Wednesday saw stocks rebounding after closing at losses on six of the past seven trading days, with the S&P 500 ending the day approximately 1.2% below the all-time high earlier this month, reports The Wall Street Journal. Sentiment continues to echo more broadly amongst investors of concerns about a general pullback after high performance for much of the year.

Hopes of a robust economic rebound have been hampered recently as the Delta variant plays havoc on the U.S. population, while in China supply chain woes and economic slowdown have broad-reaching implications for the global economy.

“We’ve shifted from worrying about premature tightening [by the Federal Reserve] killing off the recovery in equities to concerns about the strength of the recovery weighing on equities,” said Sebastian Mackay, multi-asset fund manager at Invesco.

While sentiment still remains positive in the long term, analysts are watching for volatility in the interim as Delta continues to be a cause of concern.

“In the long term, we think stocks are the place to be, notwithstanding some short-term volatility,” said George Mateyo, CIO of Key Private Bank. He believes that the current slowing of growth is consistent with a shift to the middle stages of an expansion cycle, as opposed to the more robust growth experienced at the beginning of recovery.

LVOL Invests in Lower Volatility Securities

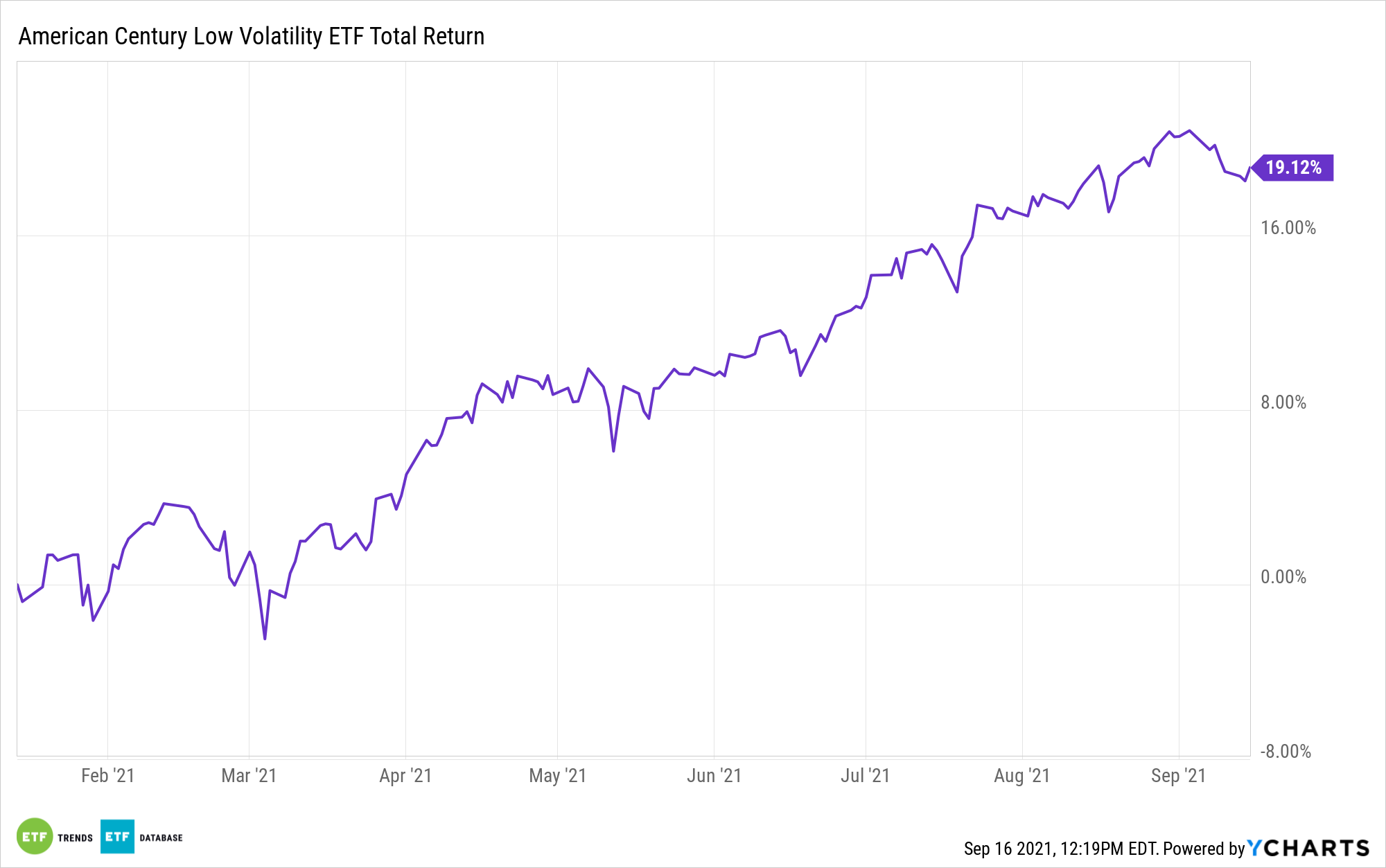

For investors that are feeling increasingly concerned about potential drawbacks, the American Century Low Volatility ETF (LVOL) might be a solution to consider, as it looks to track the market long-term while also offering less volatility, especially in downturns.

LVOL is an actively managed fund that uses the S&P 500 as its benchmark. The fund seeks to offer lower volatility than the overall market by screening for asymmetric, or downside, volatility as well as investing in companies with strong, steady growth.

It not only looks to reduce volatility at the portfolio level, but also in its individual securities. The portfolio managers seek to balance returns with risk management by evaluating the individual securities and their place and performance within their sector and overall.

Securities are sold when they become less viable compared to other opportunities, the risk becomes greater than the return potential, or other events that might change its prospects.

LVOL has an expense ratio of 0.29%.

For more news, information, and strategy, visit the Core Strategies Channel.