The inflation that the U.S. is currently experiencing is historic in two major ways: it is both the highest it has been in 30 years, and it is a combination of inflationary pressures from supply and demand that doesn’t adhere to old models, reports the Wall Street Journal.

Inflation is typically driven up by supply side pressures such as shortages (supply chain restrictions) or demand side pressures such as increasing wages or, in recent times, economic stimulus. Current inflation has come about because of a unique combination that hasn’t been seen since end of World War II, driven by strong demand meeting supply shortages.

It has made finding a path through inflation extremely difficult for policy makers, as supply side issues are largely outside of the realm of control that any changes in policy could affect, but tackling inflation purely from a demand standpoint would cause even greater inflation, paradoxically.

Federal stimulus and reduced interest rates work to bolster spending, driving up demand and thereby decreasing unemployment. Tighter labor markets then enable workers and firms to push wages higher, creating inflationary pressure.

Countries worldwide are under the same supply side inflationary pressures driven by shortages but have experienced less inflation gains than the U.S. This is an indicator that the supply chain issues and supply side of inflation isn’t solely to blame for the core inflation (which does not include food or energy) that is being experienced in the U.S.

What is currently happening is a unique combination of demand having been driven up by stimulus meeting constricted supply that is, for all intents and purposes, fixed. It’s most easily seen in the auto industry, where the stimulus drove an uptick in demand but was met by a fixed supply that is limited by semiconductor shortages; the prices of vehicles have increased substantially, reflecting about a third of the core inflation rise.

For now, the biggest solution to reducing inflation is simply time; time for the supply chain to regulate and time for pandemic-driven demand to settle and workers to return to the marketplace. In the interim, record high inflation is likely to prompt Federal intervention, which could in turn mean higher interest rates and a potential economic pullback.

Hedging With Diversification in Unprecedented Inflation

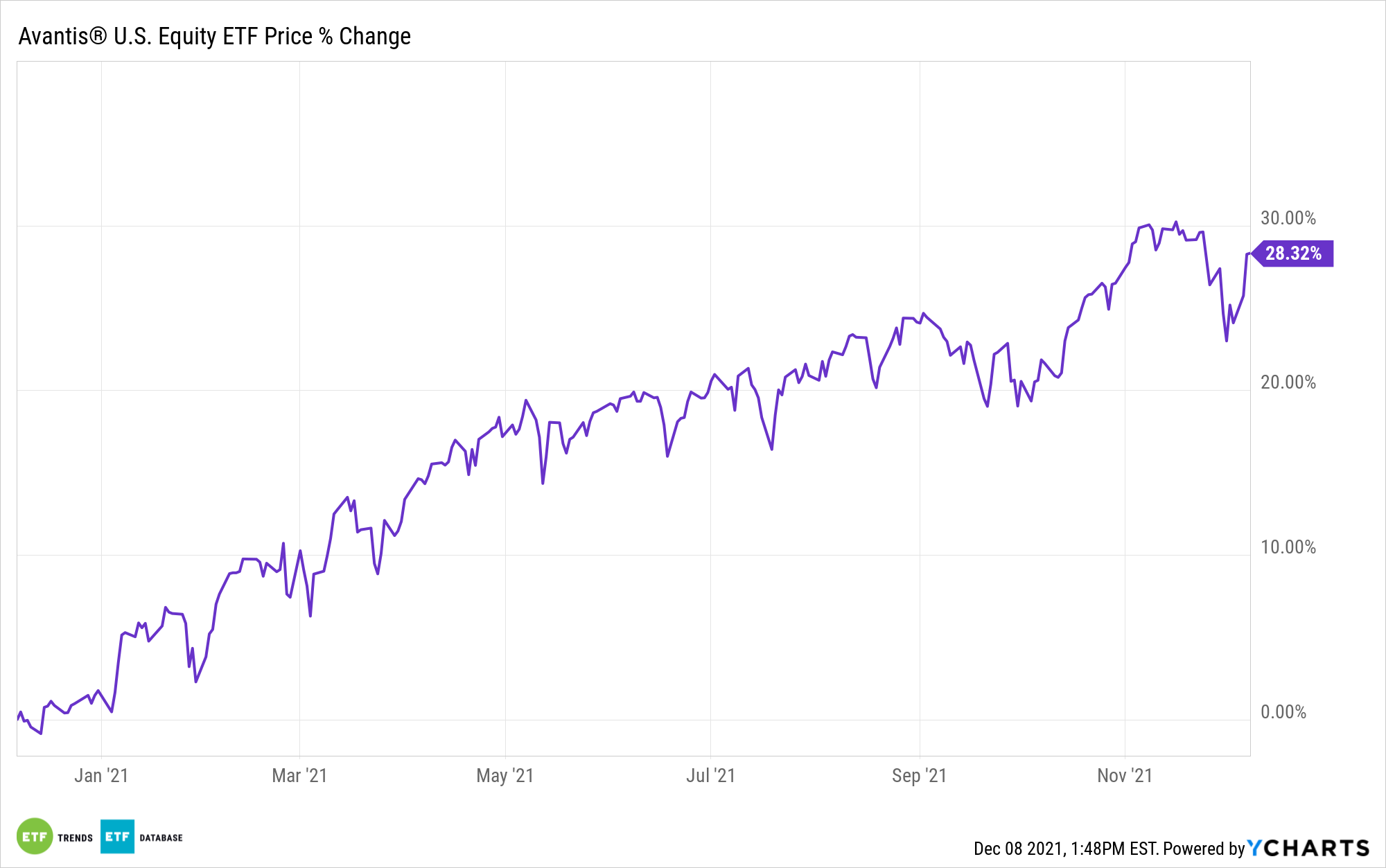

For investors seeking a way to invest in a market of uncertainty and unprecedented inflationary pressures, diversifying exposure is an excellent option; the Avantis U.S. Equity ETF (AVUS) offers diversification in spades. The fund is actively managed and invests in U.S. companies across all market caps and sectors, offering exposure to a variety of industries.

AVUS is benchmarked to the Russell 3000 Index. It works by overweighting smaller market cap companies, high profitability companies, and value companies, and it underweights or excludes large-cap companies that offer lower returns.

The portfolio managers consider the financials and market data of companies when investing, as well as industry classification, the performance of a security compared to its peers, and the stock’s liquidity, float, and tax considerations.

As of the end of November, sector allocations were information technology at 23%, financials at 16%, consumer discretionary at 15%, healthcare at 11%, and industrials at 11%, with smaller allocations to other sectors.

AVUS has an expense ratio of 0.15% and has 2059 holdings.

For more news, information, and strategy, visit the Core Strategies Channel