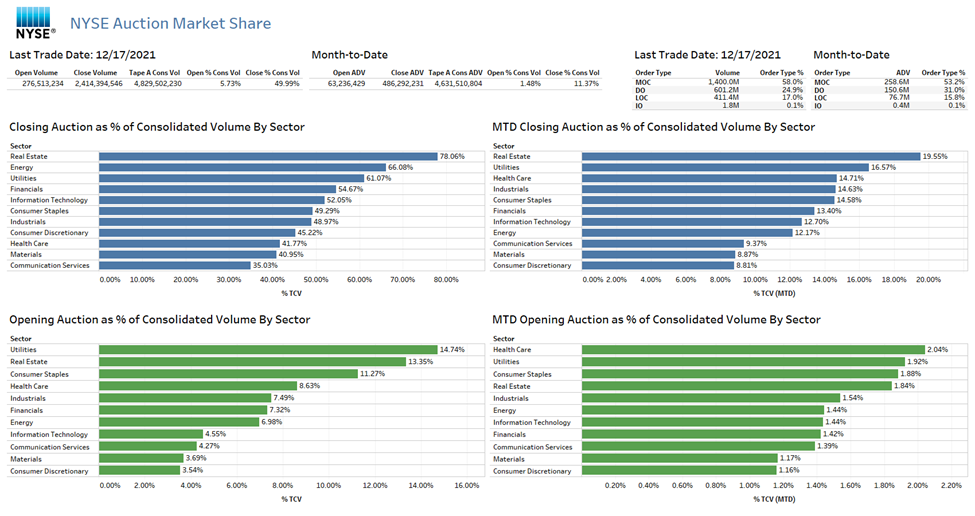

Quadruple witching day comes four times a year, and this most recent one brought with it record trading volume during the closing auction for the NYSE.

“Last Friday’s Quadruple Witching (12/17/21) was historic in the sense that it was the heaviest trading volume day on the NYSE Closing Auction ever at 2.4 billion shares (previous high was 2.3 billion shares),” wrote Paul Weisbruch, ETF/options sales and trading for GTS Mischler, in a communication.

The quadruple witching refers to the day when all derivatives from stock index futures, stock index options, stock options, and single stock futures expire at the same time. These days fall on the third Friday of March, June, September, and December and always bring heavy trading volumes and potential volatility with them. This most recent one saw the highest trading volumes yet.

Image source: Paul Weisbruch of GTS Mischler

The Role of the NYSE Closing Auction

The NYSE Closing Auction is an event that brings together all the buyers and sellers under a common trade and works to establish the closing price for every stock. It’s considered a large scale liquidity event, as it processes three different order types simultaneously while bringing together individual investors alongside institutional ones, as explained by the NYSE.

The closing auction is the last event of every trading day and is when market-on-close orders are traded; these orders must transact during the closing auction no matter what the price is. In addition, these orders are always executed.

During the closing auction, limit-on-close orders are also processed, but only if they meet the specific requirements of the order. Limit-on-close orders have certain buy or sell conditions related to closing price and their limit price, and if those do not align, the order doesn’t transact during the closing auction for that day.

NYSE floor brokers are also able to process investor interest at close and, of the three options, provide the greatest amount of flexibility for investors because of their ability to cancel or enter interest all the way up until the closing bell sounds.

Markets are generally very fragmented during the day; the closing auction is the only time of day that traders can invest and reap the benefits of the centralized liquidity event, getting access to a transparent and accessible price. Because of the mechanics of the closing auction, days like quadruple witching ones are able to be accommodated without major market disruption, outside of the volatility that can be inherent to four different asset classes all expiring simultaneously.

For more news, information, and strategy, visit the Core Strategies Channel.