U.S. markets bounced higher this past week after the Federal Reserve stood pat on interest rates and its bond purchasing program. Investors can also track U.S. equities through a broad exchange traded funds.

The Fed reaffirmed its guidance since December, stating that it must see “substantial further progress” towards its inflation and employment goals before pulling back from its accommodative monetary policy, Reuters reports.

The S&P 500 was mostly unchanged following the Fed’s announcement, but the benchmark later strengthened after Fed Chair Jerome Powell stated that it was “not time yet” to cut the Fed’s support in the economic recovery.

“The market [is waiting]to see whether we are going to get another breakout in the economic data, how the recovery is progressing and how much stimulus is going to go through,” Willem Sels, global chief investment officer at HSBC Private Bank, told the Wall Street Journal. “We are seeing some trade-off between stronger earnings now, which is a positive, and the fear that higher taxes to come could offset that.”

Investors are watching the tech-heavy earnings week from some of the country’s biggest companies. The earnings reports could show how tech companies are coping with changing consumer habits as lockdown restrictions ease.

“There hasn’t been a huge reaction to earnings. The market had anticipated a lot of the improvement because it is reflective of what is happening in the economic data,” Sels added. “That is why earnings season is all about whether there are new messages, for example, around production and input costs.”

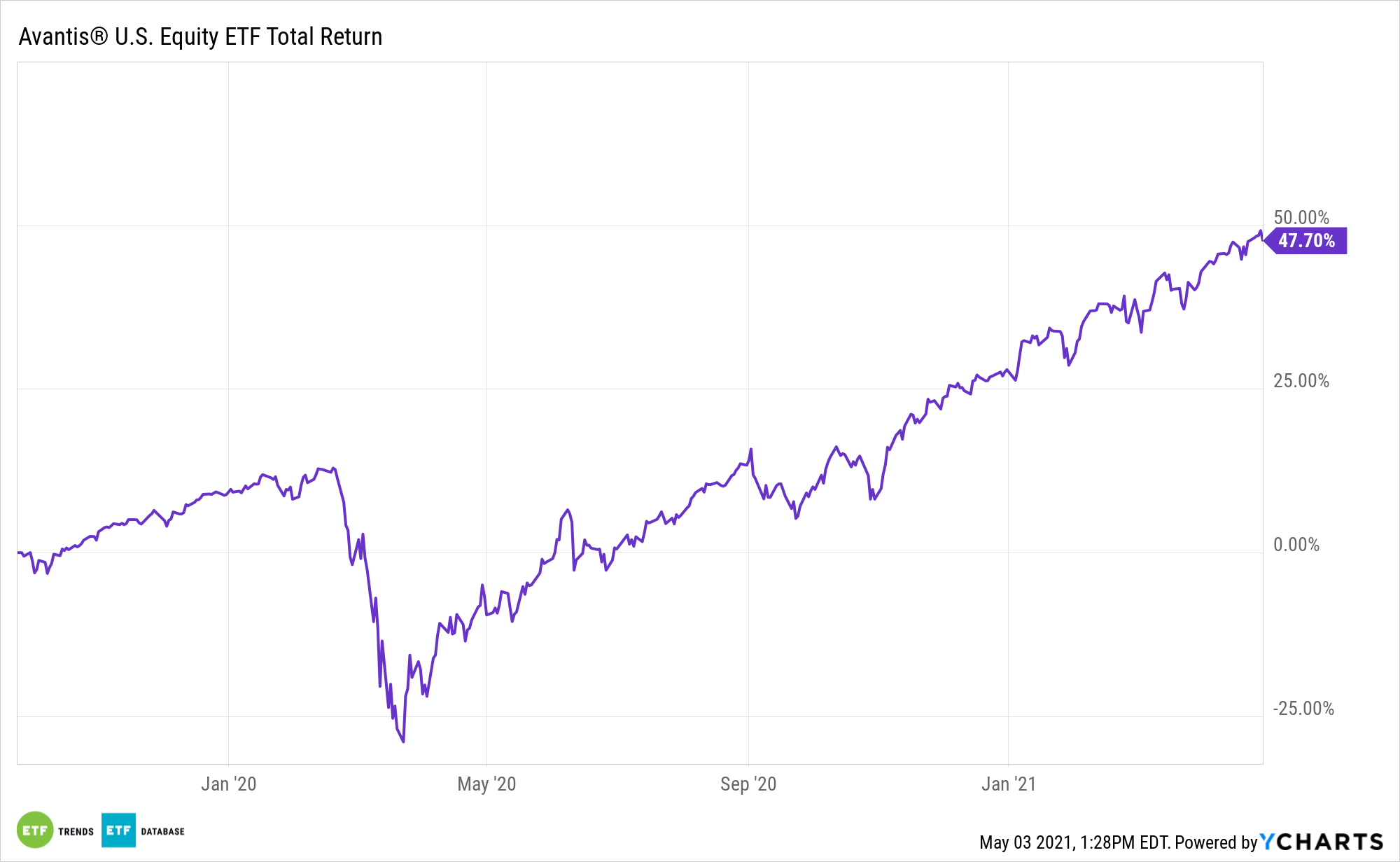

To track the U.S. markets, investors can look to the actively managed Avantis U.S. Equity ETF (AVUS). AVUS pursues the benefits associated with indexing (diversification, low turnover, transparency of exposures), but with the ability to add value by making investment decisions using the information in current prices. The fund features an efficient portfolio management and trading process that is designed to enhance returns while seeking to reduce unnecessary risks and costs for investors.

For more news, information, and strategy, visit the Core Strategies Channel.