Navigating small-cap investing can be difficult; it’s not always easy to find the pockets that hold potential for growth in companies that aren’t industry giants. Through the use of active management, American Century Investments is able to offer the Avantis U.S. Small Cap Value ETF (AVUV), which seeks out those areas of opportunity, and investors are taking note.

One area that is primed for growth going forward is engineered wood products. ReportLinker posted the Global Engineered Wood Products Market 2021-2025, an outlook and forecast for the space over the next four years, and found that a compound annual growth rate of 6% was expected.

The analysis anticipates an increase to residential and commercial construction overall as well as a greater use of engineered wood in construction as opposed to sawn wood.

The report was an analysis of the industry globally and included a detailed look at the market as a whole and within different categories, as well as the profits and financial metrics of major vendors within the space. One such vendor, Louisiana-Pacific Corporation, commonly referred to as LP, is a major vendor of engineered wood products in the U.S.

LP reported a net sales of $1.3 billion in their last earnings call, an increase of 142% that covered the time period ending on June 30th, according to their website. For the first six months of the year, sales were up $1.2 billion over last year, a total of $2.3 billion, reflecting a 107% increase.

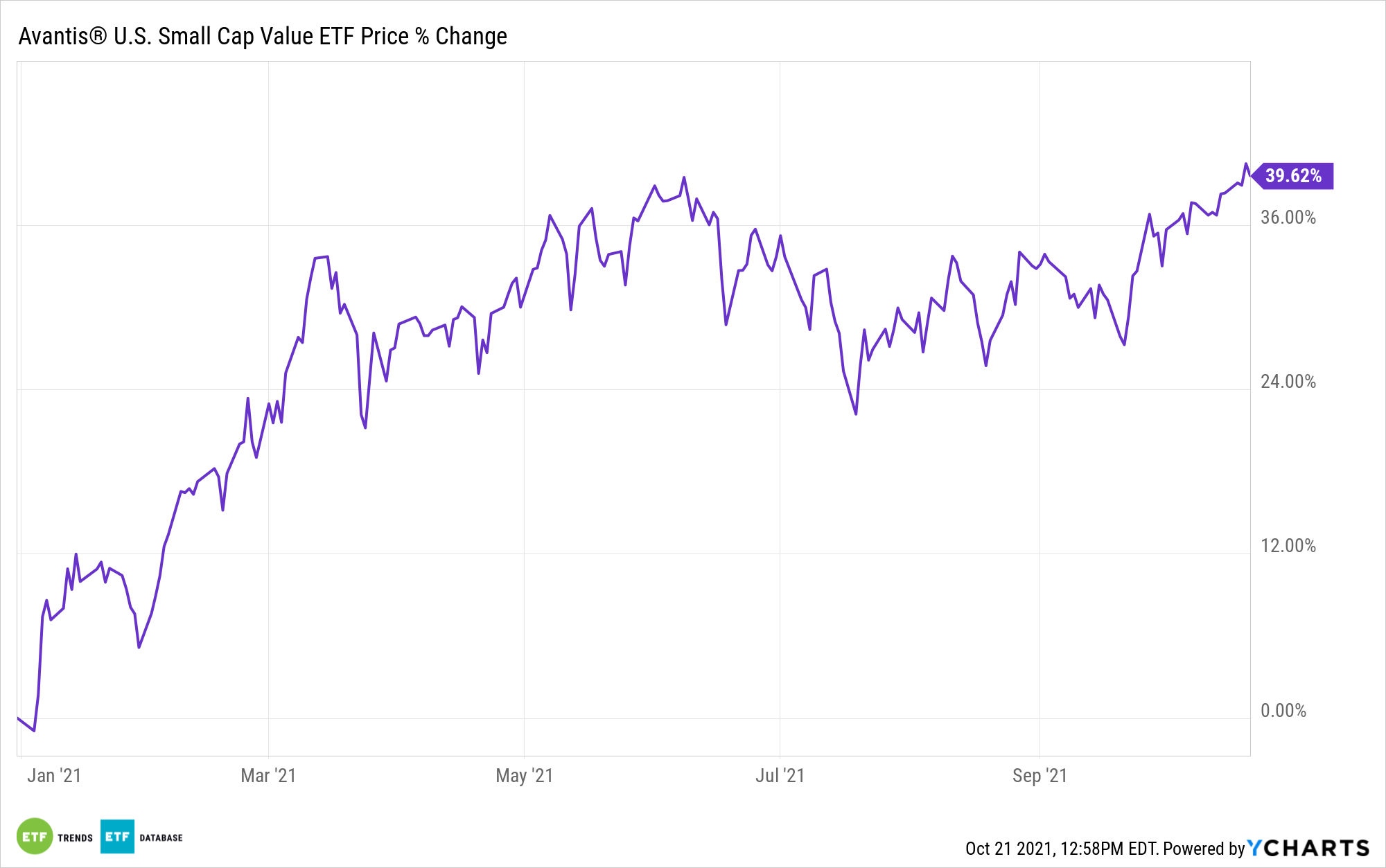

AVUV Captures Small-Cap Growth

American Century Investments, partnering with Avantis Investments, offers the Avantis U.S. Small Cap Value ETF (AVUV), an ETF that invests in small-cap companies with low valuation but high profitability ratios.

An actively managed ETF, AVUV combines the typical benefits of following an index — diversification, low turnover, and a transparency of exposures — with the flexibility to capture price movements as they happen, and advisors are increasingly investing because of the methodology, according to American Century.

For benchmarking purposes, the fund uses the Russell 2000 Value Index, which tracks the 2,000 smallest-capitalization stocks of the larger Russell 3000 Index, but the ETF does not replicate this index.

AVUV’s portfolio managers use fundamental screens such as shares outstanding, cash flow, expenses, revenue, and book-to-value to select stocks. Smaller companies with high profitability are weighted more heavily than those with lower returns and higher prices.

In addition, AVUV can also invest in derivatives, such as future contracts, currency forwards, and swap agreements to gain exposure to equities and manage cash flow.

AVUV invests in Louisiana-Pacific Corporation: LPX is one of the top 10 holdings of the fund with a 0.74% weighting.

As of the end of September, some of the top sector allocations for the fund include financials at 30%, consumer discretionary at 17%, and industrials at 17%.

AVUV has an expense ratio of 0.25%.

For more news, information, and strategy, visit the Core Strategies Channel.