Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Nick Peters-Golden and James Comtois debated the investment case for small-cap stocks in an environment where recession looks increasingly likely.

Nick Peters-Golden, staff writer, VettaFi: Hi James! I’m so glad to be chatting with you today about the merits of getting small. The last 10 years have left small-caps beaten, bruised, but crucially, unbowed — and I think they’re ready for their comeback.

James Comtois, staff writer, VettaFi: Maybe, but investing in small-caps comes with big drawbacks, which may outweigh whatever benefits investing in these stocks provide.

Small-Caps Performance: It All Depends on the Timing

Comtois: For one thing, the data shows large-caps outperform small-caps over the long term. The large-cap-focused S&P 500 Index has outperformed the small-cap-centric Russell 2000 Index for the one-, five-, and 10-year periods ending April 4, and by wide margins. Heck, over 10 years, the S&P 500 outperformed the Russell 2000 by nearly 70 percentage points. That’s percentage points, not basis points.

So I’m not exactly taking it as a given that going small may be a worthwhile bet over the long haul.

Peters-Golden: Here’s why I’m looking at small-cap opportunities right now: They love to bounce back from tough years. Before 2022, there were 24 years in which small-caps had an overall negative calendar return, according to research from Franklin Templeton’s Royce Investment Partners, and in 19 of the subsequent years, small-caps enjoyed a positive return. They really did show that rebound to start this year, with the S&P 600 small-cap index up 8.1% compared to the large-cap S&P 500’s 2.9% as of the start of March.

Of course, small-caps then ran into a brick wall in the form of the mini bank crisis last month. Small-caps’ biggest indexes, the Russell 2000 and Russell 2000 Value, have pretty big weights towards regional banks — at 16% at the end of March in the latter index.

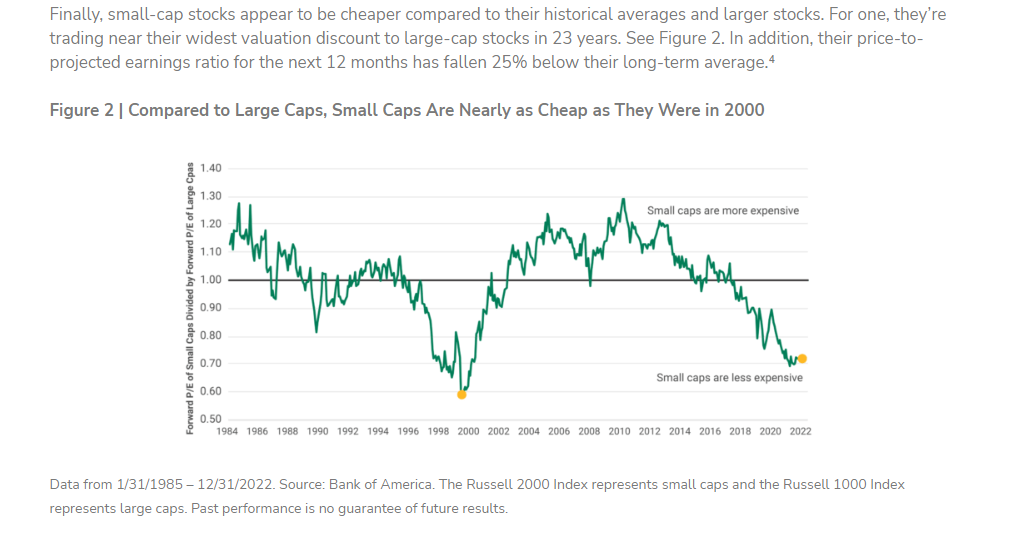

That’s since simmered down, and the asset class is showing some very attractive valuations right now. Small-cap stocks look to be pretty cheap compared to both their own historical averages and larger stocks — trading near their biggest discount to large-cap stocks in 23 years, actually, per analysis from American Century Investments:

Small-caps have been at a discount for a while, but the landscape has changed in a significant way from the post-Global Recession period. The money supply is drying up as interest rates are rising, and the environment in which large-caps were available at a more attractive P/E discount in 2011 compared to small value is not the same environment in which we’re operating today.

Small-caps’ underperformance over the last, say, eight years, taking out big external hits like the pandemic, has been tough to explain by even the smart folks over at CME. But if you ask me, I think that small-caps’ relatively smaller exposure to the emergence of the “mega-cap” tech names that benefitted from low interest rates and low-hanging fruit disruption compared to large-caps is a trend that is about to come to a close — with small-caps able to finally make good on those discounts.

