The growth style and related exchange traded funds advanced Thursday as investors shifted out of economically sensitive cyclical plays, following lackluster economic data.

According to the Labor Department, the number of U.S. workers filing first-time applications for unemployment benefits unexpectedly increased to 419,000 last week, a two-month high, Reuters reports.

“The market got spooked over jobless claims, but investors remain focused on earnings instead of the macro data,” Peter Cardillo, chief market economist at Spartan Capital Securities, told Reuters. “And earnings so far are better than expected. It’s a market that’s priced to its heights and there’s no room for mistakes.”

The second quarter reporting season pushed forward, with 104 S&P 500 companies having already reported and 88% of those reporting beating consensus estimates, according to Refinitiv data. Analysts currently project year-on-year S&P earnings growth of 76.5% for the prior three-month period, as compared to the previous 54% projected at the beginning of the quarter.

“The earnings results have continued to be strong and guidance is showing that the delta variant isn’t impacting the recovery, so far at least,” Esty Dwek, head of global market strategy at Natixis Investment Managers, told the Wall Street Journal. “That is giving confidence to the market that the recovery can continue.”

Investors who are interested in the growth style can turn to targeted strategies like the American Century Focused Dynamic Growth ETF (FDG), which is designed to invest in early-stage, high-growth companies. FDG is a high-conviction strategy designed to invest in early-stage, rapid-growth companies with a competitive advantage, along with high profitability, growth, and scalability.

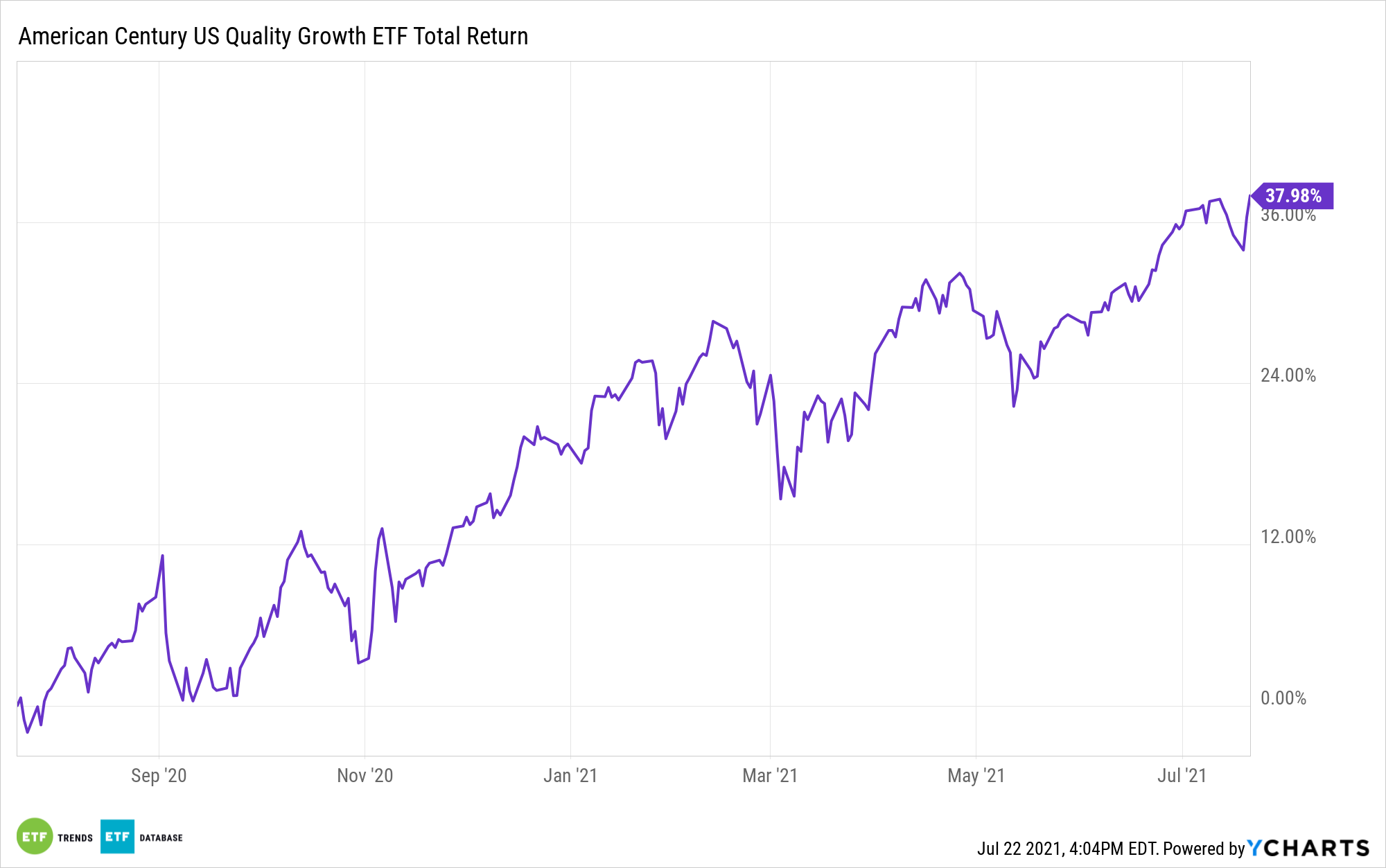

Additionally, investors can look to the American Century STOXX U.S. Quality Growth ETF (NYSEArca: QGRO). QGRO’s stock selection process is broken down into high-growth stocks based on sales, earnings, cash flow, and operating income, along with stable-growth stocks based on growth, profitability, and valuation metrics.

For more news, information, and strategy, visit the Core Strategies Channel.