Fixed income exchange traded funds strengthened Tuesday, with U.S. government bond yields dipping to their lowest level in four months, as investors looked past inflation concerns and a disappointing services sector survey added to the risk-off mood.

Bond yields have surged this year on fears that rising inflation would push the Federal Reserve to tighten its monetary policy. However, a tamer outlook has helped drive the rebound in fixed income markets, with data on Friday showing U.S. hiring rose slightly.

On Tuesday, the Institute for Supply Management, which tracks activity in the service sector, helped accelerate the rush into government debt assets, which tends to perform well during times of heightened uncertainty, the Financial Times reports. The survey showed business and employment conditions in the service industry declined in June month-over-month due to difficulty in finding qualified workers to fill open positions.

“The ISM reading just added more motivation to extend the move in Treasury yields lower,” Ian Lyngen, an interest rate strategist at BMO Capital Markets, told the Financial Times. “A big portion of what we are seeing is a capitulation of the higher rates thesis.”

Meanwhile, U.S equities retreated Tuesday after hitting record highs last week.

“It just may be time for a little bit of a breather or a pause in the pace of equity market returns,” Chris Dyer, director of global equities at Eaton Vance, told the Wall Street Journal. “A lot of the good news is priced in and I think that makes it a little bit more tricky for the equity markets to grind higher in the short term.”

