President Biden reassured the public on Monday morning at a press release that he is not currently considering lockdowns for the Omicron COVID-19 variant, and markets bounced back from their frenzied sell-offs on Friday, reports CNBC.

The S&P was up 1.6%, the Dow Jones Industrial rose 310 points, and the Nasdaq Composite gained 2% following the press release; this follows one of the worst days for markets on Friday with the announcement of the new COVID variant. The Dow closed at its worst day since October 2020, dropping 905 points (2.5%), while the S&P fell 2.3% and the Nasdaq dropped 2.2%, and all three indexes were negative for the week overall.

“There are still more questions than answers regarding the omicron variant, but after what happened on Friday, the bounce today is a welcome sign,” said Ryan Detrick of LPL Financial. “We’ve seen other variants cause some indigestion, but after a little bit of time things were able to calm down and move forward. We’re optimistic that will be the playbook once again.”

Many investors are seeing the drop as an opportunity to buy into stocks at reduced prices and believe the new variant will follow in the footsteps of previous variant effects on the economy and markets.

“As with the case for Beta and Delta variants, the ‘bark’ has proven worse than the bite in each of those precedent instances. The market carnage, in our view, will be short-lived and transitory,” wrote Fundstrat’s Tom Lee Sunday night in a note to clients.

The Omicron variant has been labeled a “variant of concern” by the World Health Organization and carries an impressive number of mutations. There is much that isn’t known about the newest variant on the world stage, but so far it seems to be both more transmissible and milder than previous variants.

The U.S. has restricted travel from southern Africa where the variant first gained attention, and as of now anticipates no further restrictions.

With an anticipated solid jobs report coming at the end of this week, markets could continue their upward momentum, even with the unknown fears of the new variant lurking.

Capturing Growth While Hedging With Diversification

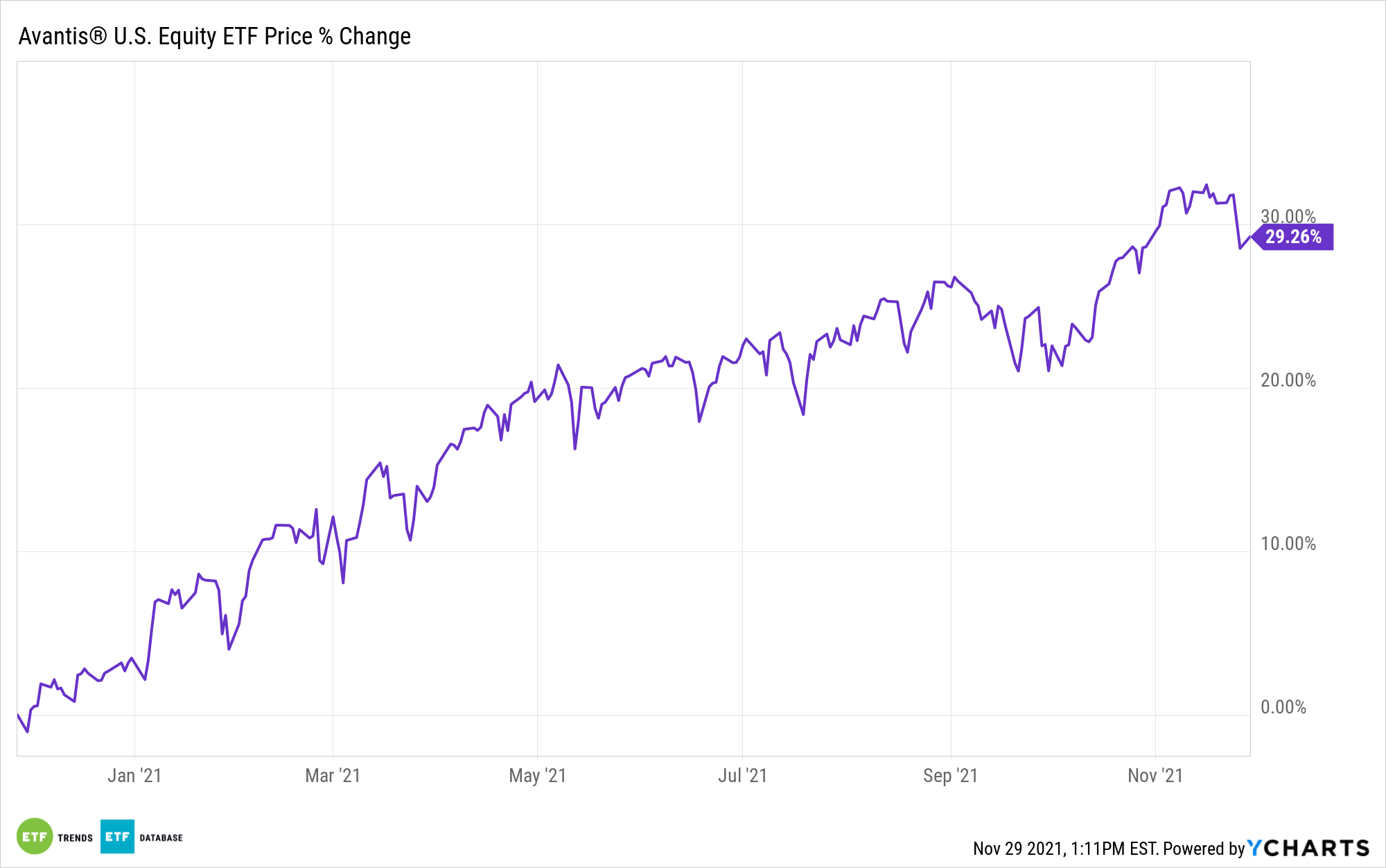

For investors who want to capture growth broadly but are looking to hedge against COVID variant fears and effects on markets, diversifying exposure is an excellent option; the Avantis U.S. Equity ETF (AVUS) offers diversification in spades. The fund is actively managed and invests in U.S. companies across all market caps and sectors, offering exposure to a variety of industries.

AVUS is benchmarked to the Russell 3000 Index. It works by overweighting smaller market cap companies, high profitability companies, and value companies, and it underweights or excludes large-cap companies that offer lower returns.

The portfolio managers consider the financials and market data of companies when investing, as well as industry classification, the performance of a security compared to its peers, and the stock’s liquidity, float, and tax considerations.

As of the end of October, sector allocations were information technology at 22%, financials at 17%, consumer discretionary at 15%, healthcare at 11%, and industrials at 11%, with smaller allocations to other sectors.

AVUS has an expense ratio of 0.15% and has 2079 holdings.

For more news, information, and strategy, visit the Core Strategies Channel.