This week, Avantis Investors, an investment offering from global asset manager American Century Investments, reached the three-year anniversary of bringing its first five equity ETFs to the market. And at the three-year mark, each of the five initial Avantis ETFs has surpassed $1 billion in assets under management.

The five funds are: the Avantis U.S. Small Cap Value ETF (AVUV), which managed $3.5 billion in assets as of September 29; the Avantis U.S. Equity ETF (AVUS), with $2.5 billion; the Avantis International Small Cap Value ETF (AVDV) ($1.6 billion); the Avantis International Equity ETF (AVDE) ($1.5 billion); and the Avantis Emerging Markets Equity ETF (AVEM) ($1.3 billion).

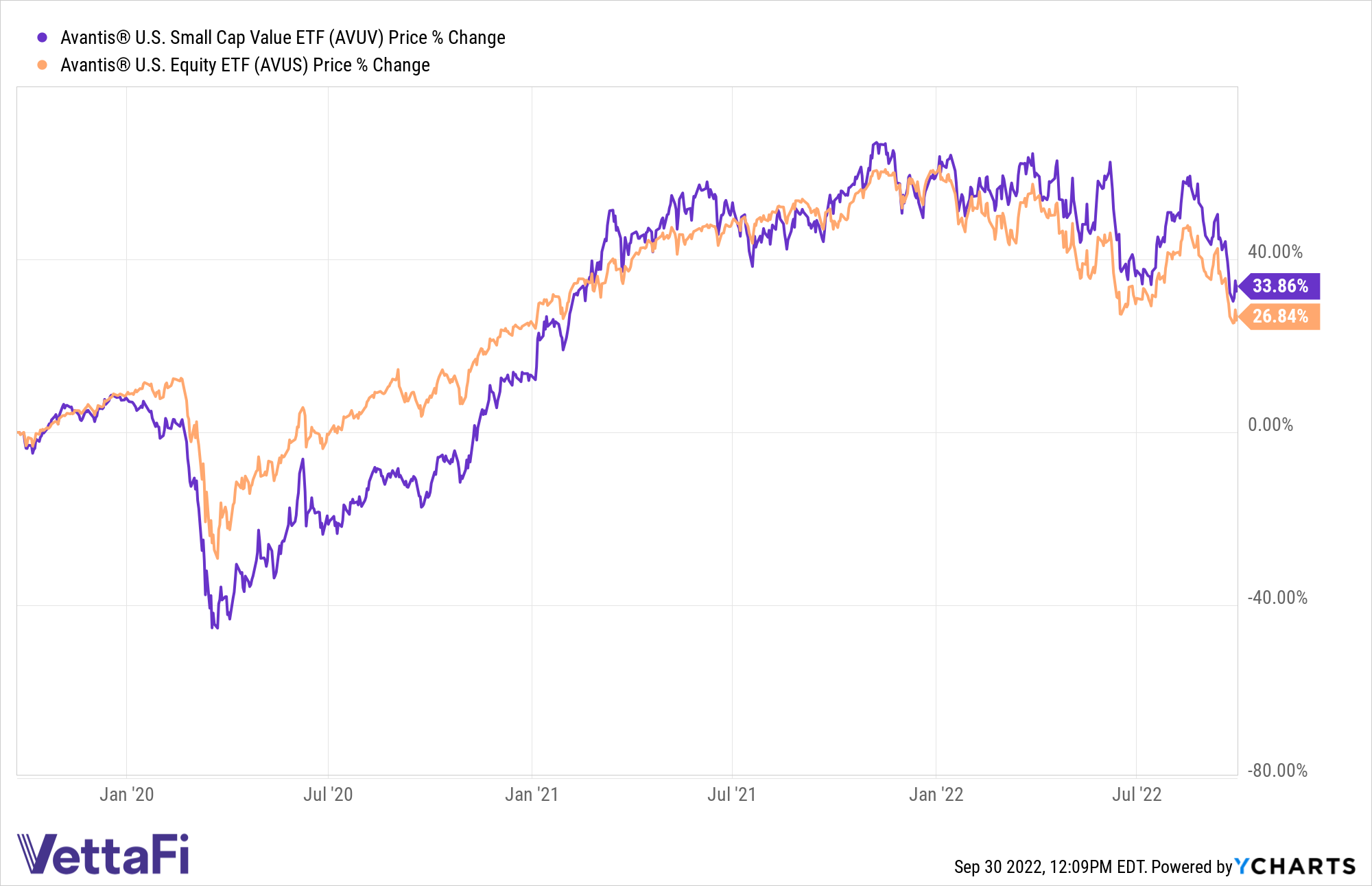

Data from VettaFi show that collectively, Avantis managed nearly $11.6 billion in assets across 16 strategies as of September 29. Two of the funds, AVUV and AVUS, have seen double-digit returns since their inception.

“While some advisors wait until an active strategy hits a three-year anniversary, these Avantis funds quickly gained a strong following,” said Todd Rosenbluth, head of research at VettaFi. “The funds provide broad exposure to an investment style, for a modest fee with the potential benefits of security selection.”

Avantis is continuing to expand its suite of ETFs. On Thursday, Avantis Investors added two new transparent active strategies to its ETF lineup: the Avantis Inflation Focused Equity ETF (NYSE Arca: AVIE) and the Avantis All Equity Markets ETF (NYSE Arca: AVGE).

“Avantis exists to take commonsense investment principles and incorporate the latest academic research to build investment strategies,” said Avantis CIO Eduardo Repetto in a news release announcing the launch of these two new ETFs. “This framework determines how we build our strategies, but the tremendous relationships we’ve formed with our clients over the last three years sets the direction for what we build.”

For more news, information, and strategy, visit the Core Strategies Channel.