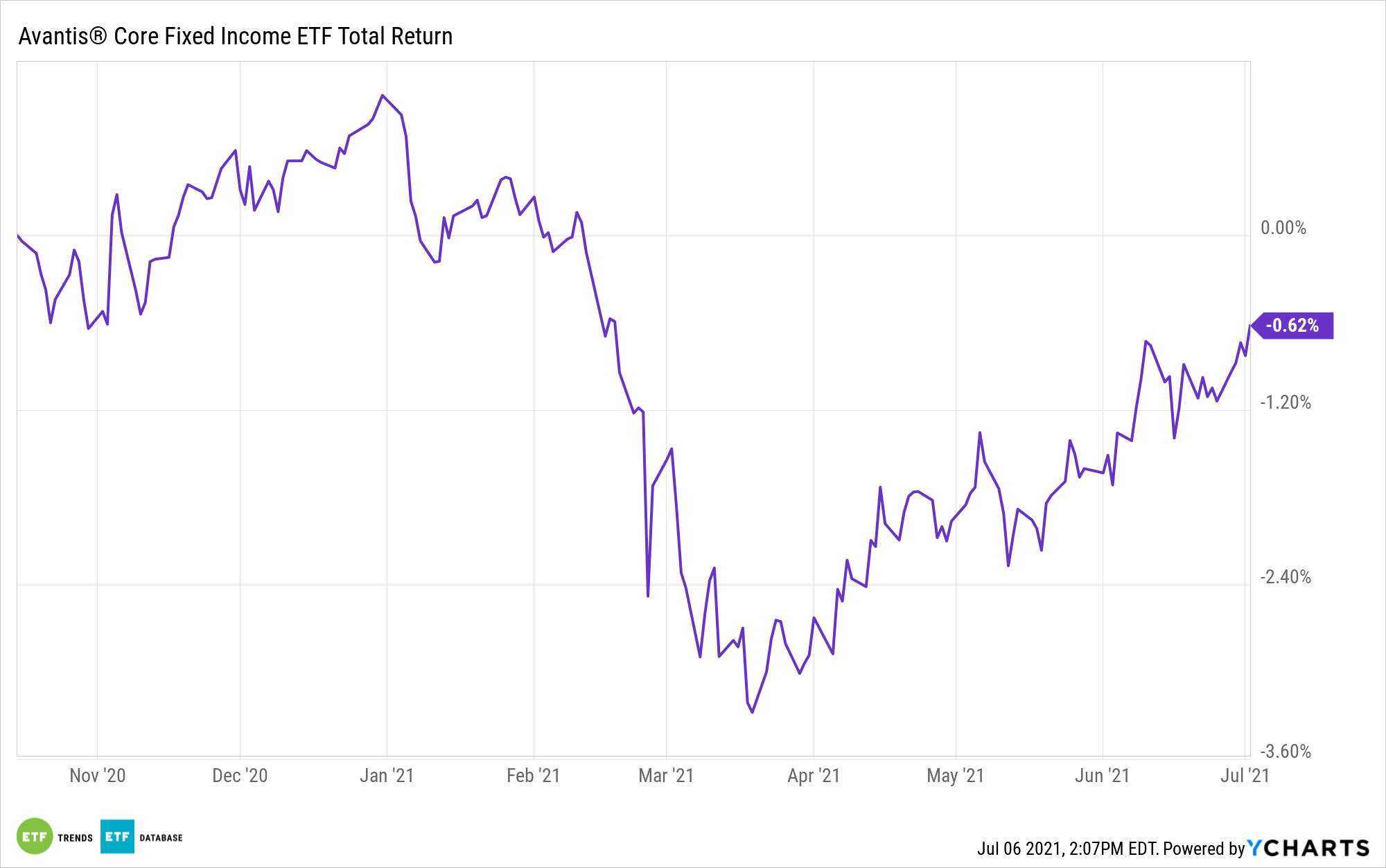

Investors who are looking to strengthen their fixed income strategies can consider the Avantis Core Fixed Income ETF (AVIG), which invests in a broad set of debt obligations across sectors, maturities, and issuers. AVIG pursues the benefits associated with indexing, such as diversification and transparency of exposures. Yet the fund also has the ability to add value by making investment decisions using information embedded in current yields.

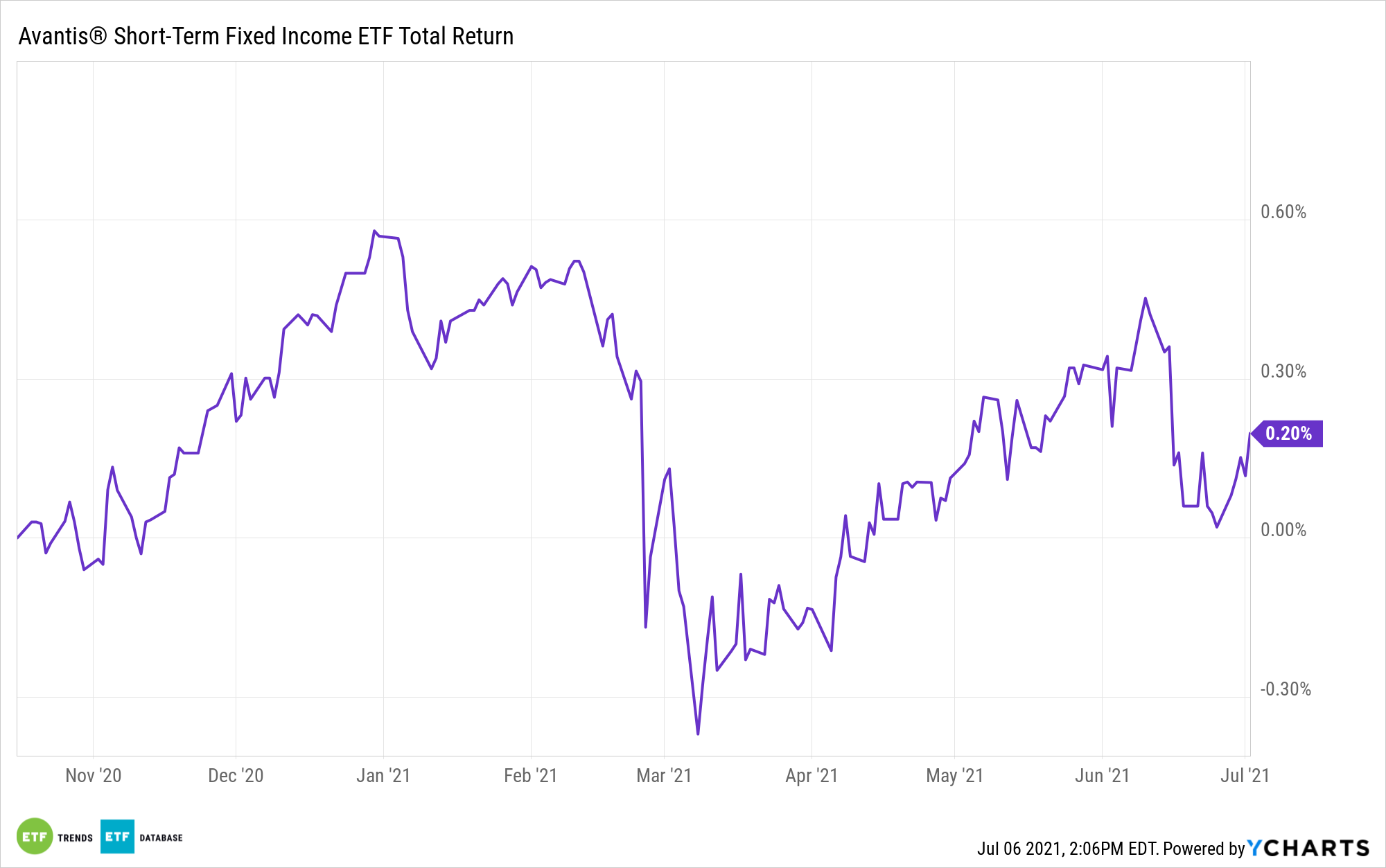

The Avantis Short-Term Fixed Income ETF (AVSF) also invests primarily in investment-grade quality debt obligations from a diverse group of U.S. and non-U.S. issuers with a shorter maturity.

