Increasingly more asset managers see ESG investing as a positive move for their clients, shows data from a recent survey of the asset manager industry by the Index Industry Association (IIA).

Of the respondents, 54% of asset management companies were investing in ESG because of client demand, while 44% invested in ESG because of a desire for increased returns.

A large and growing body of evidence shows a correlation between a company’s positive ESG performance and its corporate metrics, including shareholder returns, return on capital, profitability, and share-price volatility.

There are several theories for why this correlation exists, including that adhering to ESG guidelines protects a company’s future interests that would otherwise negatively impact their performance. By protecting resources and having better environmental practices, they stand to benefit from those choices over the long-term.

“ESG can also help ward off reputational or regulatory risk, a key factor affecting a firm’s cost of capital and ability to secure finance,” reports the IIA.

In addition, 36% of asset managers surveyed that are driving investment in ESG do so because of reputation or regulatory risk.

Increasingly greater public pressure is being put on industries to reduce emissions and follow environmentally friendly practices, coincident with a rising push towards diversity and inclusion within corporate leadership teams.

By investing in ESG practices, companies avoid negative public pressure. They also stay clear of business controversies and even regulatory crackdowns.

Investing in ESG at the corporate level can also benefit society as a whole, says the II, for example, “through creating products and services for lower-income consumers, redesigning supply chains to reduce energy usage and costs, reducing packaging and water use, investing in local producers, and providing health and training for workers.”

ESGA Maximizes ESG Investment

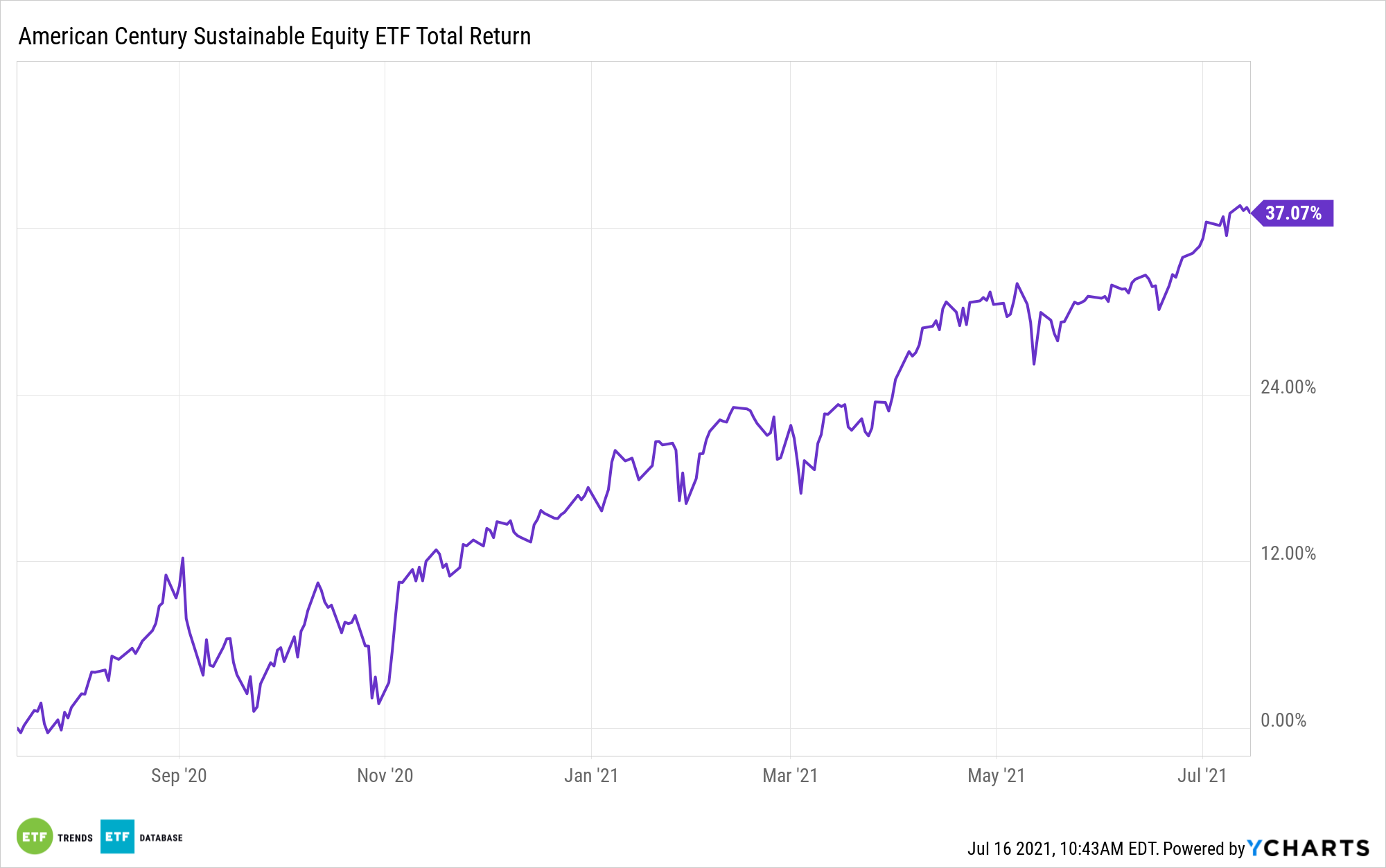

The American Century Sustainable Equity ETF (ESGA) invests in U.S. large cap companies with large growth and value potential that rank highly on ESG metrics.

ACI’s proprietary model assigns a score to each security for its financial metrics and a separate score for its ESG metrics, then combines them for an overall score.

The highest-scoring securities are selected within each sector, creating a portfolio with strong performance and higher ESG ratings than the stocks in the S&P 500 Index.

The fund is actively managed and a semi-transparent ETF, meaning that allocations are disclosed on a quarterly basis, not daily. As of its last disclosure, ESGA held companies like Alphabet (GOOGL), Home Depot (HD), and NVIDIA (NVDA).

ESGA has a total annual fund operating expense of 0.39%.

For more news, information, and strategy, visit the Core Strategies Channel.