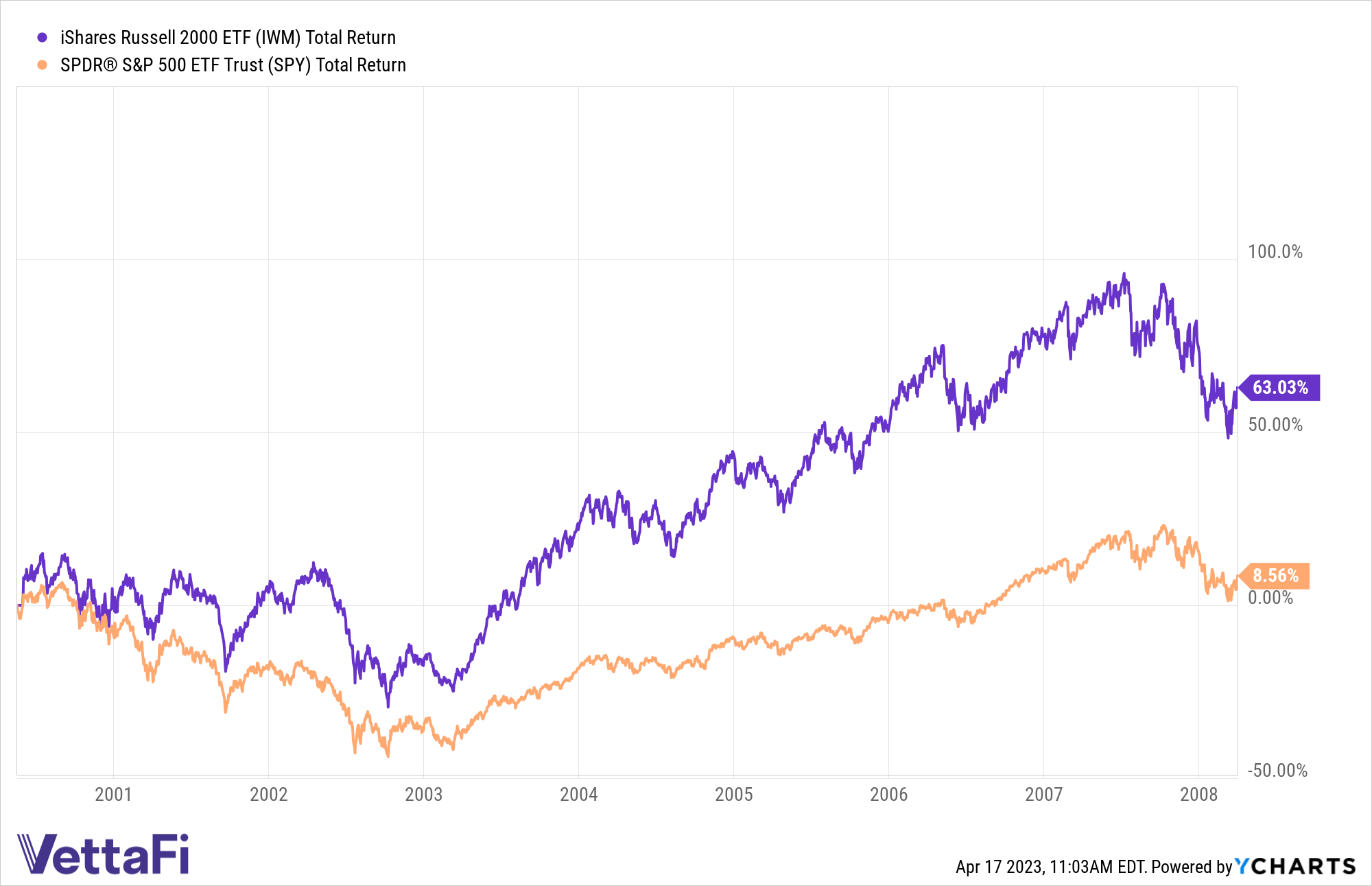

A more normalized environment may allow small-caps to take off. Just look at how the iShares Russell 2000 ETF (IWM) did compared to the SPDR S&P 500 ETF Trust (SPY) at the start of the millennium up to the financial crisis:

Comtois: While yes, I will agree that small-cap funds are trading at bargain basement prices, and that’s obviously very attractive to investors (I’m literally on the record being bullish on value investing), those long-term returns relative to their large-cap counterparts don’t fill me with confidence.

How Small-Caps Perform During Recession

Comtois: Which brings me to my next point: Not only do small-caps tend to underperform relative to their larger stock siblings over the long-term, stocks for smaller companies also don’t do so great during a recession or times of market volatility. Citing data from FactSet, abrdn cites the dot-com bubble, the global financial crisis, and start of the COVID pandemic as recessionary periods in which small-caps underperformed large-caps (by 100, 300, and 700 basis points, respectively). And while we all know that past performance isn’t indicative of future results, we can’t deny that there’s a pattern here.

By their very nature, smaller companies tend to be more volatile than large ones. In bear markets, or during periods of high inflation, smaller firms just don’t have the stability, track record, or liquidity that, say, FAANG stocks have and need during economic downturns. And with many industry observers forecasting a recession in the not-too-distant future, I’d look into large-cap ETFs like the Schwab US Large-Cap Growth ETF (SCHG), the Vanguard Large-Cap ETF (VV), or the actively managed T. Rowe Price Blue Chip Growth ETF (TCHP), rather than any indexed small-cap funds.