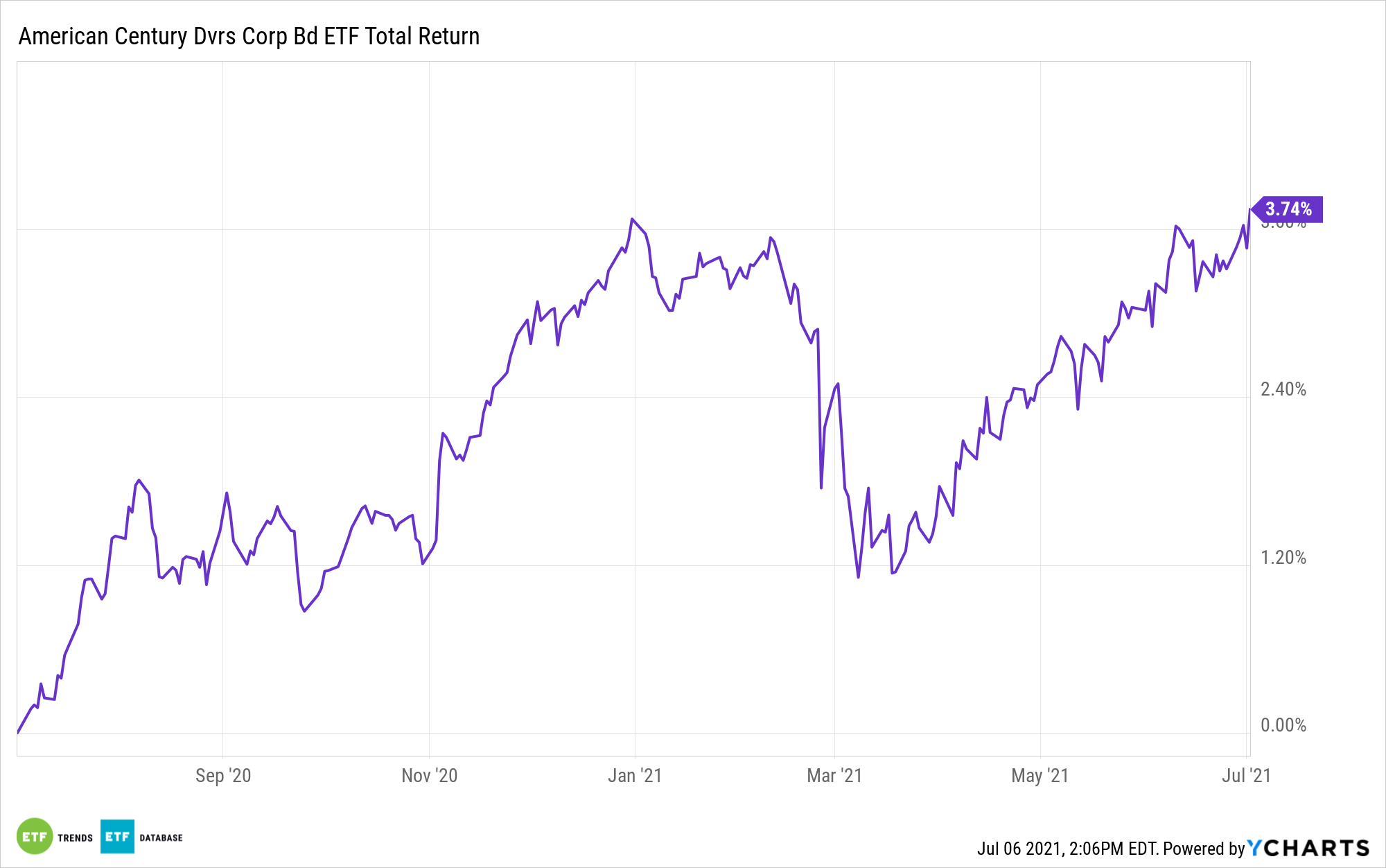

Finally, the actively managed American Century Diversified Corporate Bond ETF (NYSEArca: KORP) invests in U.S. dollar-denominated corporate debt securities issued by U.S. and foreign entities, but may also hold securities issued by supranational entities. Up to 35% of the fund’s net assets may be invested in high-yield securities or junk bonds. The fund may also invest in derivative instruments such as futures contracts and swap agreements. The weighted average duration of the fund’s portfolio is expected to be between three and seven years.

For more news, information, and strategy, visit the Core Strategies Channel.