Economies abroad and within the U.S. are continuing to miss forecasts to increasingly larger degrees in moves that have investors concerned. The spread of the delta variant and poorer-than-anticipated economic numbers, combined with signals that the Fed may be withdrawing economic supports soon, are all having a dampening effect on what has until recently been a surging market.

Data reported in the U.S. has been consistently missing economists’ goals in the last month, and as of last week were missing predictions by their largest margin since the pandemic started, reports the Financial Times.

The information was collected by Citigroup, and recorded a sharp drop-off in consumer confidence. A retail sales report also posted weaker-than-expected numbers and new home construction is down, which could be signaling a slowing economy in the U.S.

It’s a trend that is being repeated globally: Citi Bank’s analysis of business performance in G10 countries reflect economies that are missing the mark, and regulatory crackdowns in China have only exacerbated economic woes.

“The tone of investor focus has shifted from reopening momentum, strong fiscal and monetary support, and earnings strength to tapering talk, political uncertainty… China slowdown and geopolitical tensions,” said Mark Hackett, analyst at Nationwide Investment Management.

Economists, looking at current trends, supply chain bottlenecks, and delta cases, have reduced growth forecasts to 6.2%, down from the 6.6% forecast at the end of July.

Active Management with Avantis Investors by American Century Investments

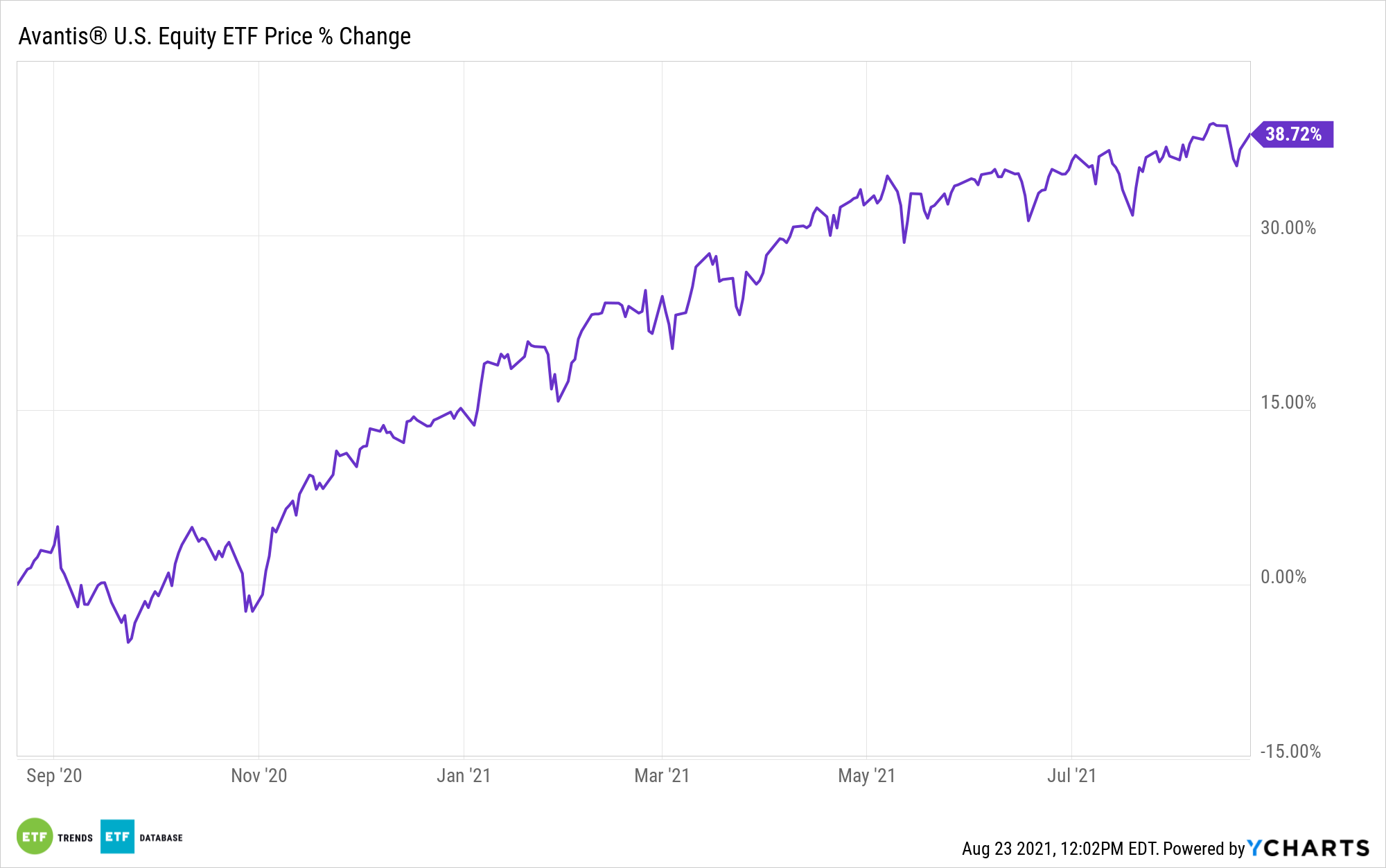

Diversifying exposures can be a smart play when markets are uncertain, and the Avantis U.S. Equity ETF (AVUS) offers diversification in spades. The fund is actively managed and invests in U.S. companies across all market caps and sectors, offering exposure to a variety of industries.

AVUS is benchmarked to the Russell 3000 Index. It works by overweighting smaller market cap companies, high profitability companies, and value companies and it underweights or excludes large cap companies that offer lower returns.

The portfolio managers consider the financials and market data of companies when investing, as well as industry classification, the performance of a security compared to its peers, as well as the stock’s liquidity, float, and tax considerations.

As of the end of July, sector allocations were information technology at 22%, financials at 16%, consumer discretionary at 15%, and healthcare and industrials both at 12%, with smaller allocations to other sectors.

AVUS has an expense ratio of 0.15%.

For more news, information, and strategy, visit the Core Strategies Channel.