When trading ETFs, there are many criteria to consider, such as the use of limit orders, market volatility, when to trade if the underlying markets are closed, and the liquidity of the ETF. Advisors typically look at the on-screen liquidity, which is gauged by its average daily volume (ADV).

The on-screen or secondary market liquidity is only one source of liquidity for an ETF. An ETF has multiple layers of liquidity, which are beyond the on-screen liquidity that trading or block desks can source to complete orders. The additional layers of liquidity could help efficiently execute and price for large trades. The on-screen liquidity or secondary market ADV only shows liquidity for trades that have already been executed.

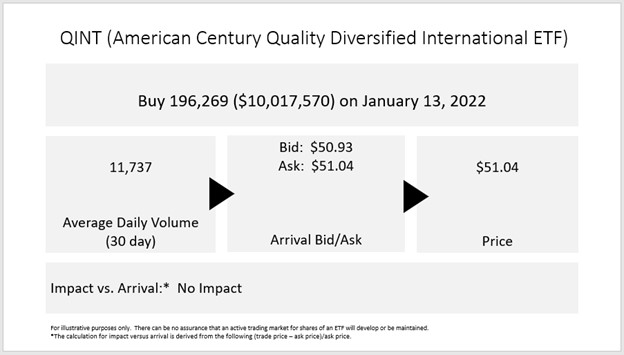

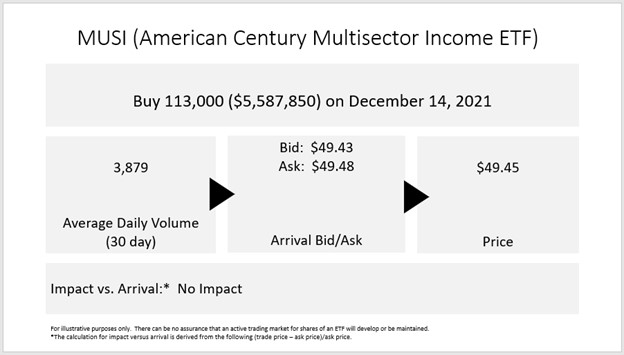

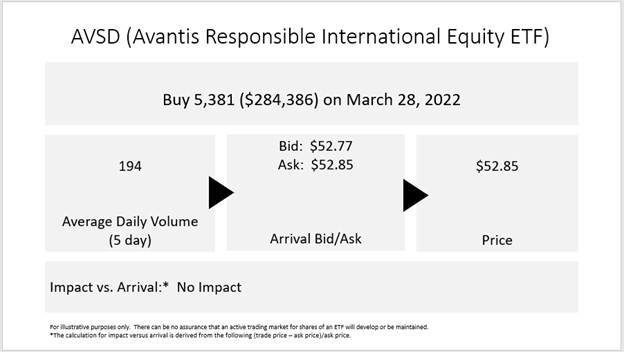

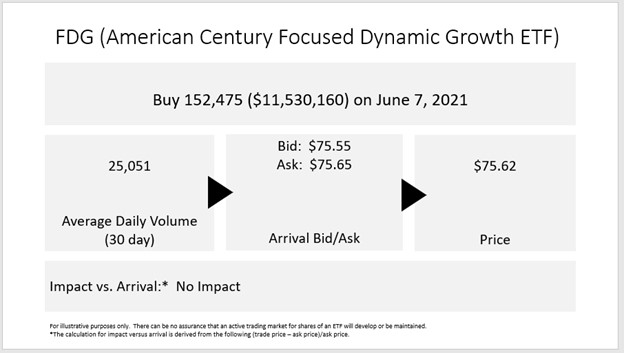

American Century Investments offers some examples where the on-screen liquidity was not as deep, and a trading or block desk helped execute these trades efficiently. These are block trades that were executed in domestic equity, international equity, and fixed-income ETFs that had minimal to no impact on the bid/ask spread, resulting in efficient execution for the investor.

These examples show how large ETF trades can achieve quality execution in ETFs with low on-screen liquidity.

Example 1 shows a trade in the American Century Quality Diversified International ETF (NYSEArca: QINT), an international equity ETF. At the time this trade was executed, QINT had a 30-day ADV of 11,737 shares, which is well below the block trade of 196,269 shares for a total value of about $10 million. The trade was executed at the asking price of $51.04. So, with the help of the block desk, the buyer could capitalize on the underlying securities that weren’t visible on the secondary market.

Source: American Century Investments

Example 2 shows a similar example within a fixed income fund, the American Century Multisector Income ETF (MUSI). This trade was for 113,000 shares at $49.45 for a total value of $5.6 million, where the 30-day ADV at the time was 3,879. The block desk was again able to capitalize on the underlying liquidity in the market to execute the trade efficiently at mid-price.

Source: American Century Investments

Example 3 shows a trade for 5,381 shares in an international equity ETF, the Avantis Responsible International Equity ETF (NYSEArca: AVSD). Since AVSD was a newly launched ETF, the 5-day ADV was only 194 shares. The trade was executed at $52.85 for a total value of $284,386. This shows that the block desk can access the market depth not seen by the average investor.

Source: American Century Investments

Example 4 is a trade in a fund that discloses holdings every quarter, the American Century Focused Dynamic Growth ETF (FDG). The trade was efficiently executed at the asking price of $75.62 for 152,475 shares and $11.53 million in total.

Source: American Century Investments

For more news, information, and strategy, visit the Core Strategies Channel.