The CBOE Volatility Index and the S&P 500 are both heading in opposite directions, making the need for low-volatility protection crucial in today’s market environment. Fortunately, there are exchange traded funds (ETFs) that feature this important hedging component baked right into the fund itself.

The bigger question is whether these funds actually work, and research from Morningstar shows that it’s indeed the case. Furthermore, research shows that the worse the markets are, the better these ETFs perform.

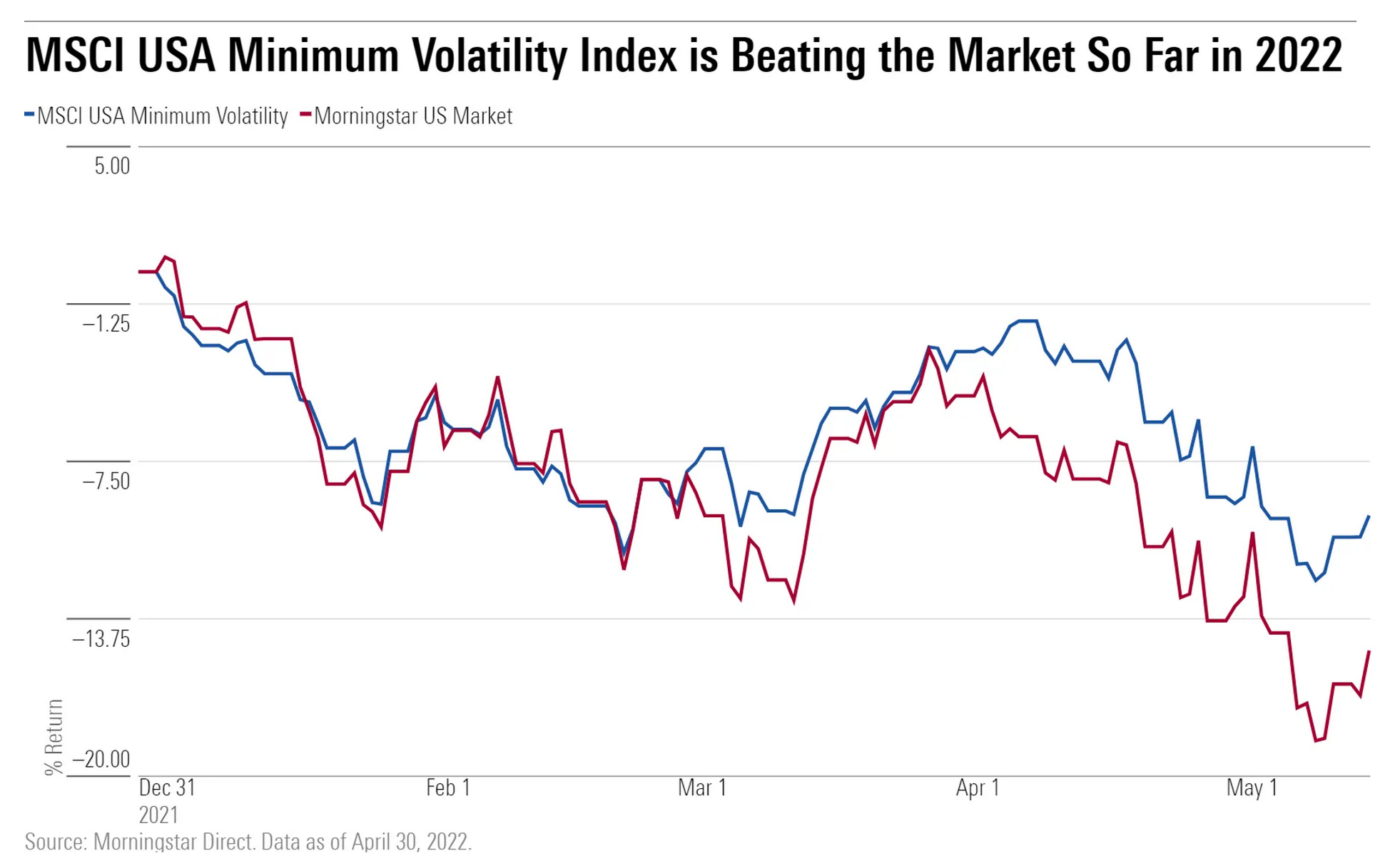

“While markets have been falling across the board in 2022, low-volatility indexes and funds have generally held up better than their counterparts,” Morningstar said. “For the year to date through May 17, 2022, the MSCI USA Minimum Volatility Index, which is designed to provide the lowest return variance, is down 9.7%, compared with a 15% loss for the Morningstar US Market Index.”

“Low-volatility strategies are at their best when markets are at their worst,” wrote Morningstar’s Ben Johnson.

“The upward spikes coinciding with the bursting of the dot-com bubble, the global financial crisis, and the current coronavirus pandemic are a testament to the strategy’s efficacy–it has taken some of the sting out of stock market drawdowns,” Johnson added.

A Low-Volatility Option From American Century

Investors looking to capture the duality of downside protection and upside in the markets can look to the American Century Low Volatility ETF (LVOL). The fund gives investors exposure to active management, meaning that portfolio managers can check the pulse of the markets and get in or out of positions depending on how the market is behaving.

This dynamic exposure comes at a low-cost expense ratio of 0.29%. The fund screens for asymmetric, or downside, volatility and invests in companies with strong, steady growth.

Key features of the fund as presented on the product website:

- Emphasizes strong fundamentals to limit potential risk of speculative companies with questionable profits.

- Expands risk measures beyond volatility to capture other downside and balance sheet risks.

- Focuses on volatility at the portfolio level as well as the individual stock level.

- Rebalancing strategy that actively responds to changing market conditions.

For more news, information, and strategy, visit the Core Strategies Channel.