Earnings season has surprised so far following a big first quarter for the tech names in the S&P 500 — but that may not last. Markets may not see the broad dip in earnings that has been part of the 2023 recession story, but that doesn’t mean that markets will avoid a dip, and it should remind investors to stick to quality. Many asset managers entered 2023 urging a quality focus via active, low-fee quality strategies like those available in the Avantis Investors’ ETF suite from American Century Investments.

First off, it’s important to acknowledge that even though initial earnings haven’t been so bad for some firms, that doesn’t mean that some of the bigger tech names are going to see the same love from customers that investors have shown their stocks. Some might suggest an optimistic view that the worst is already here with the Fed close to done with its rate hikes, but there are signs in tighter and tighter lending, among other factors, indicating that we’re still yet to feel the aftershocks of hikes and the mini bank crisis.

See more: “Update Your Shortlist of Quality ETFs for a Recession”

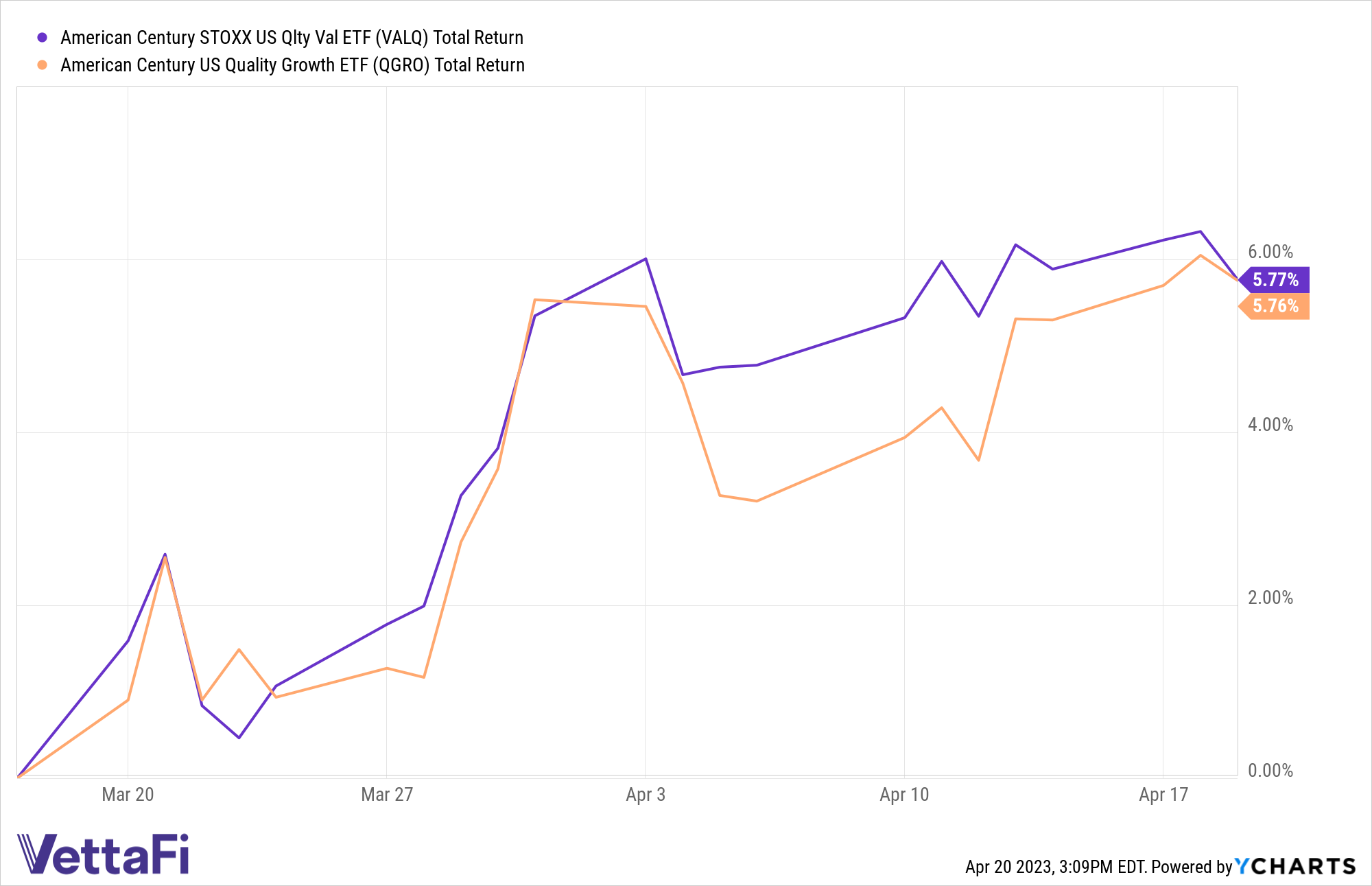

That could help explain big recent inflows for quality strategies, given the merits of sticking to a fundamentals-driven, quality strategies focus. ETFs like the duo of the American Century STOXX U.S. Quality Value ETF (VALQ) and the American Century STOXX U.S. Quality Growth ETF (QGRO) could be an appealing option for those who want to stick to quality rather than respond on a moment-by-moment basis to short-term, earnings-related stock swings.

QGRO tracks the iSTOXX American Century USA Quality Growth index, while VALQ tracks the value version of the same, both charging 29 basis points. QGRO looks to firms with less volatility, with 35%–65% of its holdings in higher-growth stocks and 30%–65% in more stable firms. VALQ, meanwhile, makes similar percentage splits between value and sustainable income stocks.

The duo are quality strategies that have a longer-term view, sticking to fundamentals in a way that could be borne out well in a tumultuous year. For those who find the start to earnings season to be deceptively positive, the pair of QGRO and VALQ may be one to watch.

For more news, information, and analysis, visit the Core Strategies Channel.