With January being active small-cap value managers’ best month since April 2007 and several industry insiders forecasting a comeback for value, investors may be looking to give small-cap value a closer look.

The actively managed Avantis U.S. Small Cap Value ETF (AVUV) seeks long-term capital appreciation. AVUV invests primarily in a diverse group of U.S. small-cap companies across market sectors and industry groups.

With a basket of 630 holdings — none of which are weighted within the fund at over 1% — AVUV is designed to increase expected returns by focusing on firms trading at what are believed to be low valuations with higher profitability ratios.

Under normal market conditions, the fund invests at least 80% of its assets in securities of small-capitalization companies located in the United States. The fund also may invest in derivative instruments such as futures contracts, currency forwards, and swap agreements.

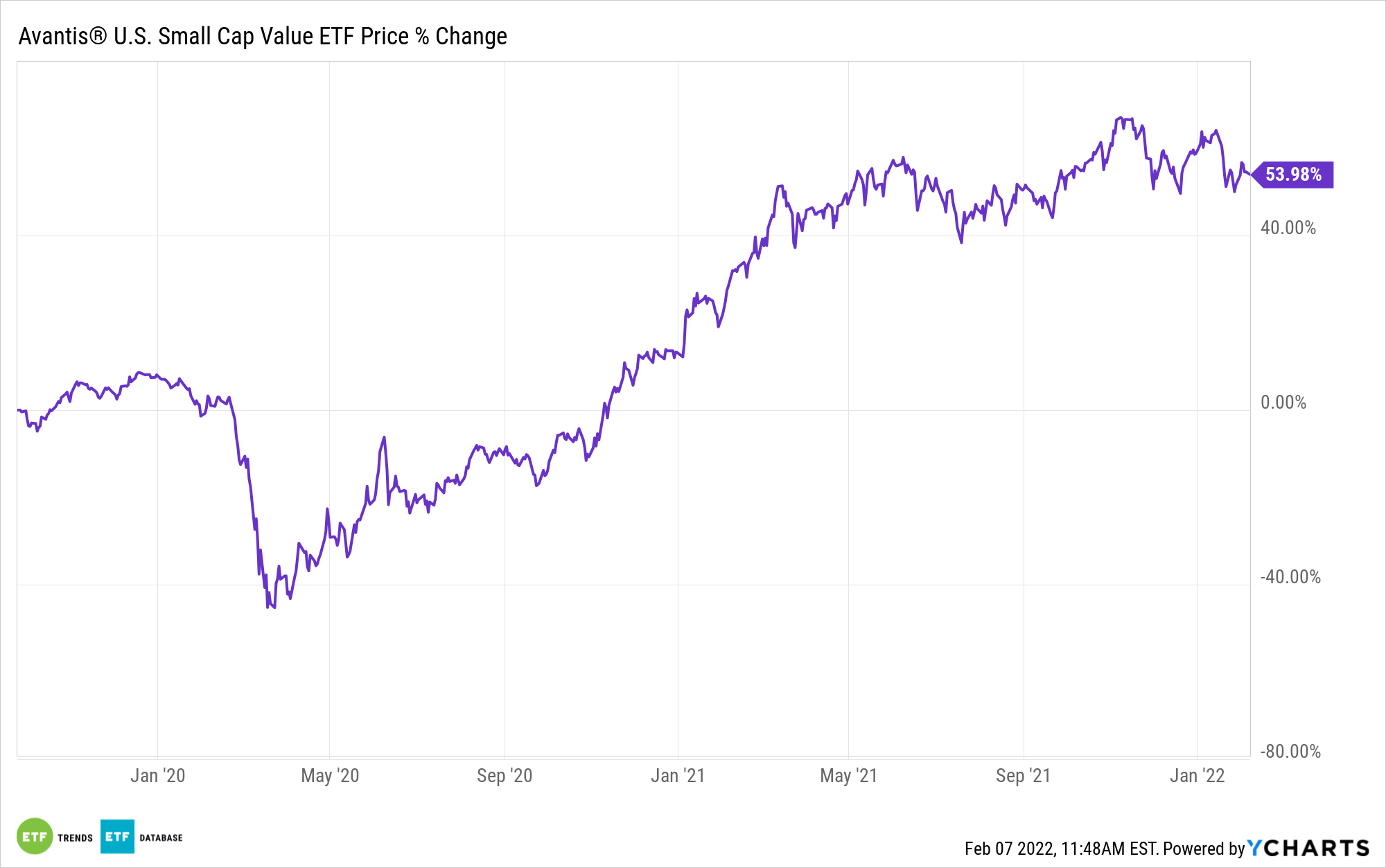

Since its inception in September 2019, the fund is up nearly 54%.

John Davi, founder, CEO, and CIO of Astoria Portfolio Advisors, recently wrote that “portfolios should be tilting towards value-centric assets,” adding: “Growth stocks will continue to suffer with higher rates and value stocks still offer a margin of safety.”

Sandra Testani, vice president of ETF product and strategy for American Century Investments, recently told ETF Trends that investor interest in value stocks is directly tied to rising rates — which the Federal Reserve recently signaled are on the horizon.

“What we found is that historically, there’s a relationship between interest rates and style,” Testani said. “Value tends to outperform in periods where rates are rising, while growth tends to outperform in periods where rates are steady or declining.”

Following a report from Jefferies LLC revealing that actively managed small-caps outperformed their benchmarks both last month and last year, Jefferies analyst Steven G. DeSanctis said that “alpha generation is alive and well in small-cap,” adding that “active management should work in small-cap going forward.”

For more news, information, and strategy, visit the Core Strategies Channel.