Peters-Golden: Yes, let’s acknowledge the elephant in the room: There is a recession coming, and, while they’re never pleasant, they tend to take a big toll on small-caps especially. But there are real reasons why small-caps may not just endure an impending recession, but ride its recovery to strong performance.

First of all, small-cap balance sheets are much stronger than they were prior to the pandemic — we’re talking about a debt-to-capital ratio for small companies that is a full 100 basis points less than it was in 2018, as of the end of 2022, as well as nearly 600 bps greater than cash as a percentage of capital.

What’s more, small-caps are more resistant to foreign currency-related issues, and if a recession does arrive, markets are expecting a rate cut that would boost small-caps. Add in stock buybacks among small-caps, which tend to benefit investors more than small-cap buybacks at higher valuations, and there’s some durability there in those smaller-cap names.

At the end of the day, though, it comes down to performance — and we can see small-caps outdo large-caps there, too. Per research from Schroders, small-caps have seen a 9.9% annualized net total return during “recession and recovery” periods, compared to just 4.9% for large-caps. Large-caps outdo small-caps in expansionary and slowdown periods by that same measure, but looking at these periods, capital flees small-caps leading up to a recession but comes right back to them when recessions get going — and we may already be in one.

Which brings me to another graph — let’s revisit IWM and SPY, but this time during those tough financial crisis years. I see strong returns for the little guys there!

How to Find Value in Small-Cap Value ETFs

Comtois: I should mention one more reason why I’m not exactly champing at the bit to cash in on small prizes: Because of their size, these stocks don’t usually have much in the way of liquid cash reserves on hand, which means they usually don’t pay dividends. Smaller firms tend to need what cash they have on hand to pay expenses and expand their businesses, while larger firms with bigger and steadier profit streams often have more free cash flow on hand to deploy for paying out dividends.

With inflation still high, the Federal Reserve expected to continue raising interest rates, and a possible recession (even just a “mild” one) in our future, investors are still firmly in income-seeking mode.

Peters-Golden: I want to close by focusing on a more specific group of small-cap slice: small-cap value. We know small-cap value investing can be a potent force — as key pillars of both Fama and French’s Three Factor and Five Factor models, they’re recognizably powerful in helping predict market returns compared to a standard capital asset pricing model (CAPM) model. But if we look at performance, we can see that small value has not only outperformed large-caps over the last five recessions on a total return basis, but also outperformed small-cap growth, too.

That may be because small-cap value has more cyclical firms that benefit more when the economy stops contracting and then turns positive. Small-cap value has a track record of rebounding after periods of underperformance and actually outperforming. Not only that, but it also has a strong tendency to do well after periods of growth outperformance — and boy have we seen some of those growthy, tech names balloon in the recent past. Plus, with interest rates higher and markets expecting some chop, a value view within that small-cap universe could be an added tool to find return.

As such, it’s worth it to visit some of the small-cap value ETFs available to play the space — and yes, there are even a few that focus on dividends, James.

Interestingly, there are just two active small-cap value ETFs: The Avantis U.S. Small Cap Value ETF (AVUV) is one of them, and it has actually outperformed IWM over the last six months, and is just now approaching its three-year ETF mark this September and charging just 25 basis points.

See more: “Avantis’ Small-Cap Value ETF AVUV Nears $6 Billion”

Dividends are really popular right now, and while rare in the small-cap world, they aren’t unheard of entirely — their ability to provide current income could be a real source of support while also investing in small-caps’ future potential. There are just six such ETFs according to VettaFi’s ETF Database, including the ALPS O’Shares U.S. Small Cap Quality Dividend ETF (OUSM).

OUSM charges 48 basis points and tracks the O’Shares US Small-Cap Quality Dividend Index, with a 2.1% annual dividend yield. As seen in the above chart, it has actually more than doubled up on the six-month performance of some other strategies with a small-cap angle.

Finally, investors can also look out for an ETF like the NightShares 2000 ETF (NIWM). Over the last 20 years, 100% of IWM’s returns have actually arrived thanks to the so-called “night effect.” From 2003 to 2020, IWM’s Sharpe ratio is 0.46 for holding the ETF overall, but 0.90 during the night session compared to -0.08 during the day session. As such, we can credit the night effect for the positives IWM has seen.

Looking at the past 20-year record (2003 through 2020), the IWM Sharpe ratio is 0.46 for holding the ETF. During the same period, the night session Sharpe ratio is 0.90, while the day session Sharpe ratio is -0.08. The day session Sharpe ratio is negative as the session’s returns over the 20-year period have been negative, as over 100% of the fund’s returns have come at night.

Offering a different view on small-caps, the night effect, previously an investing approach only available to hedge funds, tries to capture the return available from overnight markets’ tendency to outperform daytime trading. NIWM provides exposure to 2,000 small-cap firms and their night effect returns, charging 55 basis points.

Taken together, small-cap value, active or not, and small-cap dividends are some intriguing ways to play the big structural discount in the asset class. With such exciting options, James, I for one am rooting for the little guy!

For more news, information, and analysis, visit the Core Strategies Channel.