International markets, notably European stocks, led the charge on Wednesday after the previous session’s sharp selling, with higher commodity prices and the earnings season supporting gains. Investors can also use exchange traded funds to capture these international moves.

European miners strengthened on the rising commodity prices, as traders grow more optimistic over the global economic recovery, Reuters reports.

Additionally, Eurozone business activity accelerated in last month as the region’s services industry adapted to the new lockdowns and returned to growth.

“Data shows the vaccine run-rate in Europe is now picking up rapidly, European macro data is improving and the Q1 earnings season suggests corporates are able to deal with higher input costs,” UBS analysts said in a note, according to Reuters.

An upbeat first quarter earnings season has also helped fueled the risk-on optimism. European earnings are projected to jump 83.1% for the first quarter, according to Refinitiv IBES data, as compared to last week’s expectations of only 71.3%.

Investors interested in international markets can consider ETF strategies for foreign exposure. For example, the Avantis International Equity ETF (AVDE) is built upon an academically-supported, market-tested framework aiming to identify securities with expected high returns based on market prices and other company information. Relying on trading and portfolio management processes, the Avantis team analyzes whether the perceived benefits of a trade overcome its associated costs and risk. AVDE primarily invests in a diverse group of companies of all market capitalizations, across non-U.S. developed market countries, sectors, and industries, emphasizing investment in companies believed to have higher expected returns.

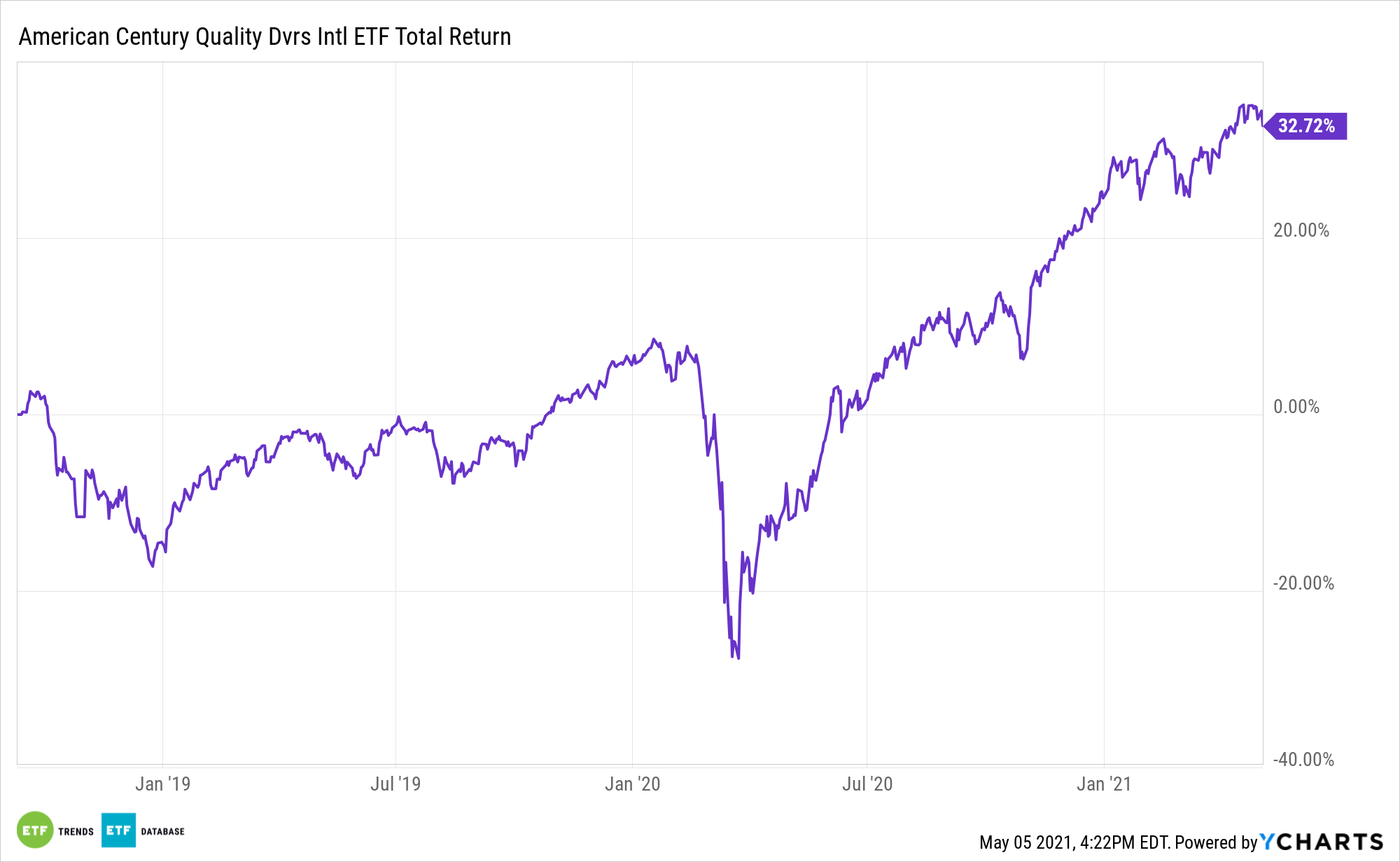

Additionally, the American Century Quality Diversified International ETF (NYSEArca: QINT) utilizes the American Century Investments Intelligent Beta methodology, which systematizes many of the same attributes that fundamental research and security selection seek to identify, in a rules-based, indexed approach. QINT is a foreign large blend fund that seeks to enhance core international exposure. Its rules-based approach analyzes each stock’s quality, growth, and value characteristics to select individual securities. It also dynamically adjusts exposures in an effort to take advantage of prevailing market conditions.

For more news, information, and strategy, visit the Core Strategies Channel.