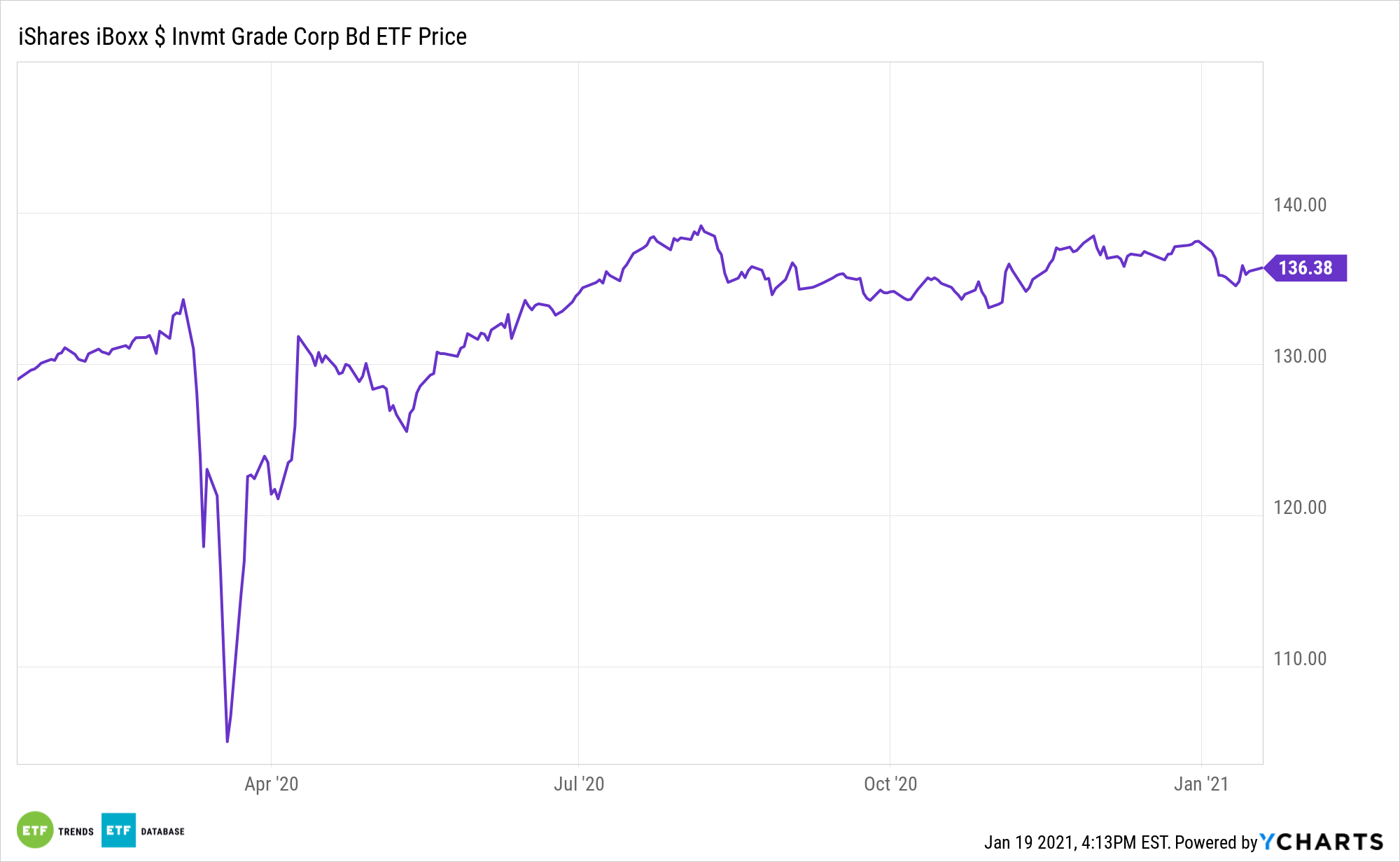

The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) increased 8.5% over the past year.

Meanwhile, the average extra yield, or spread, by which investors demanded to hold investment-grade corporates over U.S. Treasuries dipped to 0.93 percentage points, compared to 1.05 percentage points one month ago, reflecting the narrowest gap since January 2020, the Wall Street Journal reports.

The falling spread reflects the rising prices and demand for highly rated corporate debt as vaccine rollouts, economic stimulus, and a loose monetary policy help support the more optimistic outlook.

In comparison, spreads widened sharply in the early 2020 market turmoil when many dumped risk assets on fears that the pandemic would trigger a number of defaults and bankruptcies, which exacerbated losses in corporate debt. However, the Federal Reserve’s intervention, which included buying billions of dollars worth of corporate bonds to support liquidity, helped mollify fears. Additionally, the lower interest rates helped raise record amounts of cash to protect balance sheets during the pandemic.

“There’s still a lot of demand because of the lack of yield globally,” Hans Mikkelsen, high-grade strategist at Bank of America, told the WSJ.

U.S. investment-grade corporate bonds make up for around 40% of the yield investors are generating right now in the global investment-grade fixed-income markets, according to Bank of America data.

Supply-side fundamentals are also improving after a slowdown in new bond issuance at the start of the year. Investment-grade companies raised over $74 billion so far in January, according to S&P Global Market Intelligence’s LCD, in line with the $75 billion issued during this period one year ago. Analysts anticipate the slowdown in borrowing to last and companies to start using the cash hoards to pay off debt or expand business, which would all support existing bond prices.

For more information on the fixed-income market, visit our bond ETFs category.